BTC Rockets 11% Higher as Bitcoin ETFs See Whopping 422M Inflow

- Investors have poured billions into Bitcoin ETFs.

- Some ETFs have thrived, while others have struggled to attract investors.

- Fear has turned to greed as investors have regained confidence in Bitcoin.

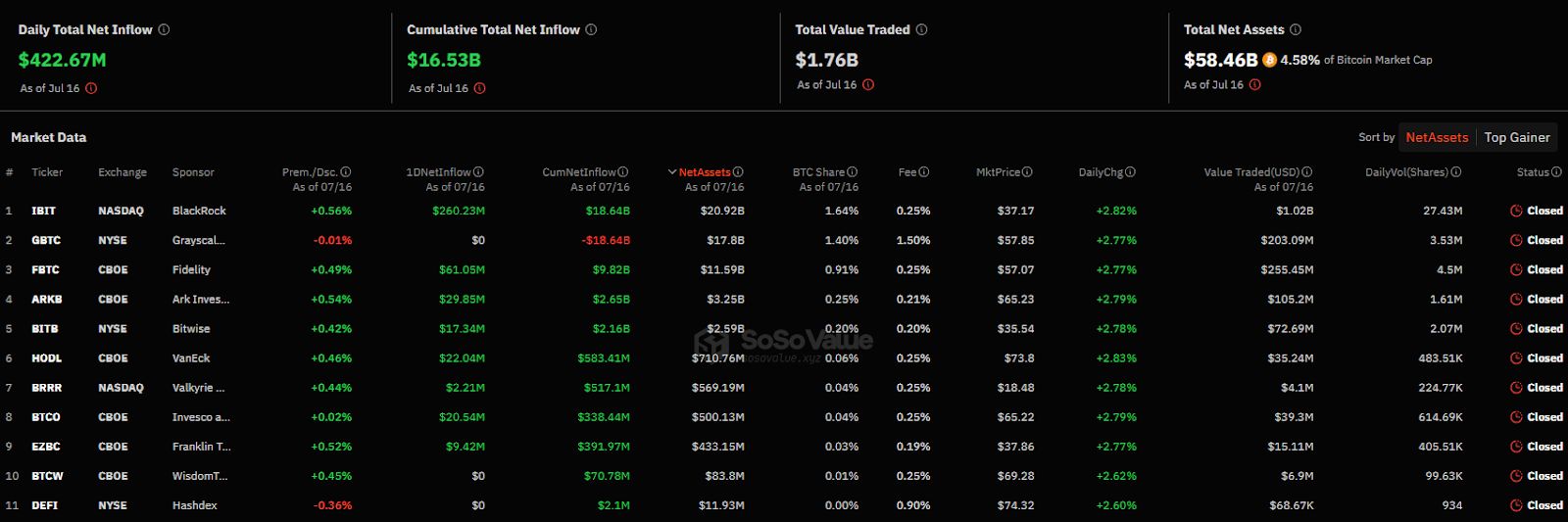

A wave of investment is surging into Bitcoin exchange-traded funds (ETFs), with investors flocking back to the digital asset in a frenzy. The past week has been a whirlwind of activity, with a staggering $422 million poured into these funds on Monday alone. This marks the eighth consecutive day of positive inflows.

This renewed interest in Bitcoin ETFs comes after a period of uncertainty. Factors such as German government BTC sales and the Mt. Gox distribution have contributed to a downturn in the cryptocurrency market, leading some investors to take a cautious approach. However, the tide appears to have turned decisively.

BlackRock Bitcoin ETF Leads Inflows

BlackRock’s IBIT ETF has been at the forefront of this surge, attracting over $260 million in recent days. This massive inflow has propelled the investment giant’s total assets under management to a new record of $10.6 trillion.

Sponsored

The shift in sentiment towards Bitcoin is evident, with BlackRock CEO Larry Fink publicly expressing his belief in the cryptocurrency as a viable investment. Fidelity’s FBTC ETF also saw significant inflows, totaling $61.05 million, while Ark Invest’s ARKB and Bitwise’s BITB contributed positively to the overall ETF landscape.

Bitcoin ETF Dashboard Data. Source: SoSoValue

Bitcoin ETF Dashboard Data. Source: SoSoValue

However, not all Bitcoin ETFs have shared in the recent bonanza. WisdomTree’s BTCW, Hashdex’s DEFI, and Grayscale’s GBTC experienced no net inflows during this period. Despite these exceptions, the cumulative net inflow into Bitcoin ETFs has reached an impressive $16.53 billion.

Bitcoin Battles $65,000

The renewed investor enthusiasm for Bitcoin ETFs coincides with a strong price recovery for the cryptocurrency itself. After experiencing a downturn to around $56,700 last week due to factors such as German government BTC sales and the Mt. Gox distribution , Bitcoin has staged a robust comeback.

Sponsored

As of this writing, Bitcoin’s price is just under $65,000, representing a 10.8% increase from the previous week. The combination of soaring Bitcoin ETF inflows and the cryptocurrency’s price appreciation highlights the growing confidence among investors in the digital asset market.

On the Flipside

- Not all Bitcoin ETFs saw net inflows during this period despite the overall surge in Bitcoin ETF investments.

- The recent spike in Bitcoin’s price to nearly $65,000 follows a significant downturn just a week ago, indicating high volatility in the cryptocurrency market.

Why This Matters

The substantial inflows into Bitcoin ETFs signal a notable turnaround in investor sentiment following recent market uncertainties. This surge, led by major funds like BlackRock’s IBIT ETF, marks a pivotal moment in Bitcoin’s investment landscape, potentially setting the stage for further market growth and institutional involvement.

Learn how the fallout from one of Bitcoin’s biggest hacks continues to impact the market:

Mt. Gox Bitcoin Hack Still Plagues Market: $6B Shift Sinks BTC

Discover why Bitcoin ETFs are attracting significant investments with another round of substantial inflows:

Bitcoin ETFs Extend Positive Streak with $300 Million Inflows

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson’s $250K BTC Forecast Says Yes

Hoskinson predicts that rate cuts and the stabilization of the recent tariff war will send the crypto market much higher.

$3 Billion XRP Volume Spike – What Do Whales Know That You Don’t?

XRP could be primed for a breakout above its recent downtrend. Here's how high it could go.

Bitcoin traders target $90K as apparent tariff exemptions ease US Treasury yields

Bitcoin bulls predict a rally to $90,000 if Treasury yields continue to fall alongside the Trump administration’s adjustments to its current tariff policy.