News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

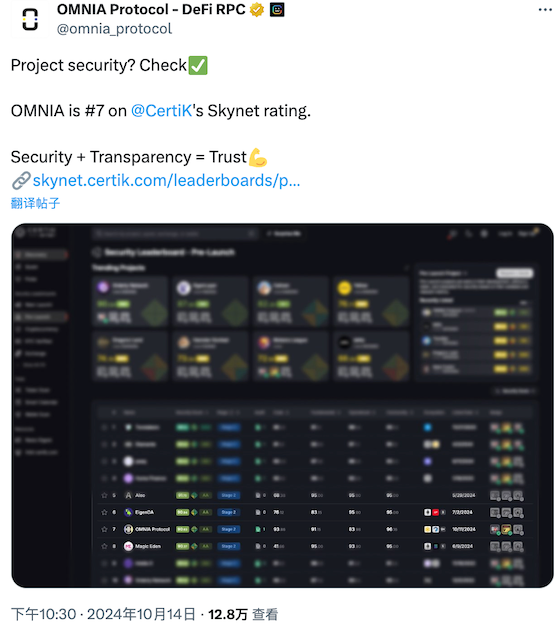

OMNIA is No.7 on CertiK's Skynet rating

X·2024/10/15 07:25

X Empire: Tell everyone about Airdrop

X·2024/10/12 08:31

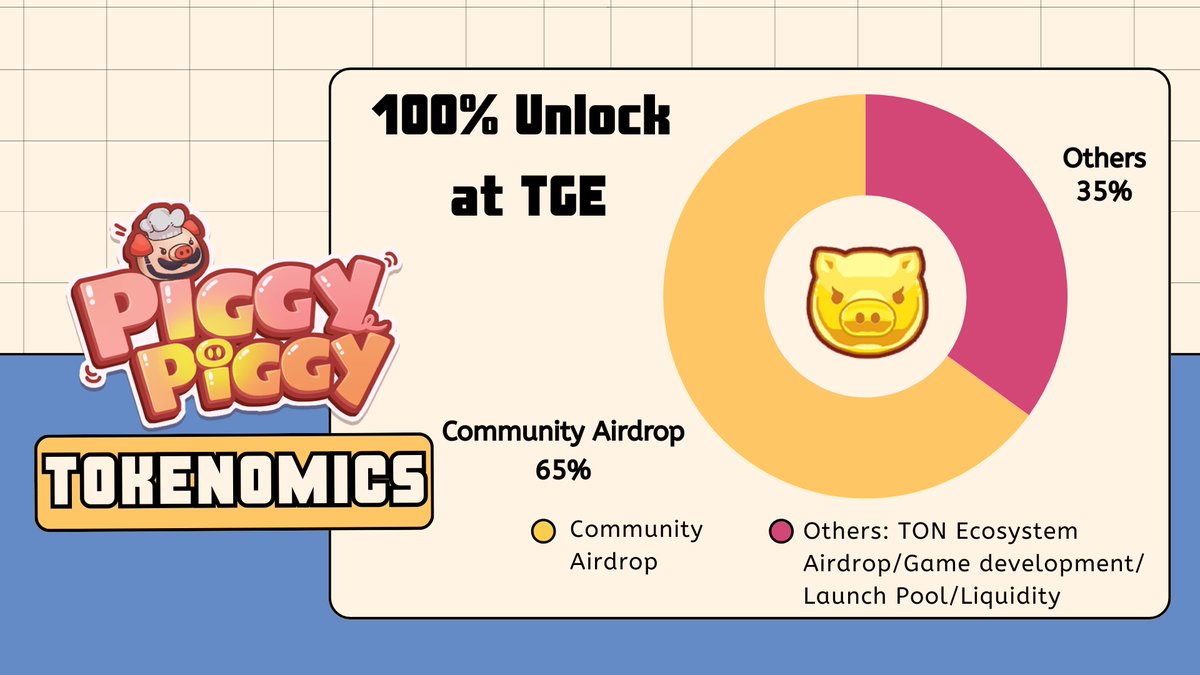

PGC Tokenomics: 65% allocated to Community,100% Unlock at TGE

X·2024/10/11 08:14

In the wake of the market narrative surrounding the "Solana Killer," SUI, which recently launched the Grayscale Sui Trust and Binance futures, has doubled in value within a month. The leading projects in the Sui ecosystem have also benefited from the generous subsidies and strong support provided by the Sui Foundation. This surge has brought numerous opportunities within the Sui ecosystem.

Bitget·2024/10/11 06:28

$PUFFER Tokenomics Breakdown: Empowering the Puffer Community and Beyond

Medium·2024/10/10 07:16

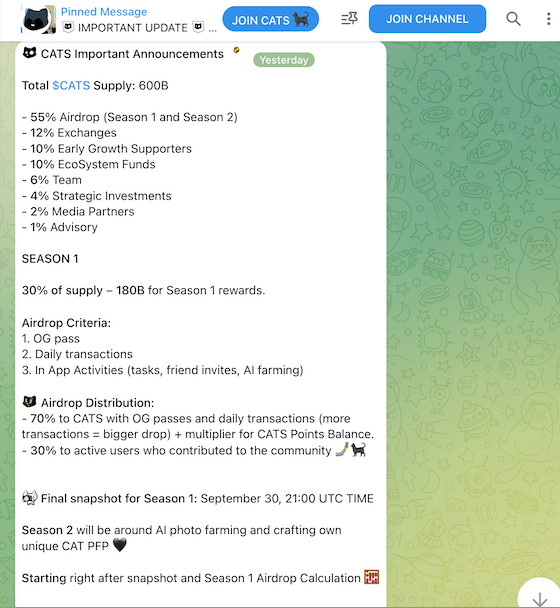

CATS on why some cats getting big bags while others ended up with just dust

Telegram Announcement·2024/10/09 03:37

Cats claim page closed and is calculating your airdrop now

Telegram Announcement·2024/10/05 06:38

What Is MemeFi?

MemeFi is a meme-based gaming app that introduces tokenized divisible character ownership enhanced with ERC-404 functionality.

Coingecko·2024/10/01 09:29

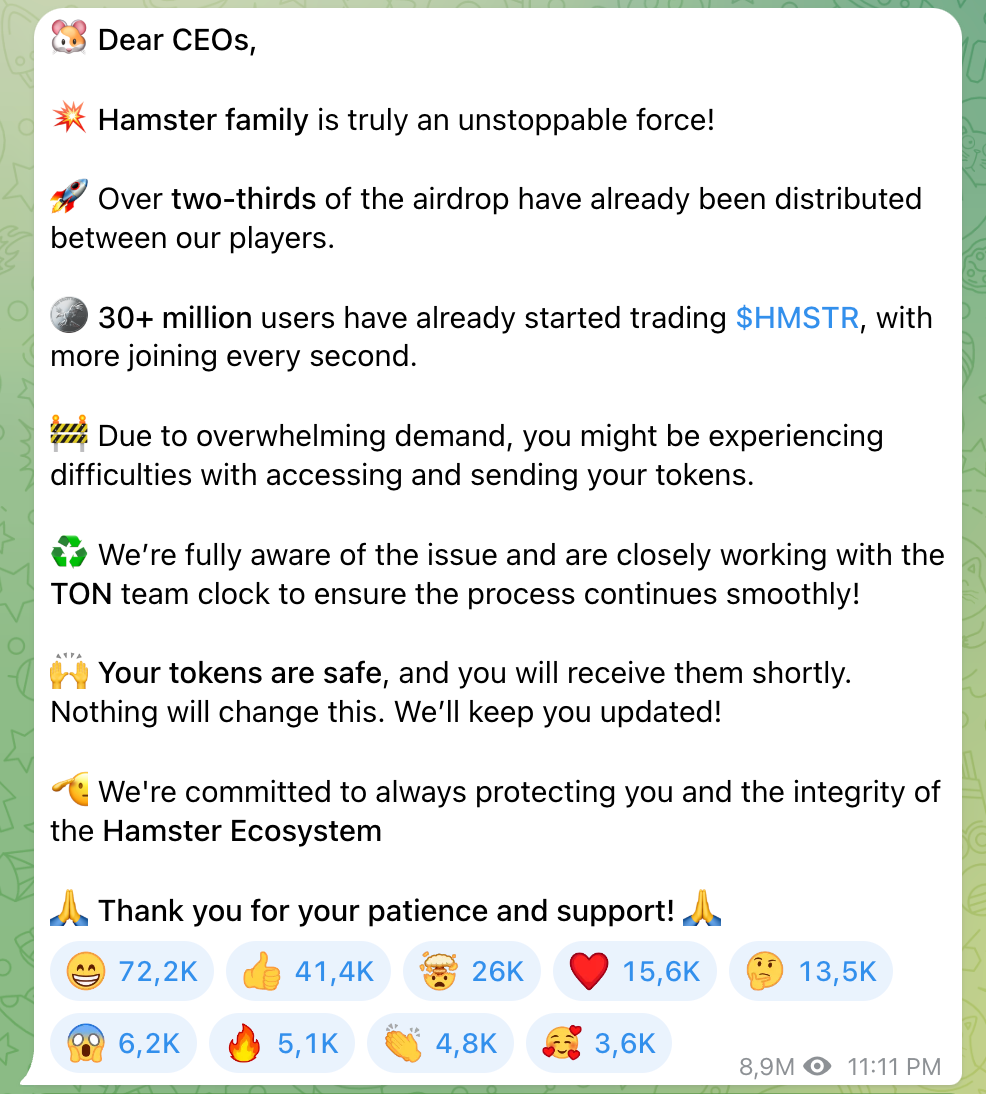

Over two-thirds of the airdrop have already been distributed between our players

Telegram Announcement·2024/09/27 08:14

Important Announcements From CATS community

Telegram Announcement·2024/09/27 08:11

Flash

- 09:18Solana Blockchain Strategy Game Honeyland Acquired by BRAVO READYOdaily Planet Daily News: The Solana blockchain strategy game Honeyland, developed by Hexagon Studios, has announced its acquisition by gaming infrastructure developer BRAVO READY. The specific acquisition amount has not been disclosed. Previously, Honeyland raised $4 million at a $20 million valuation. Upon completion of the acquisition, Honeyland will be integrated into BRAVO READY's portfolio of real-time revenue-generating products. (Businesswire)

- 09:12Data: CoinUp platform token CP is currently trading at $0.47, over 15 times its opening priceAccording to ChainCatcher, market data shows that CoinUp's platform token CP opened at $0.03 and is now trading at $0.47, representing an increase of more than 15 times.

- 09:07Opinion: Trump Exhausts Resources on the Big and Beautiful Act, GENIUS Act Passage May Be Delayed Until Early OctoberAccording to a report by Jinse Finance, as disclosed by Caijing Magazine, some U.S.-based scholars have stated that Trump has already "exhausted" his political capital during the push for the "Big and Beautiful Act," and there is little left if he tries to use the same approach for stablecoin legislation. In addition, several senior legal experts in the U.S. told Caijing that, since the more important "Big and Beautiful Act" was passed in a timely manner, the likelihood of the "GENIUS Act" being passed as scheduled before August has greatly increased. However, they also believe that if the "GENIUS Act" is forced to be bundled with other market structure bills, it will introduce significant uncertainty to the review process. If it cannot be passed smoothly before Congress's summer recess, and since Congress will not reconvene until early September, the earliest the bill could be passed would be late September or early October.