News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2Bitget UEX Daily |US-Iran Conflict Escalates, Shaking Markets; Oil Prices, Gold and Silver Surge, Stock Index Futures Fall; Tech Stocks Show Mixed Performance (March 02, 2026)3SEC approval sought for JitoSOL Solana-based liquid staking token ETF

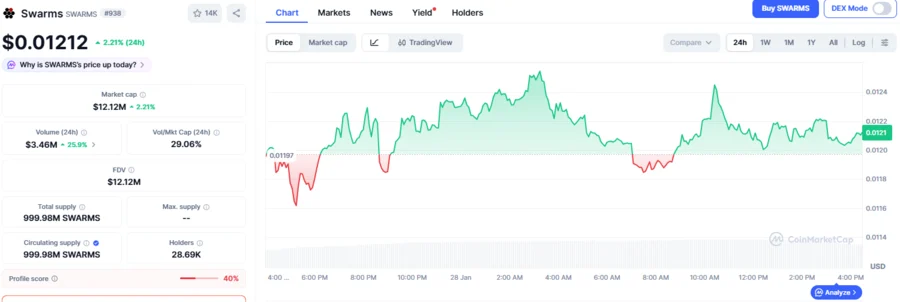

SWARMS Stabilizes Above $0.012 As Falling Wedge Signals a Looming 230% Spike: Analyst

BlockchainReporter·2026/01/29 03:00

LG Energy Solution Looks to ESS Expansion Amid Profit Challenges from EV Market Slowdown

101 finance·2026/01/29 02:48

SEC States That Tokenized Assets Are Considered Securities Before Being Viewed as Technology

101 finance·2026/01/29 02:39

FOMC Bitcoin Revelation: Why Federal Reserve Meetings Merely Trigger Market Repositioning, Not Direction

Bitcoinworld·2026/01/29 02:21

Scallop DeFi CEO Reveals Ambitious Vision in Exclusive Korea Economic Broadcasting Interview

Bitcoinworld·2026/01/29 02:06

When Too Many Expectations Are Placed on Monetary Policy

101 finance·2026/01/29 02:06

Bitwise files for a Uniswap ETF, but UNI’s price tells a different story

AMBCrypto·2026/01/29 02:03

How Samsung’s first-ever chief design officer is reinventing the electronics giant for the AI age

101 finance·2026/01/29 02:03

5 Top-Performing Energy Stocks Outpacing the Market

101 finance·2026/01/29 01:45

Flash

18:59

UK natural gas futures rose about 41% on Monday, while Dutch natural gas futures also increased by over 37%.TTF benchmark Dutch natural gas futures rose by 37.27%, quoted at 42.250 euros/MWh, and at 21:41 (UTC+8) once surged to 48.951 euros. ICE EU carbon emission trading permits (futures price) increased by 0.23%, quoted at 69.21 euros/ton.

18:55

Institution: If the Iran conflict persists for a long time, oil prices may rise to $100 per barrel.“If there is no feasible plan to incentivize shipping companies and insurers to arrange tankers to pass through the strait, the lack of secure alternative export routes could result in most of the Middle East's energy exports becoming ‘stranded assets’.” Expand

18:50

Vitalik Buterin proposes plan to prevent excessive centralization of Ethereum block buildingVitalik Buterin is concerned about the issue of decision-making power over which transactions enter a block, and has proposed a series of solutions to prevent excessive centralization in the block construction process. He also focused on discussing "harmful MEV," referring to behaviors where traders exploit the visibility of pending transactions to front-run or "sandwich" user trades.

News