Analysis: Trade War May Have Sparked a Sell-off of U.S. Financial Assets

Jinse reports that on the evening of April 21, Beijing time, U.S. stocks once again plunged, with the three major indexes opening lower and continuing to decline. At the same time, the dollar also faced intense selling pressure, with the dollar index briefly falling below the 98 mark for the first time since March 2022. Furthermore, U.S. Treasury yields also declined in the short term, with the 30-year yield touching 4.989%, and the 10-year yield briefly surpassing 4.4%. Wall Street warns that the "Dismiss Powell" controversy has significantly undermined investor confidence, as the independence of the Federal Reserve has long been seen as a critical assurance for investing in U.S. assets. Kathy Jones, the chief fixed income strategist at the Schwab Center for Financial Research, stated that Trump might attempt to fulfill his threat to dismiss Powell, and investors should not dismiss this possibility—such a move could exacerbate the sell-off of U.S. Treasuries and the dollar. Vital Knowledge analyst Adam Crisafulli wrote: “Investors are facing a new source of macro risk with Trump's threat to the Fed's independence. This is closely tied to the trade war, as tariffs in the coming months may push inflation to surge, forcing Powell and other officials to stand by even as markets have already experienced violent fluctuations and economic downside risks are rising.” Crisafulli also stated: “The simultaneous decline in stocks, the dollar, and Treasuries suggests that Trump's trade war may have already sparked a sell-off of U.S. financial assets, a trend that negotiations alone may not reverse.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRC20-USDT Issuance Surpasses 70 Billion, Reaching 70.7 Billion

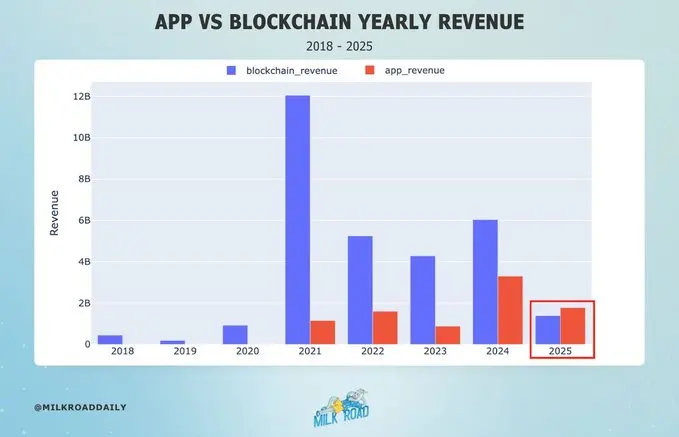

Data: The total fee revenue for dApps in Q1 this year was $1.8 billion, surpassing infrastructure protocols

Today's Fear and Greed Index is 52, and market sentiment has returned to neutral