News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

A hellish market; even insider whales can't withstand it.

For a single GPU, ZKsync Airbender not only has the fastest verification speed but also the lowest cost.

Being with people who understand trading can help you stay clear-headed.

UTXO is no longer just a "proof of transfer," but has become a "universal language" for value exchange between machines, serving as a quantum bridge connecting the physical and digital worlds.

Warren Buffett has reduced his stock holdings for the third consecutive year, with Berkshire Hathaway's cash reserves soaring to 382 billions USD. As the "Oracle of Omaha" takes these actions before stepping down, is he defending against risks or preparing for the next round of low-price investments?

From Tesla Roadster refunds to the restructuring of OpenAI, the conflict between two tech moguls has flared up again. Elon Musk angrily accused Sam Altman of stealing OpenAI, while Altman responded: "You abandoned it, I saved it, why can't we look forward?"

The significance of MOCASTR does not lie in its current price, but in the fact that it is the first to enable NFTs to have their own "treasury strategies."

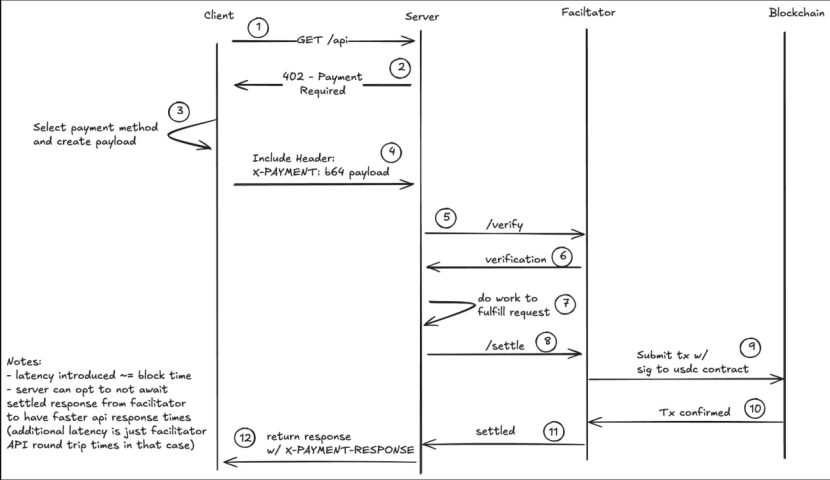

The further development of AI will inevitably generate demand for machine-to-machine transactions and micropayments, and blockchain may become the ultimate infrastructure for AI and machine interactions.

Once, it was something so pure, liberating, and full of hope.

- 10:11BNB Chain: The Balancer incident has not affected any BNB Chain projects, but all forked projects should remain vigilant.Jinse Finance reported that BNB Chain stated: "The recent Balancer vulnerability attack has not affected any BNB Chain projects. However, all forked projects should remain highly vigilant and consider suspending operations as a precaution. Our team and partners are actively monitoring the situation. Please ensure security at all times."

- 10:07Balancer: Potential Vulnerability in v2 Pools, Team InvestigatingChainCatcher news, Balancer tweeted, "We are aware of a potential vulnerability in Balancer v2 pools. Our engineering and security teams are prioritizing the investigation. Once we have more information, we will promptly share verified updates and next steps."

- 09:55Balancer sends on-chain message: willing to pay 20% of the stolen assets as a white hat reward to recover the funds, valid for 48 hoursAccording to Jinse Finance, monitored by GoPlus, Balancer has made an on-chain announcement: they are willing to pay 20% of the stolen assets as a white hat reward to recover the funds, valid for 48 hours.