Bitget Daily Digest (April.21) | $SOL's staking market cap surpasses $ETH; Strategy may increase $BTC holdings again

远山洞见2025/04/21 09:46

By:远山洞见

Today's preview

1. Babylon completes the voting on its governance proposal to adjust the unbonding fee for new Phase-2 stakes.

2. Bittensor (TAO) unlocks 210,000 tokens worth approximately $47.7 million.

3. The Lorentz mainnet upgrade is scheduled to go live today on opBNB.

4. The Pectra client is expected to launch today, adding EIP-7702 delegation status to JSON-RPC.

Key market highlights

1. U.S. President Donald Trump posted on his social platform: "

The golden rule of negotiation: He who has the gold makes the rules." He also stated that "

the businessmen who criticize tariffs are bad at business, and really bad at politics," and called himself "

the greatest friend that American capitalism has ever had." The market interpreted these remarks as renewed support for aggressive trade policies, sparking risk-off sentiment. Gold surged during Asian trading hours, briefly hitting a record high of $3360/oz—up $32 for the day, a 0.99% increase.

2. According to on-chain analyst ai_9684xtpa, a total of 9 altcoins and 4 memecoins have submitted spot ETF applications. The altcoins are SOL, XRP, LTC, ADA, AVAX, APT, SUI, MOVE, and TRX. The memecoins are DOGE, TRUMP, BONK, and PENGU Among the altcoins, SOL, XRP, LTC, ADA, and SUI are often referred to as "American coins" due to their strong ties to U.S.-based teams or resources. The remaining altcoins—AVAX, APT, MOVE, and TRX—are part of WLFI’s investment portfolio.

3. ai16z founder Shaw stated on social media that auto.fun's native token is ai16z. In response to speculation about his purchase of a token named "FUN" on pump.fun, Shaw clarified: "There’s no official auto.fun token yet, nor are there any plans for one. The token purchase was just for hype. I'll send my supply to the DAO—we'll just hold onto it, I guess. Feel free to make it the CTO or whatever."

4. Yesterday, Michael Saylor, founder of Strategy (formerly MicroStrategy), posted the Bitcoin portfolio tracker on X again, saying: "Insufficient Orange." As observed in the past, Strategy often announces new BTC purchases shortly after such posts.

5. Nansen CEO Alex Svanevik posted on X stating that $SOL's staking market cap has just surpassed $ETH's. According to his data, SOL's staking market cap reached $53.96 billion, taking the top spot, while ETH's stands at $53.77 billion, now in second place.

Market overview

1. $BTC is consolidating within a narrow range, with mixed market performance. New token $WCT is gaining traction, while popular tokens $RFC and $DARK have seen notable pullbacks.

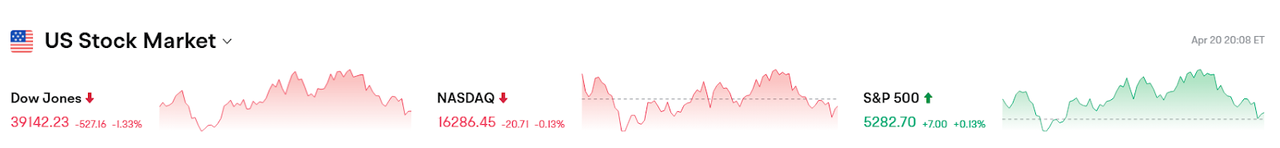

2. U.S. stock index futures fell across the board during early Asian trading on Monday. The U.S. Dollar Index dropped below 99 for the first time in three years.

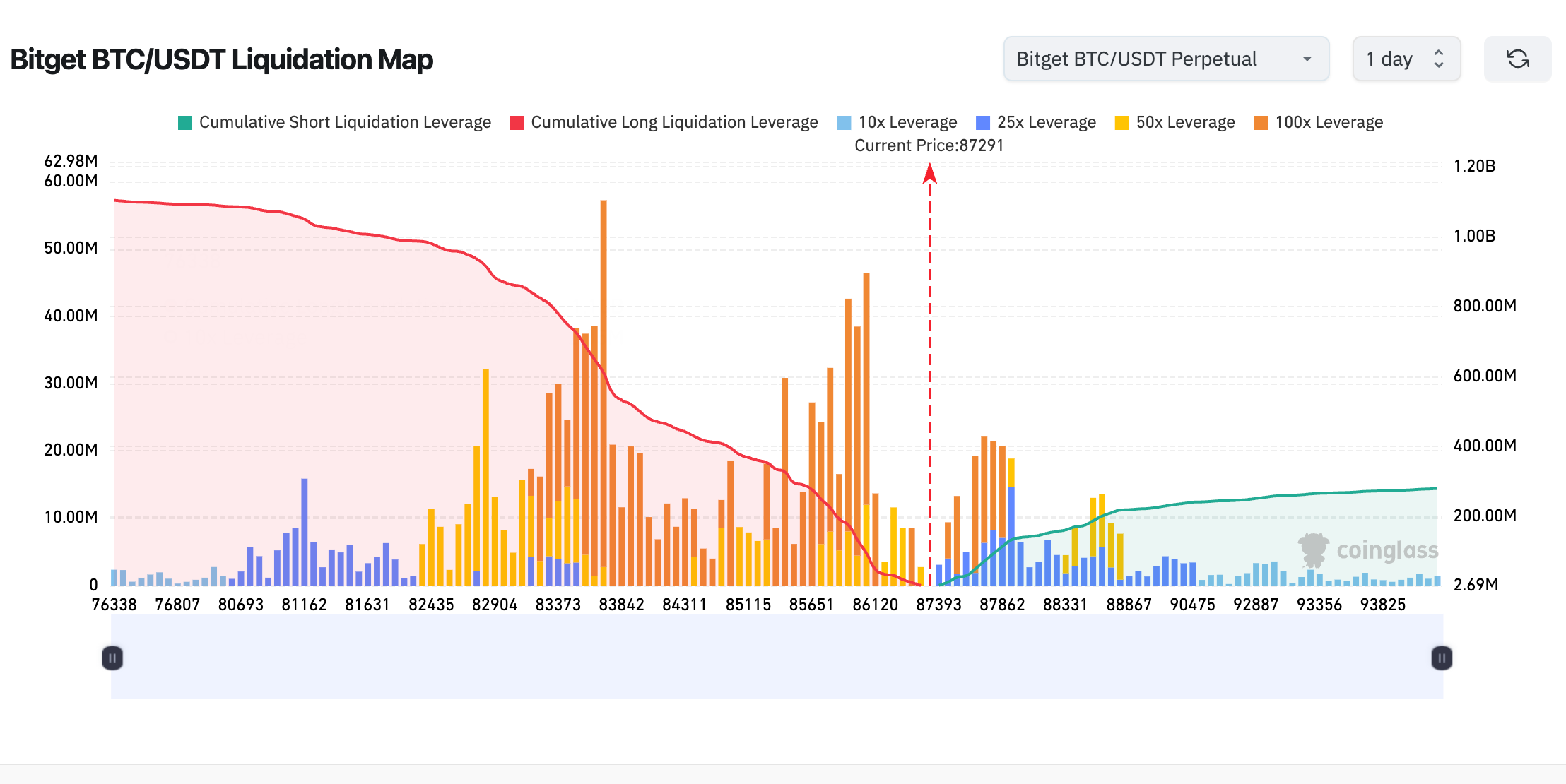

3. Currently standing at 87,097 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 86,075 USDT could trigger

over $65 million in cumulative long-position liquidations. Conversely, a rise to 88,085 USDT could lead to

more than $145 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

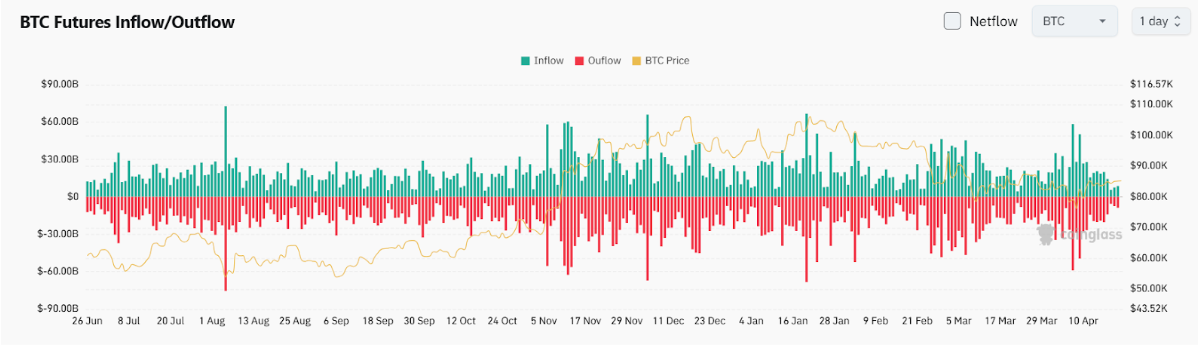

4. Over the past day, Bitcoin has seen $910 million in spot inflows and $990 million in outflows, resulting in

a net outflow of $80 million.

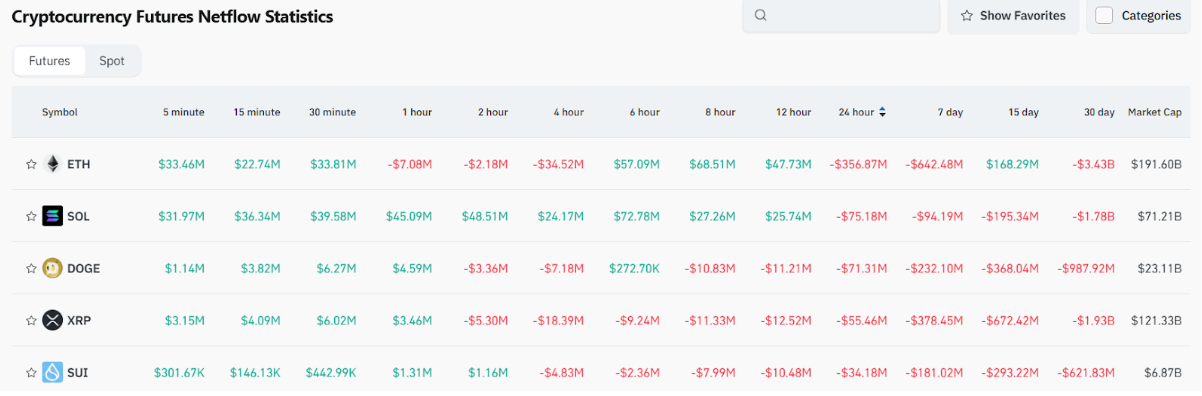

5. In the last 24 hours, $ETH, $SOL, $DOGE, $XRP and $SUI led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Glassnode: Bitcoin holders who bought at high prices and are now "underwater" tend to become long-term

holders—a

pattern that often signals the confirmation of a bear market.

X post:

https://x.com/glassnode/

Galaxy: The U.S. government may start purchasing Bitcoin this year for its strategic reserve and could potentially use altcoins as a funding source.

X post:

https://x.com/intangiblecoins/

21Shares report: Bitcoin is projected to reach $138,555 by the end of 2025

Read the full article here:

https://www.coindesk.com

News updates

1. Three former U.S. presidents speaks out in succession to condemn Trump’s recent remarks.

2. South Korea’s acting president states that the country will not retaliate against U.S. tariffs.

3. Texas to hold a public house hearing on April 23 to discuss its proposed Bitcoin strategic reserve bill.

4. The White House plans to set up a task force to urgently address the crisis sparked by increased tariffs on China.

Project updates

1. Founder of ai16z states that the native token of auto.fun is ai16z.

2. Balance Foundation announces that its TGE will take place on April 21, 8:00 PM (UTC+8).

3. Hyperlane Foundation states that around 8.8 million unclaimed HYPER tokens will be used to incentivize the expansion of the Hyperlane network.

4. Michael Saylor shares another Bitcoin tracker update, potentially signaling another BTC purchase.

5. OpenSea announces that Solana token trading is now open to all users.

6. PumpSwap surpasses 1.89 million users, accounting for 18.2% of total DEX volume on Solana.

7. SKYAI completes all presale refunds and token airdrops, with presale returns exceeding 50x.

8. All altcoins with submitted spot ETF applications are either U.S.-based projects or part of the WLFI investment portfolio.

9. Vitalik Buterin proposes replacing the EVM language with RISC-V to improve execution efficiency.

10. Nansen CEO states that SOL has surpassed ETH in staking market cap

Highlights on X

1. Daan Crypto Trades: Bitcoin-to-gold ratio hits key zone. Will this time be different?

The current $BTC / $GOLD ratio is hovering around 25, placing it in the lower-middle range of its typical trading band (roughly 16–37) over the past four years. Historically, this range has often preceded strong rebounds. While gold is currently leading the rally, past trends suggest that gold surges are frequently followed by a catch-up move in Bitcoin. Market watchers are now closely watching to see whether we’ll see a repeat of this “gold first, BTC later” pattern—or will this time be different.

2. Vida: Low market cap + whale control = next cycle rocket? Breaking down the $KOMA heavy position

Opened a $200K position in $KOMA at $0.0185 for three key reasons: 1) It's currently the smallest-cap memecoin on Binance futures—just $11 million market cap. Yet combined open interest (OI) across Binance, Bybit, and Gate has reached $6 million, suggesting strong signs of whale control. 2) About $2.7 million of tokens are locked up by the team, meaning real circulating market cap is just $9 million. 3) The market is shifting toward "low-cap, whale-controlled, aggressive pumps"—echoing the DWF Labs era of 2022–23. For example, $BROCCOLIF3B just 10x'ed, and many small-cap coins are spiking. $KOMA is a textbook case of a "market-manipulating cabal coin." Even with a 30% pullback, the expectation is factored in during entry. This is not financial advice—don't blindly follow.

3. Phyrex: The market enters a wait-and-see phase as trading hits a new low and earnings season is approaching, with fluctuations likely to be compressed.

The market saw mild weekend moves, but BTC's on-chain turnover just hit multi-year lows—worse than during the 2022 bear market. This signals ultra-low trading activity and growing investor caution. Futures positions are also shrinking. Meanwhile, U.S. earnings season is underway and Q1 GDP data drops at month-end, raising market uncertainty. Tariff news has lost its punch—real direction will come from upcoming economic data and Big Tech earnings. Short-term BTC volatility will likely remain muted unless major holders start moving their chips.

4. Kevin Z: The meme playbook—narrative, whales, or chain sniping: what matters most?

In meme trading, strong results usually come from a trifecta: a compelling narrative, effective whale backing, and a well-timed entry. Of these, narrative is key. A powerful meme narrative is one that’s unique, polarizing, and feels “official”—that’s what drives major momentum. Next is the whale’s ability to control supply and drive the rally. Price and entry timing are secondary; what matters more is assessing market cap potential and managing your position size. The winning traders are those who stay calm amid the hype and focus on the signals that truly matter.

4

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin rally nears $100,000

Grafa•2025/04/23 21:00

Crypto Market Surges Amid Influential Institutional Moves

Theccpress•2025/04/23 20:55

Top High ROI Cryptos in 2025: BlockDAG, Pi Coin, BNB, Stellar & Polkadot

TheCryptoUpdates•2025/04/23 20:33

Cardano Surges 17%, Eyes Potential $5 Target

Bitcoininfonews•2025/04/23 20:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$93,574.45

+1.82%

Ethereum

ETH

$1,790.7

+2.94%

Tether USDt

USDT

$1

-0.01%

XRP

XRP

$2.21

+0.83%

BNB

BNB

$606.29

-0.64%

Solana

SOL

$150.58

+2.97%

USDC

USDC

$0.9999

+0.00%

Dogecoin

DOGE

$0.1785

+1.46%

Cardano

ADA

$0.6965

+4.97%

TRON

TRX

$0.2465

+0.40%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now