News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Spot Ethereum ETFs to Launch Next Tuesday Ending Excruciating Waits

Newscrypto·2024/07/16 13:10

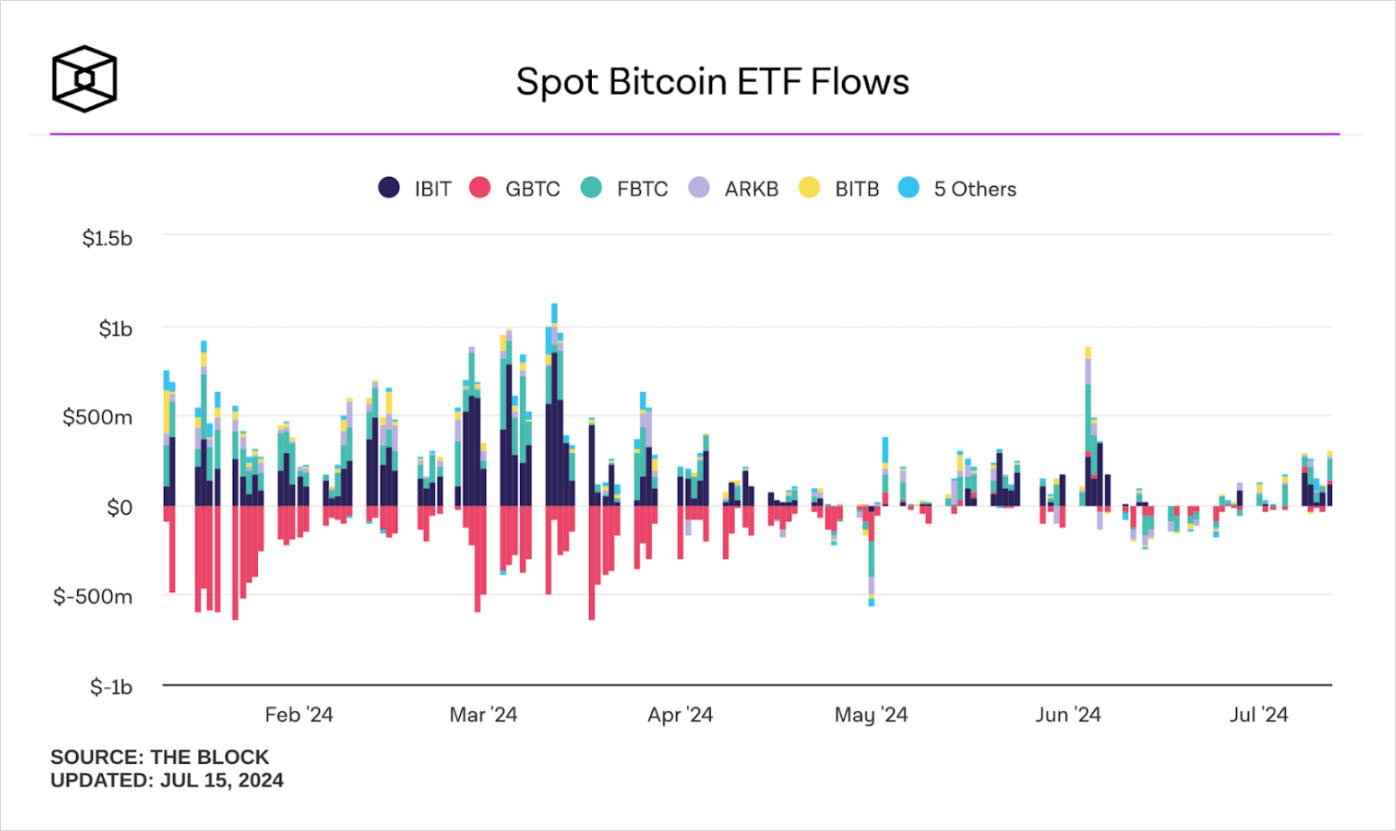

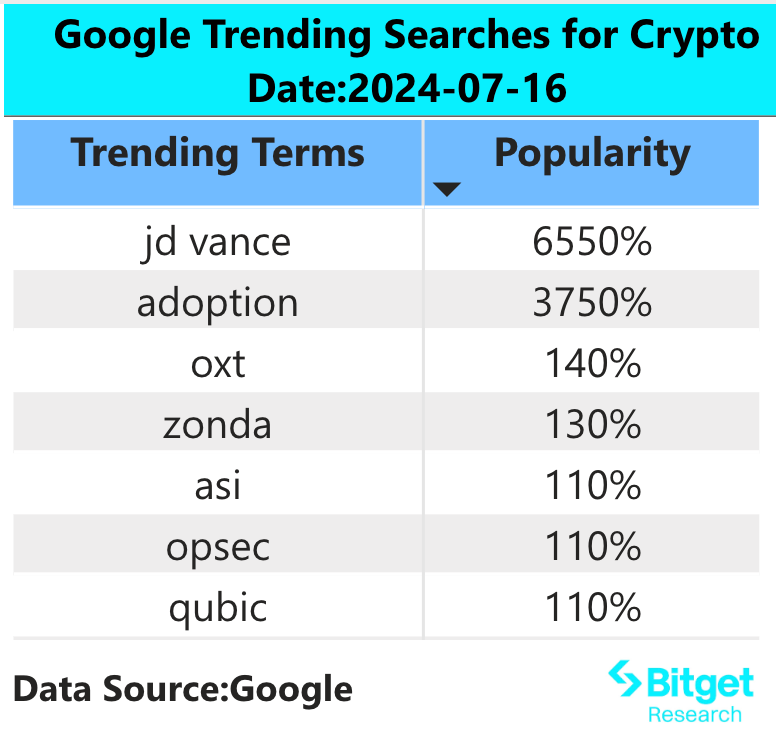

Bitcoin Booms: ETFs Surge & Ether ETF Approval Imminent!

Cointime·2024/07/16 12:50

Pepe With a Major Surge After a Significant VC Purchase

Cryptodnes·2024/07/16 12:37

Will PEPE Hit New Highs by the End of July?

Newscrypto·2024/07/16 10:31

Memecoin Floki Targets $0.0003 After 28% Daily Gain

Newscrypto·2024/07/16 10:31

PEPE, WIF, FLOKI Explode by Double Digits While BTC Retraces After Mt. Gox News (Market Watch)

PEPE is today’s top performer, followed by OM and WIF.

Cryptopotato·2024/07/16 09:58

Mt. Gox Moved $3 Billion in Bitcoin – Will There be Another Price Drop?

Cryptodnes·2024/07/16 09:52

Ether ETF Launch Date: July 23rd on the Horizon? Experts Weigh In

Coinedition·2024/07/16 09:37

Crypto Analyst Predicts Bitcoin Bull Run as Hash Rate Drops

Coinedition·2024/07/16 09:37

Flash

- 08:53Data: Total Stablecoin Market Cap Increased by 1.61% Over the Last 7 Days, Surpassing $238.1 BillionAccording to ChainCatcher, data from DefiLlama shows that the current total stablecoin market cap stands at $238.101 billion, having grown by 1.61% over the past 7 days, with USDT accounting for a market share of 61.66%.

- 08:52Data: The cryptocurrency market's "greed" sentiment is rising, with today's Fear and Greed Index at 65According to ChainCatcher, based on Alternative data, today's cryptocurrency Fear and Greed Index is 65 (yesterday it was 60), indicating a rise in the market's "greed" sentiment.

- 08:52UBS: Market Bets on Trump and the Fed to Rescue Economy, S&P 500 Year-End Target at 5800 PointsAccording to ChainCatcher, as reported by Jinshi, UBS stated that the current market sentiment aligns with the bank's base forecast that tariffs will be reduced from the currently announced levels by the end of this year, and the Federal Reserve will further cut rates this year. However, due to the persistent uncertainties in trade, economy, and Fed policies, volatility is expected to remain high. Nonetheless, UBS believes the U.S. stock market is attractive, maintaining the S&P 500 year-end target at 5800 points. UBS's current base forecast is for the Fed to cut rates by 75 to 100 basis points this year, but in the short term, the Fed's policy flexibility seems more limited as it must balance concerns over economic growth with the risk of inflation recovery.