- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (April 10) | Trump authorizes 90-day suspension of some reciprocal tariffs; CFTC clarifies cessation of industry regulation through litigatio

Bitget Daily Digest (April 10) | Trump authorizes 90-day suspension of some reciprocal tariffs; CFTC clarifies cessation of industry regulation through litigatio

远山洞见

2025/04/10

Today's preview

1.U.S. March unadjusted CPI (YoY) will be released today, with the previous reading at 2.80%.

2.U.S. March seasonally adjusted CPI (MoM) will be released today, with the previous reading at 0.20%.

3.U.S. initial jobless claims (week ending April 5) will be released today, with the previous reading at 219,000.

Key market highlights

1.

Trump announced that he had authorized an immediate suspension of 90-day reciprocal tariffs and 10% tariffs. The news sent U.S. stocks and Bitcoin surging, with Bitcoin spiking briefly and the Nasdaq posting strong gains. On the same day, Trump posted multiple messages on social media, stating that "this is a great time to buy" and that "everything is going to work out well." He also urged Congressional Republicans to pass the tax cut bill immediately.

2.Acting CFTC Chair Caroline D. Pham expressed support for the Department of Justice's decision to end its practice of regulating the crypto industry through prosecution. She directed the CFTC not to bring cases involving violations of registration provisions under the Commodity Exchange Act without evidence of intent. Meanwhile, the U.S. House held a hearing on crypto market structure legislation, marking a key step forward.

Lawmakers debated a regulatory framework for digital assets aimed at establishing clear rules for exchanges and token issuers. The hearing sets the stage for final legislation.

3.

Aave has officially launched its token buyback program with a first-month budget of $4 million. According to the latest governance proposal, Aave DAO will use aEthUSDT to buy back AAVE through its treasury committee, then allocate the tokens to the ecosystem reserve to boost protocol incentives and encourage governance participation. The plan will run for six months, with a weekly buyback cap of $1 million. The move is seen as a major milestone in advancing Aavenomics.

4.Bitget has announced an upgrade to its BGB burn mechanism. Going forward, quarterly burn volumes will be tied to actual on-chain gas usage, enhancing both compliance and transparency.

Under the new mechanism, approximately 30 million BGB (around 2.5% of total supply) will be burned in Q1 2025, with all records made publicly available on-chain. This initiative aims to reinforce BGB's role as a vital link between CEX and DeFi, while supporting a more sustainable tokenomics model.

Market overview

1.Trump's announcement to suspend tariffs sparked a sharp market rally, the $BTC leading the charge. $SWCH, $MOZ, and $XCN stood out as the top rebounders, while the TON-based $X broke into the top ten by trading volume.

2.Following the U.S. pause on certain tariffs, gold, copper, and oil posted strong rebounds. The Nasdaq jumped over 12%, while Chinese equities and offshore RMB surged. The U.S. 10-year Treasury yield spiked before pulling back.

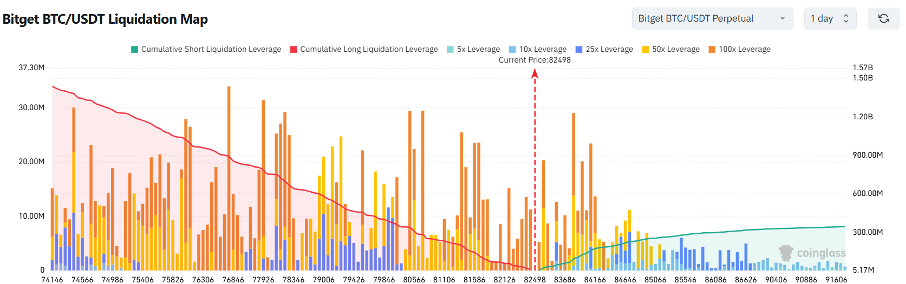

3.Currently standing at 82,498 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,498 USDT could trigger

over $205 million in cumulative long-position liquidations. Conversely, a rise to 83,498 USDT could lead to

more than $46 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

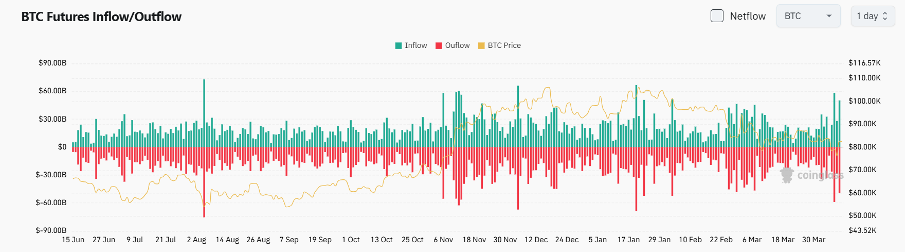

4.Over the last 24 hours, BTC spot saw $50.1 billion in inflows and $49.5 billion in outflows, resulting in

a net inflow of $600 million.

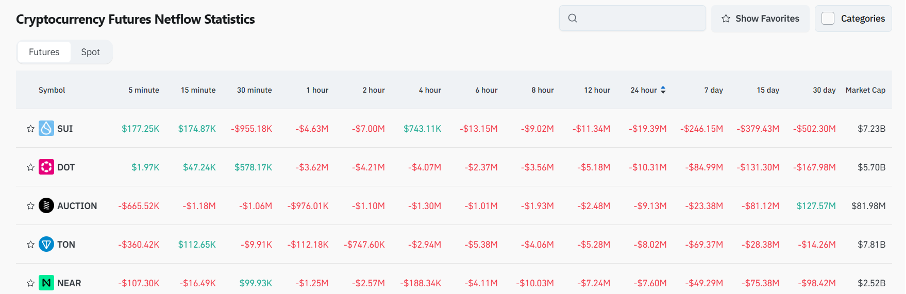

5.In the last 24 hours, $SUI, $DOT, $AUCTION, $TON, and $NERA led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Glassnode: Selling pressure for BTC and ETH has been easing. The $65,000–$71,000 range remains a critical support zone that bulls need to defend.

Article:

https://insights.glassnode.com/

Bitwise: Lending rates have been falling steadily since the election, suggesting the market may be at or near the bottom.

X post:

https://x.com/Matt_Hougan/

Deutsche Bank: Confidence in U.S. assets is rapidly deteriorating.

X post:

https://x.com/DeItaone/

Matrixport: It's not yet the right time to "buy the dip" on Bitcoin.

X post:

https://x.com/

News updates

1.The U.S. CFTC has clarified it will stop regulating the crypto industry through prosecution.

2.Pakistan plans to use excess electricity to support Bitcoin mining operations and AI development.

3.U.S. President Trump authorizes a 90-day suspension of tariffs.

Project updates

1.The U.S. SEC approves options trading for spot Ethereum ETFs.

2.21Shares' Dogecoin ETP is now listed on Switzerland's SIX exchange under the ticker DOGE.

3.DWF Labs subscribes to 250 million WLFI tokens at an average price of $0.1.

4.Infini's Earn feature is officially back online, with a fully upgraded security architecture.

5.BGB burn rules have been upgraded—around 30 million BGB will be burned in Q1 2025.

6.Aave launches token buyback mechanism with a $4 million budget for the first month.

7.Bitget Onchain adds projects AGAWA, Steve, and Jockey.

8.Florida's public hearing on the bill allowing public funds to invest in Bitcoin is scheduled for April 10.

9.Cakepie DAO opposes PancakeSwap's tokenomics 3.0 proposal, warning of serious consequences from removing veCAKE.

10.Glassnode: The share of BTC holders in the 3–6 month range currently at a loss has risen to 19.4%.

Highlights on X

@Michael_Liu93: Why do U.S.

stocks

react first to macro events, while crypto tends to dip earlier?

When macro events like tax hikes or rate changes occur, U.S. stocks usually react faster than crypto. That's because traditional markets rely on a well-established "discounted cash flow model," allowing fund managers to quickly factor in changes like tax or interest rates. This helps form a shared valuation consensus and enables quick position adjustments. Crypto, lacking a standardized valuation framework and a consistent market consensus, often lags in reaction — generally following the stock market. But when liquidity tightens, the pattern flips: crypto drops first. Fund managers looking to de-risk will offload the most volatile and least liquid assets first — crypto being a prime example. In short, U.S. stocks reflect "rational response," while crypto acts as a "panic barometer."

@Crypto_Painter: From U.S.–China trade and geopolitics to crypto: notes on a global power game

The core of the U.S.–China "trade decoupling" is mutual reliance. In the short term, the U.S. will struggle to replace low-cost Chinese goods, while China is pushed to invest in domestic R&D—potentially accelerating tech innovation. Institutional differences between China and the U.S. dictate that as the global order grows more chaotic, the country that maintains internal strategic continuity will gain a competitive edge. This power shift will eventually reflect in the monetary system: the dominant party will overdraw sovereign credit, fueling global monetary expansion. In this context, BTC and other non-sovereign assets stand to benefit over the long term.

@ZKSgu: Why did I choose to go big on Hype?

The CEX landscape is already set—it's nearly impossible for new CEX to break into the top tier. The real disruptor lies in the rise of on-chain derivatives markets. The trillion-dollar futures market will spawn multiple tens of billion-dollar projects. This is the core narrative for the next cycle. That's why @ZKSgu has gone heavily on Hype and is also positioning in next-gen perpetual DEXs like StandX. Built by a former top-tier exchange team, StandX isn't fully live yet, but its deep technical stack and market insights make it one of the most promising projects out there. Whether it can leverage top-tier exchange resources or face them head-on remains to be seen. CEX dominates now, but DEX is the future.

@Grimmzer1: Tracking the whales — how to outsmart on-chain operators

To trade coins with PvE-style market setups, first determine if a whale is manipulating the market. This means identifying signs of sniping, accumulation, manipulation, and key wallet movements first. Use tools like GMGN and Arkham to track activity, then combine that data with chart patterns, liquidity pool analysis, and DCA behavior to judge whether a whale is tightly controlling supply and has the intent to continue. This helps define the optimal entry timing and safe trading range. Address labeling is also key, since the same players often rotate through multiple projects on the chain. Historical data becomes your edge for futures trading.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.