News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S.-Iran Conflict Escalates Driving Oil Prices Surge; Private Credit Redemption Pressure Intensifies; Tesla Approved for Indirect Stake in SpaceX (March 13, 2026)2Asian stocks slide as Iran war keeps oil near $100, dents rate-cut bets3BlackRock’s staked Ethereum ETF sees $15.5M volume on debut

Wall Street Expands Its Presence in Prediction Markets Through Recent ETF Applications

101 finance·2026/02/18 06:00

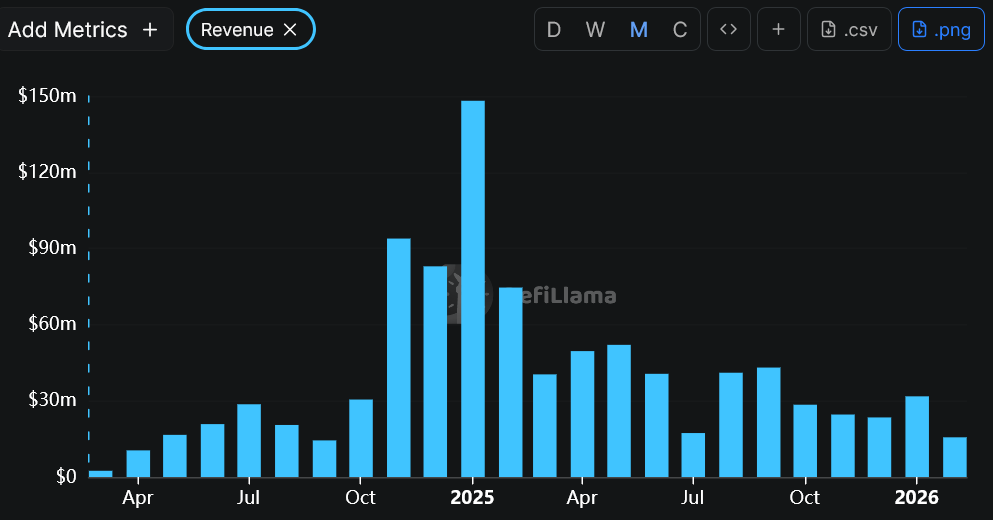

Pump.fun rolls out trader cashbacks amid memecoin 'capitulation'

Cointelegraph·2026/02/18 05:51

Oracle Glitch Results in $1.8 Million Bad Debt for DeFi Lender Moonwell

101 finance·2026/02/18 05:51

Bitcoin's tech stock divergence is a 'fire alarm' for fiat: Arthur Hayes

Cointelegraph·2026/02/18 05:33

“AI Can’t Touch Cash”: BitGo CEO Sees Crypto as AI’s Native Currency

CoinEdition·2026/02/18 05:12

BRICS Launches Decentralized Payment System to Bypass the US Dollar

CoinEdition·2026/02/18 04:39

Why Signing Day Sports (SGN) Stock Is Trending Tonight

Finviz·2026/02/18 04:24

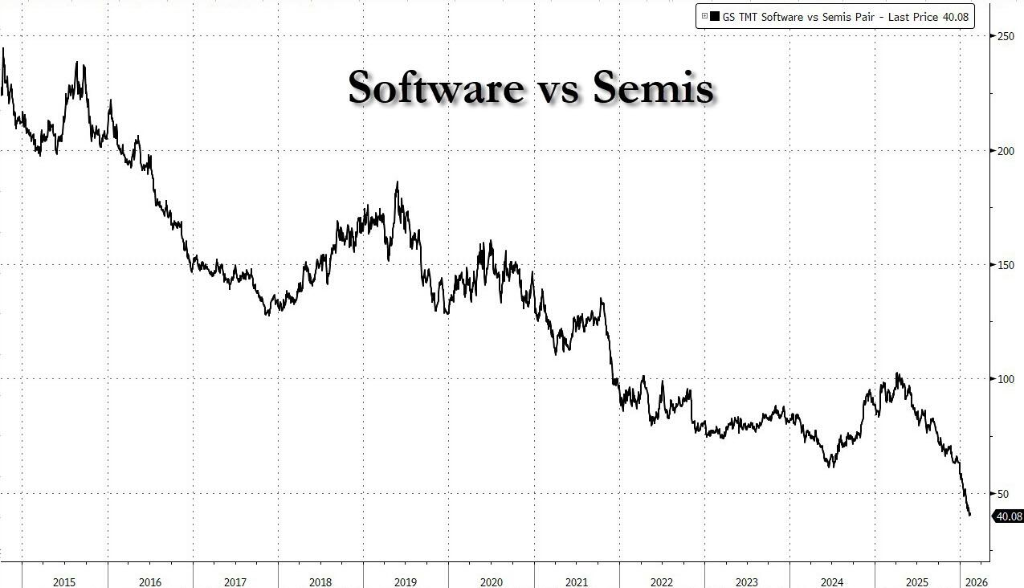

Who will save "software stocks"?

美股ipo·2026/02/18 03:47

Flash

12:32

U.S. Core PCE Reaches Near Two-Year High, in Line with ExpectationsBlockBeats News, March 13, the US January Core PCE Price Index year-on-year further rose to 3.1%, the highest level since March 2024, in line with market expectations. (FX678)

12:29

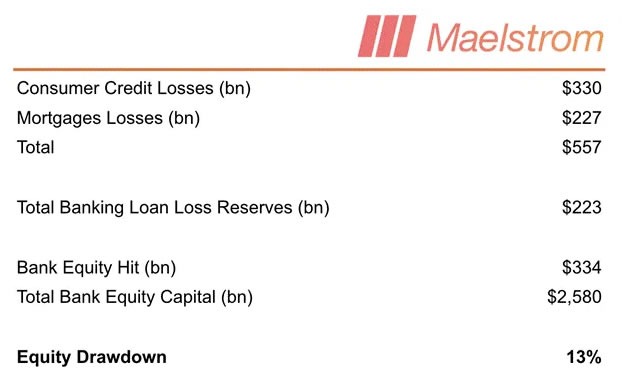

Bank of America warns that market trends resemble the eve of the 2007 crisisJinse Finance reported on March 13 that Michael Hartnett, a strategist at Bank of America, stated that the surge in oil prices and growing concerns surrounding private credit are making market movements increasingly resemble the period before the outbreak of the global financial crisis. He pointed out that between July and August 2007, oil prices rose from $70 per barrel to $140, while the "subprime shock" began to emerge and affected institutions such as Northern Rock and Bear Stearns. The Iran war that broke out on February 28 has driven oil prices up by more than 60% this year. Hartnett said in the report: "The performance of assets in 2026 is increasingly approaching the price trends from mid-2007 to mid-2008." He added that Wall Street is "trading disturbingly similar to the 07-08 pattern." Hartnett noted that the current market consensus still believes the Iran conflict will not last long, and that private credit issues do not pose systemic risks. This judgment is prompting investors to continue holding bullish positions, as they believe "policymakers will always step in to save Wall Street." Hartnett believes that the greater risk to the stock market from rising oil prices and tightening financial conditions lies in corporate earnings, rather than inflation. (Golden Ten Data)

12:28

Synthetix 2026 roadmap: All trading revenue will be used to buy back SNX and sUSD, and plans to restore sUSD peg in Q2Foresight News reports that Synthetix has released its 2026 roadmap, aiming to establish the protocol as the preferred perpetual contract trading venue on the Ethereum mainnet. Synthetix stated that the core architecture rebuild was completed in 2025, including the launch of mainnet CLOB perpetual contracts, the acquisition of Kwenta and TLX to unify the frontend, and the implementation of SIP-420 delegated staking. According to the 2026 plan, Synthetix will initiate buybacks in the first quarter, with all trading revenue used to buy back SNX and sUSD (50% each), targeting the restoration of sUSD peg by the end of the second quarter.Additionally, Synthetix plans to launch a multi-collateral feature in April, supporting users to use assets such as ETH and cbBTC as margin. In the second quarter, Basis Trade Vaults and the public version of Synthetix Liquidity Pool (SLP) will go live. Regarding asset classes, the commodity market is scheduled to open in April, and the forex market will launch in June. Starting from the second half of 2026, sUSD will transition into a decentralized stablecoin supported by delta-hedged crypto collateral. Synthetix will also introduce an esports-style trading competition called "Synthetix Teams" and continue to optimize advanced order features such as limit orders.

News