- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (March 17) | Trump crypto project WLFI purchases $AVAX and $MNT, on-chain MUBARAK becomes a hot topic

Bitget Daily Digest (March 17) | Trump crypto project WLFI purchases $AVAX and $MNT, on-chain MUBARAK becomes a hot topic

远山洞见

2025/03/17

Today's preview

1.The U.S. February retail sales month-on-month report will be released today, with the previous value at -0.90%.

2.Ethereum Foundation developers launch a new "Hoodi" testnet for the final upgrade test of Pectra.

3.ApeCoin (APE) unlocks approximately 15.4 million tokens, valued at around $10 million.

4.The Graph (GRT) unlocks about 87.3 million tokens, valued at approximately $11 million.

5.Nvidia is hosting its GTC conference, running until March 21.

Key market highlights

1.Global markets face a "Super Central Bank Week", with major central banks, including the Federal Reserve, Bank of Japan, and Bank of England, holding monetary policy meetings.

Markets generally expect the Fed to keep rates unchanged amid high uncertainty, watching Powell's statements for any hints of rate cuts. Morgan Stanley predicts two rate cuts by the Fed this year but anticipates the Fed to remain patient and data-driven in the short term.

2.Gold ETF assets under management surpass Bitcoin ETF. 21Shares plans to liquidate its BTC and ETH futures ETFs amid rising market risk aversion. Gold prices have surged above $3000 per ounce, driving the largest monthly inflow into gold ETFs since March 2022. Consequently, gold ETFs have overtaken Bitcoin ETFs in assets under management.

Meanwhile, Bitcoin ETFs have seen large outflows totaling $3.8 billion since February 24. In response, crypto asset management company 21Shares has announced plans to liquidate its Bitcoin futures ETF (ARKC) and Ethereum futures ETF (ARKY).

3.The Solana ecosystem continues to expand, with stablecoin TVL exceeding 5% and all-time high trading volume as it celebrates its fifth anniversary. Citing Artemis data, Perena's founder Anna Yuan reports that the proportion of stablecoin TVL on Solana has exceeded 5%, a significant increase from under 3% two months ago, currently second only to Ethereum (over $100 billion) and TRON (over $50 billion).

Solana also celebrates its fifth anniversary, with total on-chain transactions exceeding 408 billion, and DEX trading volume exceeding $987 billion, demonstrating a strong growth trend.

4.Kanye West shares a tweet containing the contract address for memecoin

YZY, causing its market cap to spike to $180 million before falling back. Meanwhile, CZ buys

TST and

Mubarak with 1 BNB and posts about it, claiming "doing some tests this weekend". Market funds flood in, fueling the hype and making it a social media hot topic.

Market overview

1.BTC experiences short-term fluctuations with a general market decline. Small-cap coins BIZA and $LVVA see sharp rises, while new coins show mixed trends. Only $OIK and $BMT have recorded positive gains, while coins from the TON ecosystem, $X and $MAJOR, have made it into the top ten by trading volume.

2.The risk of a U.S. government shutdown has been averted, with the S&P 500 seeing its strongest rebound since the election, Nvidia is up over 5%, European stocks have risen more than 1%, and gold briefly hits $3000. Oil ends its seven-week losing streak.

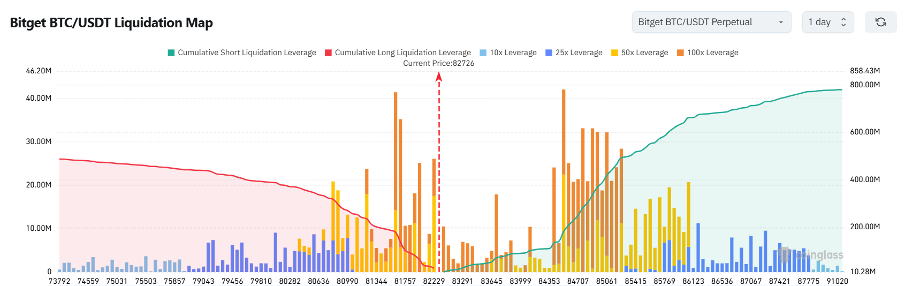

3.Currently standing at 82,726 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,726 USDT could trigger

over $100 million in cumulative long-position liquidations. Conversely, a rise to 83,726 USDT could lead to

more than $70 million in cumulative short-position liquidations. Both long and short positions should exercise caution and manage leverage prudently to avoid large-scale liquidations.

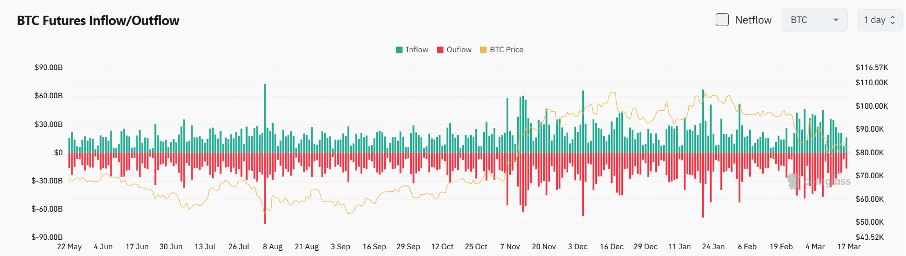

4.Over the past 24 hours, the BTC spot market recorded $16.3 billion in inflows and $16.6 billion in outflows, resulting in a

net outflow of $300 million.

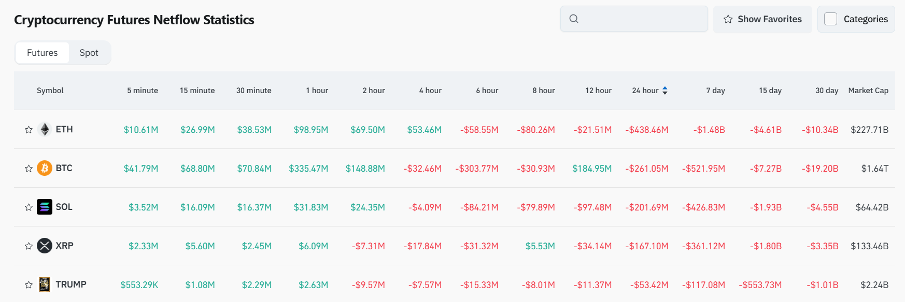

5.In the last 24 hours, $ETH, $BTC, $SOL, $XRP, and $TRUMP led in

net outflows in futures trading, signaling potential trading opportunities.

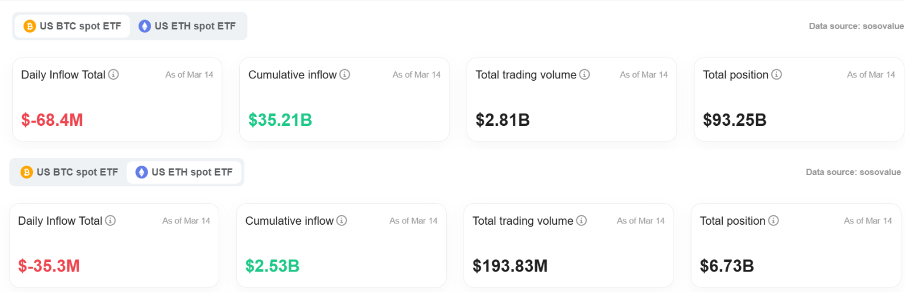

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $68.4059 million, while the cumulative inflows amount to $35.206 billion, with total holdings at $93.248 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $35.3043 million, with cumulative inflows of $2.521 billion and total holdings of $6.723 billion.

Institutional insights

10x Research: Bitcoin may enter another long consolidation phase as the market lacks momentum to buy the dip.

Read the full article here:

https://cointelegraph.com/news/bitcoin-consolidation-phase-repeat-2024-price-action-possible-crypto-analyst

Fideum: Memecoins have become a tool for retail investor value extraction, straying from their decentralized roots.

Read the full article here:

https://cointelegraph.com/news/libra-melania-creator-wolf-wall-street-memecoin-crashes-99

News updates

1.Pakistan forms a cryptocurrency committee, with the finance minister serving as chairman.

2.The U.S. Senate passes a spending bill, reducing government shutdown risk.

3.Argentina's securities regulator finalizes rules for virtual asset service providers.

4.The Lazarus Group holds approximately 13,562 BTC, pushing North Korea's Bitcoin holdings ahead of El Salvador and Bhutan.

Project updates

1.DOGE sees a surge in active addresses, peaking over 390,000 in the short term.

2.21Shares plans to liquidate its Bitcoin ETF (ARKC) and Ethereum ETF (ARKY).

3.Trump's crypto project WLFI purchased $2 million each of AVAX and MNT yesterday.

4.Astar zkEVM will shut down on April 1, and users must withdraw assets in time.

5.VanEck files its S-1 form for the Avalanche ETF.

6.Solana celebrates its fifth anniversary with over $987 billion in on-chain DEX trading volume.

7.NFT trading volume fell by 7.84% over the last 7 days to $109.2 million, but both buyer and seller numbers increased by over 400%.

8.The cumulative net inflow of U.S. Bitcoin spot ETFs has dropped to its lowest level since January 2.

9.Telegram founder Pavel Durov was granted permission to leave France for Dubai, boosting TON's price.

10.Bank of New York Mellon announces it will be an early user of the lending platform EquiLend 1Source and has acquired a minority stake in EquiLend.

Highlights on X

DaPangDun: The right way to participate in the SONIC ecosystem: How to maximize Alpha returns

The SONIC ecosystem is rich with opportunities, and rather than focusing on fiercely competitive airdrop points, it's more advantageous to focus on high Alpha opportunities within the ecosystem, such as Shadow, MetropolisDEX, NaviExSonic, HandofGodSonic, and Derp NFT. These early-stage investments often bring higher returns while passively earning user points and Gems. The strategy is to seize project Alpha during an uptrend using $S tokens, earn during flat or downward trends through LP + lending cycles, and look for potential low-priced $S opportunities after the June airdrop. The key idea is to adjust strategies flexibly and seize market rhythm to maximize potential returns within the ecosystem.

Newton: Market misunderstanding and repricing of $ARC: The long-term potential of the B2B model

ARC is undergoing a misunderstanding-driven repricing, as early investors had misaligned expectations about its model. Many believed ARC was building an AI agent or an AI agent launch platform, but after the release of the Litepaper, it became clear that $ARC is actually an AI agent app store (B2B model). This led to disappointment and exits among some investors. Retail investors often lack the ability to assess B2B models and are more familiar with consumer-facing brands like Apple, Google, Microsoft, and Nvidia, overlooking many profitable but low-key B2B giants. However, the B2B space, including developer tools and middleware markets, has immense commercial potential. The $ARC team is transparent, experienced, and continuously building. Despite short-term sell-offs due to a lack of understanding of practical projects, the risk/reward ratio is attractive, and the market will eventually recognize its true value.

@thecryptoskanda: CZ's BSC revival logic: Asset operations + memecoin cooperative mechanism

CZ's logic for reviving BSC essentially revolves around stabilizing BNB and constantly generating new memecoins. The essence of the memecoin market is a cooperative mechanism, where liquidity must be continually introduced under controlled global debt conditions to prevent funds from being concentrated in a single project, leading to a collapse. As long as BNB prices remain predictable, LPs will be willing to hold positions in the main coin and drive memecoin ecosystem expansion. BSC demonstrates wealth potential to developers, attracting them to create liquidity pools, thereby increasing DEX TVL and market depth, ensuring continued market liquidity. Given the limited impact of any single high FDV project, it is crucial to continuously launch new memecoins to ensure that retail funds are reinvested rather than prematurely draining liquidity. The key to breaking the market cap ceiling lies in the liquidity advantage of BNB, allowing BSC to expand the memecoin space at any time once market conditions mature. For Solana, this might be a challenge, but for BSC, it's the ultimate advantage in controlling market liquidity.

0xJeff: 2025 Q1 AI agent ecosystem panorama: Market slowdown, innovation accelerating, who will break through first?

The past two months have been exceptionally tough for the AI agent space, as the market was hit by Trump family coins, $LIBRA, market manipulation, trade policies, and other factors, causing AI agent tokens and memecoin volumes to decline. Core players are facing liquidity and growth pressures. Virtuals remains the largest ecosystem, but daily trading volume has dropped from over $100 million to $5 million – $10 million. ACP (Agent Commerce Protocol) is currently the key breakthrough direction; Clanker has rapidly emerged, surpassing Virtuals in DEX trading volume in a short period, offering a more developer-friendly launchpad mechanism. Meanwhile, ElizaOS has undergone a major rebranding, shifting its focus toward building an AI agent operating system, with several new products currently in development. Arc is positioning itself as an "AI agent app store," aiming to bridge Web2 and Web3 interoperability. Despite the market downturn, innovation in AI agents continues to accelerate, with the key competition point being which team can launch truly valuable products, attract users, and generate real revenue. After the initial hype and speculation, the market has entered a phase of evaluating practicality and business models. The future leaders in the space will be those who find market fit quickly and sustain long-term growth.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.