News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April.21) | $SOL's staking market cap surpasses $ETH; Strategy may increase $BTC holdings again2Gold hits new ATH at $3,390, is Bitcoin close behind?3Bitcoin Stock-to-Flow model creator PlanB slams Ethereum, calls it ‘premined shitcoin’

6 Best Altcoins to Buy Now July 17 – Ton, Polkadot, Stellar, Injective

Insidebitcoin·2024/07/18 07:25

Bombastic Ethereum Price Prediction After ETF Launch

Cryptodnes·2024/07/18 06:13

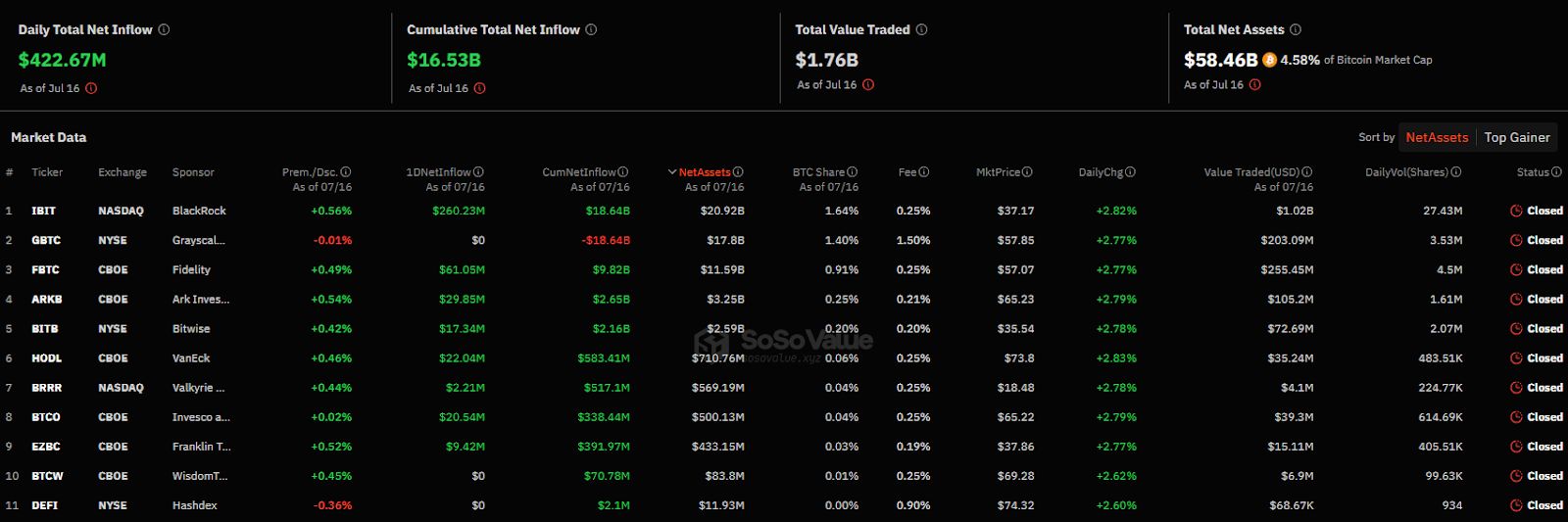

BTC Rockets 11% Higher as Bitcoin ETFs See Whopping 422M Inflow

Dailycoin·2024/07/18 02:31

a16z co-founders endorse Trump, citing crypto and AI policy concerns

Cryptobriefing·2024/07/18 01:25

Ethereum ETFs set for July 23 launch as S-1 forms updated

Cryptobriefing·2024/07/17 23:46

Bitcoin Bull Flag Pattern Explained: Is $100K in Sight?

Coinedition·2024/07/17 23:16

Grayscale Launches New Fund Targeting Decentralized AI Protocols

Grayscale Decentralized AI Fund offers early investment in blockchain-based AI protocols, while simultaneously addressing deep fakes, misinformation, and bot authentication challenges.

Cryptopotato·2024/07/17 20:01

FLOKI and PEPE Pick Up Momentum Ahead of Upcoming ETH ETF Launch

Coinedition·2024/07/17 19:37

Flash

- 16:31Data: Galaxy Digital Withdraws Over 123,000 SOL, Worth $17.09 Million, from CEXAccording to ChainCatcher, monitored by Arkham, Galaxy Digital withdrew 123,058 SOL (approximately worth $17.09 million) from CEX 22 minutes ago. In the past 7 days, the company has withdrawn $95 million worth of SOL from crypto exchanges.

- 16:30Viewpoint: Strategy's Bitcoin Purchases Have Minimal Impact on PriceAccording to a report by Jinse, TD Cowen's research indicates that despite Strategy's growing influence as a major corporate holder of Bitcoin (BTC), its large-scale cryptocurrency purchases seem to have minimal impact on the price. As per TD Cowen's analysis, Strategy's Bitcoin buying generally constitutes only 3.3% of the weekly trading volume. Over the past 27 weeks, the company's total trading volume accounted for 8.4% of the total trading volume, but this figure is skewed by a few weeks where purchase volumes briefly surged over 20%. There were eight weeks during which Strategy did not buy any Bitcoin at all.

- 16:30Analysis: Trade War May Have Sparked a Sell-off of U.S. Financial AssetsJinse reports that on the evening of April 21, Beijing time, U.S. stocks once again plunged, with the three major indexes opening lower and continuing to decline. At the same time, the dollar also faced intense selling pressure, with the dollar index briefly falling below the 98 mark for the first time since March 2022. Furthermore, U.S. Treasury yields also declined in the short term, with the 30-year yield touching 4.989%, and the 10-year yield briefly surpassing 4.4%. Wall Street warns that the "Dismiss Powell" controversy has significantly undermined investor confidence, as the independence of the Federal Reserve has long been seen as a critical assurance for investing in U.S. assets. Kathy Jones, the chief fixed income strategist at the Schwab Center for Financial Research, stated that Trump might attempt to fulfill his threat to dismiss Powell, and investors should not dismiss this possibility—such a move could exacerbate the sell-off of U.S. Treasuries and the dollar. Vital Knowledge analyst Adam Crisafulli wrote: “Investors are facing a new source of macro risk with Trump's threat to the Fed's independence. This is closely tied to the trade war, as tariffs in the coming months may push inflation to surge, forcing Powell and other officials to stand by even as markets have already experienced violent fluctuations and economic downside risks are rising.” Crisafulli also stated: “The simultaneous decline in stocks, the dollar, and Treasuries suggests that Trump's trade war may have already sparked a sell-off of U.S. financial assets, a trend that negotiations alone may not reverse.”