News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

US Output and Labor Costs – Q3 2025, Initial Estimate

101 finance·2026/01/08 13:36

US Weekly Jobless Claims for Unemployment Insurance

101 finance·2026/01/08 13:36

JPY finishes 2025 a bit stronger versus the Dollar – Commerzbank

101 finance·2026/01/08 13:33

AUD/USD maintains upward momentum even after today’s retracement – Rabobank

101 finance·2026/01/08 13:33

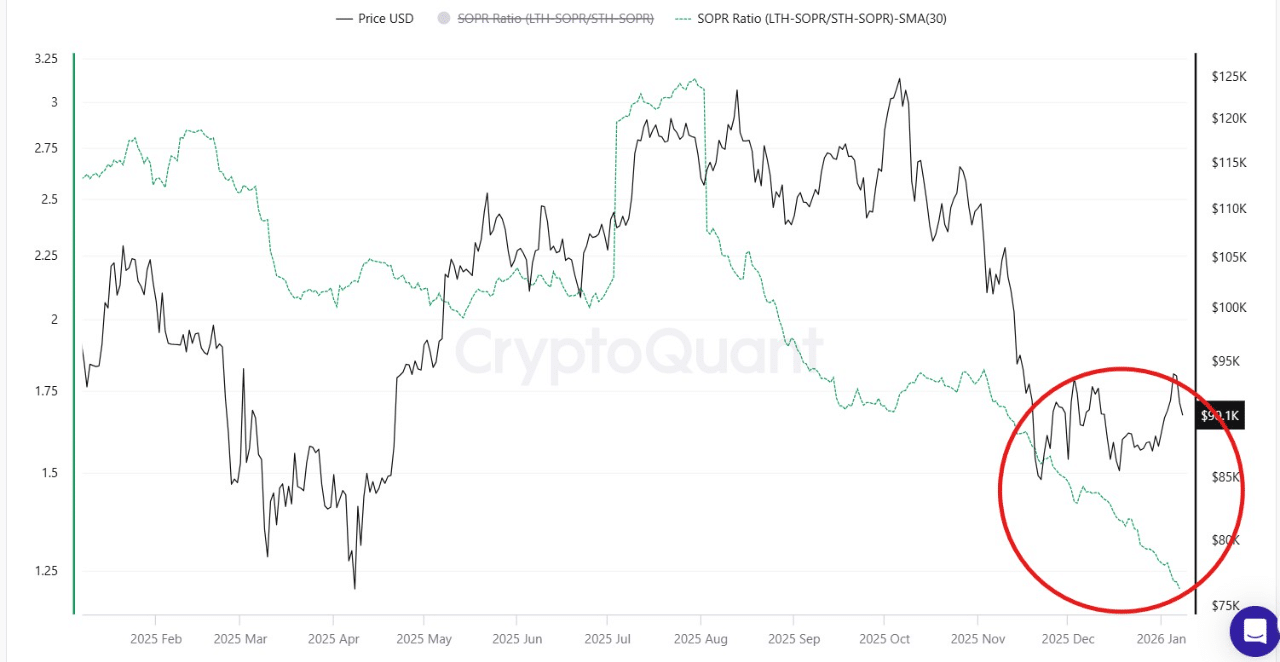

Crypto Liquidations Top $477M as Bitcoin Slips Below $90K

101 finance·2026/01/08 13:24

Shell Reports Subdued Results in Oil Trading

101 finance·2026/01/08 13:18

BlackRock’s Bitcoin Buying Spree: $878M Accumulated in 3 Straight Days

Coinspeaker·2026/01/08 13:18

Flash

20:41

The 10-year US Treasury yield falls by about 1 basis point as investors focus on geopolitical risks.The yield on the 2-year US Treasury rose by 0.62 basis points to 3.4657%; the yield on the 30-year US Treasury fell by 0.29 basis points to 4.7030%. The yield spread between the 2-year and 10-year US Treasuries dropped by 1.161 basis points to +60.530 basis points. The yield on the 10-year Treasury Inflation-Protected Securities (TIPS) fell by 1.29 basis points to 1.7747%. At 02:00, there was a sharp drop when the US Treasury announced the results of the 30-year TIPS auction; the yield on the 2-year TIPS fell by 2.04 basis points to 0.7315%; the yield on the 30-year TIPS fell by 0.77 basis points to 2.4717%, dropping from 2.4950% to 2.47% when the 30-year TIPS auction results were released.

20:27

Report: Bank of America invests $25 billions to enter the "private credit" sector, officially launching proprietary lendingThe appointment established a new leadership team for this initiative, including Anand Melvani as Head of Private Credit and Scott Wiate as Head of Private Credit Structuring and Underwriting. The private credit industry, with a scale of 1.8 trillion USD, has experienced explosive growth in recent years. Among major Wall Street banks, Bank of America is one of the last large banks to officially announce a strategic investment in this sector. (Bloomberg)

20:18

Against the backdrop of the ongoing recovery in the entertainment industry, Live Nation Entertainment demonstrates strong growth momentum.According to the latest analysis, the company has laid a solid foundation for its performance in 2026, and is expected to once again achieve double-digit growth in operating profit and adjusted operating income. This optimistic outlook is attributed to the strong rebound of its global concert and ticketing business, as well as the optimization of its diversified revenue structure. With the continued release of demand for live entertainment and improvements in operational efficiency, the company is steadily moving towards a new cycle of growth.

News