- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (April 11) | U.S. CPI comes in below expectations; Trump signs first-ever federal crypto bill repealing expanded IRS broker rule

Bitget Daily Digest (April 11) | U.S. CPI comes in below expectations; Trump signs first-ever federal crypto bill repealing expanded IRS broker rule

远山洞见

2025/04/11

Today's preview

1. U.S. March PPI YoY will be released today, with the previous reading at 3.20%.

2. The preliminary University of Michigan Consumer Sentiment Index for April will be announced today, with the previous reading at 57.

3. The U.S. one-year inflation expectation for April will be released today, with the previous reading at 5.00%.

4. Aptos (APT) will unlock approximately 11.31 million tokens at 4:00 PM on April 12 (UTC+8), representing 1.87% of the current circulating supply, valued at around $53.70 million.

5. Axie Infinity (AXS) will unlock approximately 9.09 million tokens at 9:10 PM on April 12 (UTC+8), representing 5.68% of the current circulating supply, valued at around $24.50 million.

Key market highlights

1. U.S. President Donald Trump has signed into law a bill that repeals a rule introduced in the final weeks of the Biden administration, which had expanded the definition of a broker to include DeFi exchanges. The Internal Revenue Service (IRS) will no longer be able to require decentralized crypto platforms to report tax data. This marks the first-ever federal law specifically targeting cryptocurrencies, marking a major step forward for DeFi regulation. Introduced by Republican Senator Ted Cruz, the bill passed with broad bipartisan support. Cruz hailed the legislation as a victory for "financial freedom, innovation, and privacy."

2. U.S. March CPI YoY came in at 2.4%, below the expected 2.6%, signaling the easing of inflation. Core CPI YoY was 2.8%, also lower than the forecast of 3%. Meanwhile, initial jobless claims for the week ending April 5 rose to 223,000, slightly above the previous 219,000 but in line with expectations. The data pushed short-term interest rates lower and fueled market bets on a June Fed rate cut, which is now almost fully priced in—giving a boost to risk assets.

3. The dYdX Foundation has proposed a treasury update that includes a new charter for its subDAO and changes to board members. The proposal also seeks to expand the token buyback program to include over-the-counter (OTC) transactions, in addition to open market purchases. Currently, 25% of protocol revenue is allocated to buy back DYDX tokens on the open market. Adding OTC buybacks could help the dYdX DAO optimize cash flow and reduce trading costs. Voting on the proposal will close on April 14.

4. Trump hints at extending tariff suspension, briefly easing market losses. Yellen calls Trump's tariff policy "the most severe self-inflicted wound." During yesterday's cabinet meeting, Trump said he might extend the 90-day suspension on tariffs, adding he hadn't seen the market sell-off on Tuesday. However, U.S. stocks did not see the same boost as on Wednesday and continued to decline sharply on Thursday. Former Treasury Secretary and Fed Chair Janet Yellen criticized Trump's policies as "the worst self-inflicted wound that I have ever seen an administration impose on a well-functioning economy", warning of rising recession risks.

Market overview

1. BTC briefly dipped to the $78,000 level, with only a few established coins like $CRV and $RENDEN posting gains among the top 100 coins. The Fear & Greed Index continues to decline, nearing another short-term low.

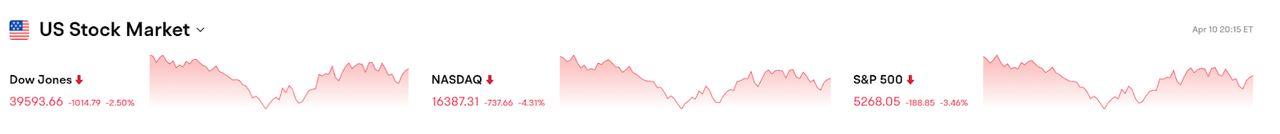

2. Despite cooling CPI data, tariff concerns weighed heavily on the markets, with U.S. stocks, bonds, and the dollar all taking hits. The Nasdaq fell over 4%, the S&P 500 dropped more than 3%, and 10-year Treasury yields rose for a fourth consecutive day. The Swiss franc surged nearly 4% intraday, marking its biggest jump in a decade, while spot gold rose 3% to a new all-time high.

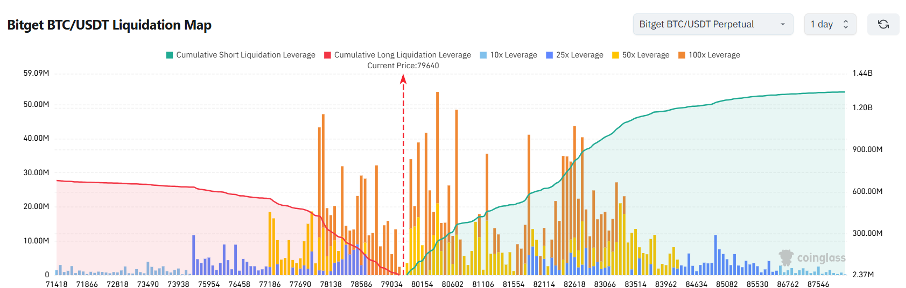

3. Currently standing at 79,640 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 78,640 USDT could trigger

over $198 million in cumulative long-position liquidations. Conversely, a rise to 80,640 USDT could lead to

more than $301 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

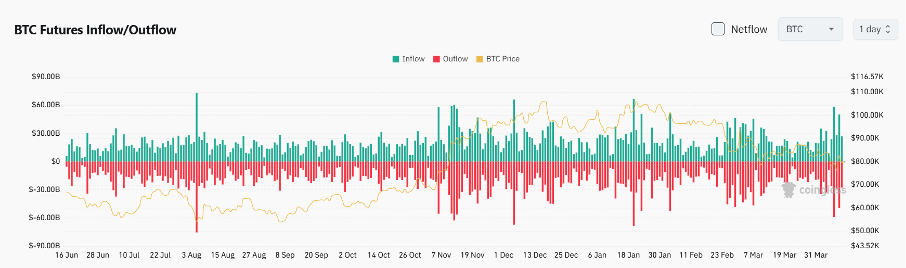

4. Over the past 24 hours, the BTC spot market recorded $33 billion in inflows and $33.2 billion in outflows, resulting in a

net outflow of $200 million.

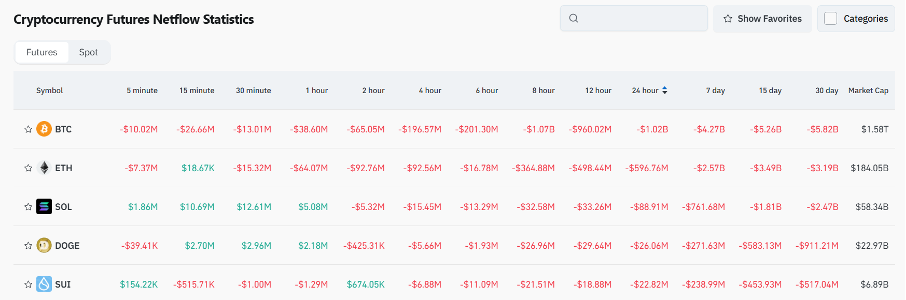

5. Over the past 24 hours, $BTC, $ETH, $SOL, $DOGE, and $SUI led in futures trading net outflows, signaling potential trading opportunities.

Institutional insights

Cardano: Bitcoin could hit $250,000 by the end of this year

Article:

https://www.cnbc.com

Bitcoin News: Over 85% of Bitcoin holders are still in profit

X post:

https://x.com/BitcoinNewsCom/

News updates

1. The U.S. House of Representatives has passed a bill to advance Trump's tax cuts and raise the government's debt ceiling.

2. U.S. initial jobless claims for the week ending April 5 came in at 223,000, in line with expectations.

3. The New York Attorney General sends a letter to senior members of Congress urging a regulatory framework for digital assets.

4. New Hampshire's House of Representatives passes Bitcoin reserve bill

5. Five major South Korean banks call for relaxed restrictions on crypto industry partnerships, supporting a model where a single exchange can work with multiple banks.

Project updates

1. ZKFair responds to rug pull rumors, stating that all funds are safe and withdrawals remain open. The cross-chain bridge has been upgraded from ZKBridge to a multisig bridge.

2. Mind Network has launched $FHE staking and agent training, with projected annual yields of up to 400%.

3. The U.S. SEC has approved applications from several institutions to launch options trading for spot Ethereum ETFs.

4. Solana ranked first in 24-hour DEX trading volume.

5. JupiterDAO has opened claims for Q1 ASR rewards.

6. 21Shares files for the first spot Dogecoin ETF in the United States.

7. DWF Labs has opened applications for its $250 million liquidity fund.

8. Bedrock will airdrop BABY tokens to users who link their Babylon wallets.

9. Wayfinder has paused airdrop claims while resolving issues related to failed transactions and MEV activity.

5. VanEck has submitted an application to the SEC for an Avalanche ETF.

Highlights on X

1. Haotian: The market has entered a "Great Reality Check" phase

The crypto market is now undergoing a widespread "expectation reset." From project teams and VCs to token holders, airdrop hunters, storytellers, infrastructure builders, and CEX users—everyone is coming back down to earth. Startup teams have shifted from hype-driven "dream teams" to simply trying to survive. VCs are moving from large bets to fast, small trades. Retail investors no longer dream of 100x returns but are focusing on trading skills and realistic 3–5x gains. Airdrop hunters are entering a stealthier phase—"zero-cost, solo hunting" is becoming the norm. The one-narrative magic that used to ignite markets is fading; instead, we're seeing fragmented, micro-narratives take center stage. Infrastructure projects are pivoting from a race for performance to a battle for attention. The once-glorified CEXs are losing their halo effect. In short, the entire crypto ecosystem is facing a collective dose of reality. But it's precisely during this cooldown that the next true breakout players will begin to emerge.

2. Phyrex: Despite positive CPI, economic slowdown signals persist — BTC still awaits a loosening pivot

While the lower-than-expected US CPI appears bullish on the surface, the negative month-over-month figure hints at economic contraction. Inflation may be easing, but so is growth. Combined with high tariffs and a Fed still in tightening mode, there's no solid macro foundation for a real market reversal yet. BTC has dipped short-term, but on-chain data shows solid holding behavior and no signs of panic selling. The real bull run will only begin when monetary policy turns dovish and a recession risk triggers a renewed liquidity cycle.

3. Crypto_Painter: ASR-VC indicator flips back to 4-hour range-bound after bears get wiped

After Trump once again applied his trademark “schoolyard bully” pressure on China, BTC bounced strongly above 79k. This disrupted the previous bearish ASR-VC channel, pushing price action back into a consolidation range. While BTC has cleanly retested the midline of the channel, bulls shouldn't get ahead of themselves just yet — a confirmed breakout hasn't happened. As warned earlier, bears are once again being liquidated by surprise bullish triggers. If BTC continues to hold above 79k, a new wave of short squeezes could follow. However, a true trend reversal is unlikely to arrive until we see one final bull trap and a fake breakout at the channel's upper boundary.

4. ZTZZ: A reflection on the industry amid the KOL hype

My recent trip to Hong Kong gave me a front-row seat to crypto's cooling momentum beneath the surface glitz. The KOL hierarchy is clear—plenty of hollow influencers chasing views, while real thought leaders often operate outside the "KOL" label. Some project teams are quietly exploring exit strategies, while truly promising projects are quietly emerging amid the bear market. Large exchanges are weighed down by internal bureaucracy, while on-chain exchanges may be the next breakout space. VCs are evolving too — shifting from chasing inflated valuations to looking for synergy and exit opportunities. The industry is losing its old "Wild West" energy. As for retail investors, the biggest danger is relying solely on communities and Twitter for information, becoming victims of opaque narratives. The real takeaway: become someone of value—use that value to build genuine connections. That's the only path to anything lasting.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.