News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Recently, as market liquidity recovers, the crypto market—led by key assets like BTC and ETH—has started to rebound. Leading DeFi assets have continued to update their products amid six months of market volatility, maintaining their market dominance and leading positions. With the upcoming U.S. presidential election, both candidates are likely to propose favorable policies regarding DeFi and Web3 applications, potentially bolstering the sector. As a result, leading DeFi assets are expected to benefit from an early boost in liquidity recovery and may outperform the broader market in the coming months.

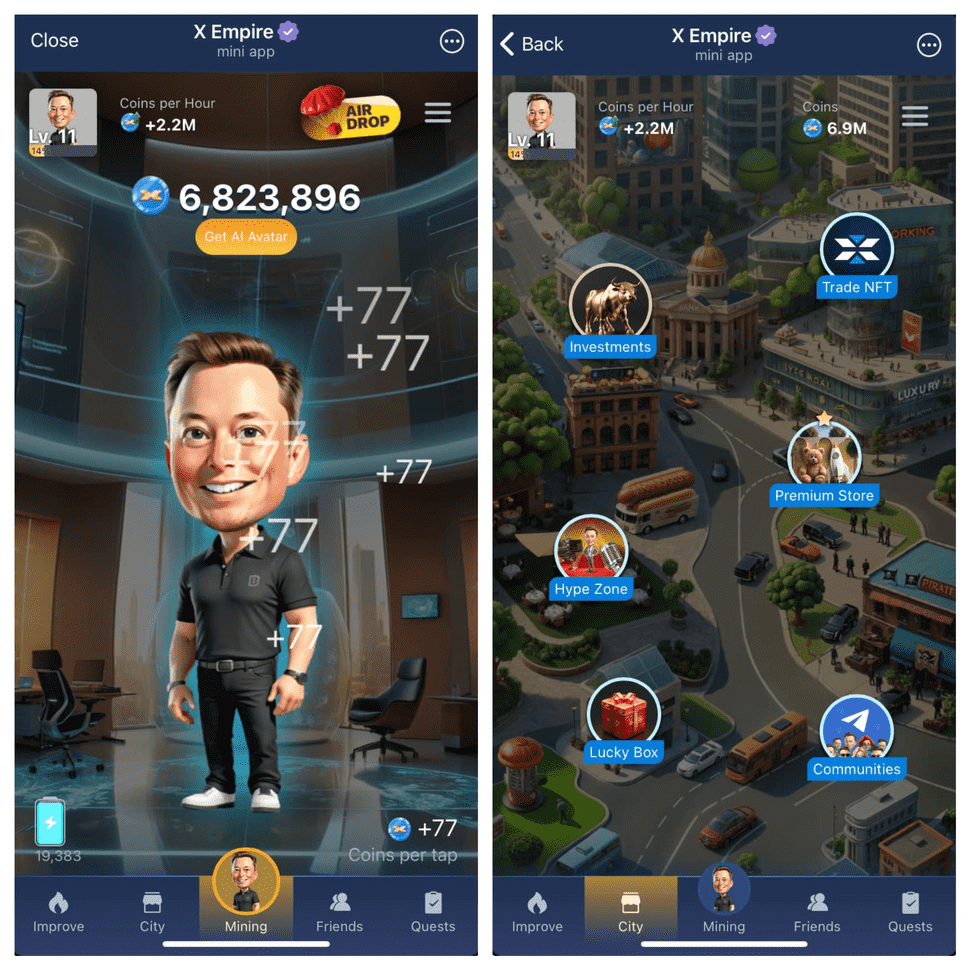

The countdown is on—X Empire is about to make serious waves! In just a few days, the X token airdrop and listing will drop on October 24, 2024, and this is your chance to be part of something HUGE. Whether you’ve been playing along or are ready to jump in, the excitement is real, and this airdrop could be your gateway to the next big thing in crypto. With the token listing on major exchanges, it's time to get ready for a game-changing moment. In this guide, we’ll cover how you can participate in the airdrop, key features, and how to link your TON wallet. It’s fast, it’s exciting, and it’s happening soon—are you ready to join the empire? Let’s dive in!

Just 2 days left until the end of the Chill Phase! Prepare for the X Empire Investment Fund on October 15-16, 2024, to decide which cards we should invest in. Make sure you join in on the excitement and bonuses—time is running out!

- 00:35Ant Digital Technologies to Tokenize Energy Assets Worth $8.4 BillionChainCatcher news, Ant Digital Technologies, the enterprise solutions division under Ant Group, is connecting energy infrastructure worth approximately $8.4 billion (60 billion RMB) to its blockchain platform AntChain. The platform has already tracked the power output and potential fault data of about 15 million new energy devices (including wind turbines and solar panels), and uploaded this data to the blockchain system.

- 00:24Cathie Wood's Ark Invest increases holdings of BMNR worth $4.46 millionAccording to ChainCatcher, monitored by Ark Invest Tracker, Cathie Wood’s Ark Invest increased its holdings of 101,950 shares of Bitmine Immersion (BMNR) stock through its three funds this Wednesday, with a total value of 4.46 million US dollars. Specifically, ARKK increased by 67,700 shares, ARKW by 21,890 shares, and ARKF by 12,360 shares.

- 00:23Tether executives meet with major South Korean financial institutions to discuss stablecoin cooperationAccording to ChainCatcher, citing Cryptonews and Korean media MoneyS, on September 8, several Tether executives met with Jin Ok-dong, Chairman of Shinhan Financial Group in Seoul, to discuss stablecoin cooperation. In addition, KB Kookmin Bank Vice President Cho Young-seo is expected to meet with Tether representatives on September 10; KEB Hana and Woori had already made initial contact on August 26, and Tether also plans to communicate with the neobank Toss during this visit. Previously, Shinhan had already held talks last month with Circle's Head of USDC, Heath Tarbert.