News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April.21) | $SOL's staking market cap surpasses $ETH; Strategy may increase $BTC holdings again2Gold hits new ATH at $3,390, is Bitcoin close behind?3Bitcoin Stock-to-Flow model creator PlanB slams Ethereum, calls it ‘premined shitcoin’

Why Bitcoin Could Still Fall to $47K in This Market Correction

The crypto market may have further to fall according to one prominent technical analyst who has fingered futures traders for exacerbating the losses.

Cryptopotato·2024/07/09 11:49

Local Bottom or More Pain for Bitcoin’s Price? Bitfinex Analysts Chip In

Bitfinex said the market could recover soon because the large BTC sales from Mt Gox creditors and the German government has been priced in.

Cryptopotato·2024/07/09 11:49

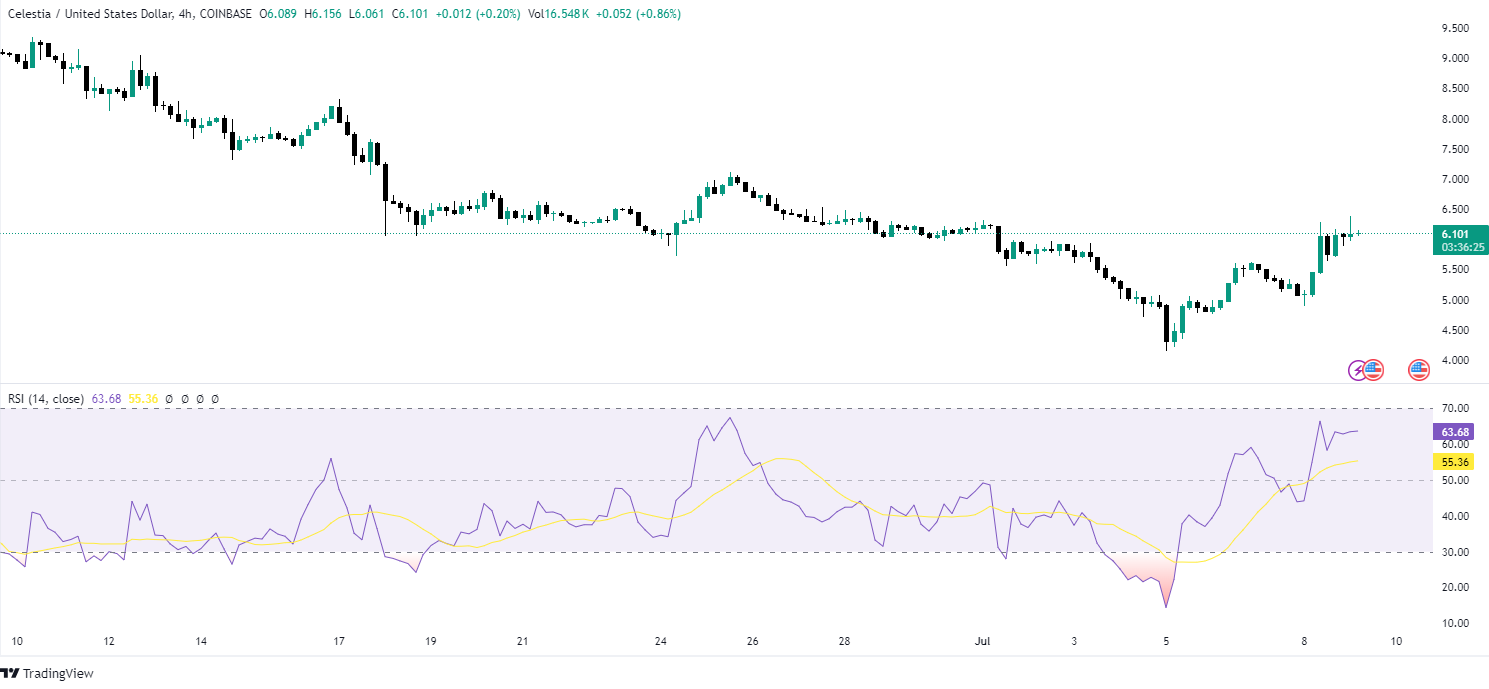

Celestia (TIA) Price Prediction 2024-2030: Will TIA Price Hit $50 Soon?

Coinedition·2024/07/09 11:31

Meme Coins are Bouncing Back Amidst Market Fluctuations

Newscrypto·2024/07/09 11:28

UPDATE: German government continues bitcoin selling spree; less than half of its holdings remain

Quick Take The German government continued to send and receive thousands of bitcoins from crypto exchanges and market makers on Tuesday. The government currently holds 22,846 bitcoins, less than half of the 50,000 bitcoins it seized from Movie2k in January.

The Block·2024/07/09 11:25

10x Research points the way again: This time we’ll look at 60,000 first, then 50,000

Odaily·2024/07/09 10:56

Ethereum (ETH) Price Sparks Green Candles Amid Market Recovery Signs

Newscrypto·2024/07/09 09:22

Ethereum ETF Approval Nears – Bitcoin Risks Loom

10xResearch·2024/07/09 08:22

Chainlink (LINK) Price Outlook: Whales Step up as Important Metrics Flash Recovery Signals

Whales have accumulated nearly $77 million worth of LINK tokens in the past week.

Cryptopotato·2024/07/09 08:19

Spot Bitcoin ETFs see record inflows in 30 days amid Bitcoin selling pressure

Cryptobriefing·2024/07/09 07:10

Flash

- 23:29A Tron address holding 15 million USDT has been frozenBlockbeats reports on April 21 that according to Whale Alert monitoring, an address on the Tron chain holding 15 million USDT has been frozen.

- 23:20Summary of Important Overnight Developments on April 2221:00-7:00 Keywords: Federal Reserve, CryptoQuant, Spot Gold 1. The probability of the Federal Reserve maintaining interest rates in May has risen to 96.3%; 2. Spot gold continued to hit record highs in early trading on Tuesday, reaching a peak of $3,433.5 per ounce; 3. CryptoQuant Director of Research: Bitcoin's resistance level may be around $91,000 to $92,000; 4. Poll: Trump's approval rating drops to the lowest level since his new term; 5. Harvard University: Has filed a federal lawsuit against the Trump administration; 6. Astra Fintech pledges a $100 million investment to support Solana's development in Asia.

- 22:30Analyst: Concerns about Federal Reserve's independence render weak dollar no longer supportive of commoditiesJinse reports that institutional analysts have pointed out that in recent trading sessions, the weakening dollar has been a force supporting commodity futures such as agricultural products and energy. However, due to concerns about the Federal Reserve's independence leading to a broad price decline, the weak dollar was ignored today, with few exceptions other than precious metals. Typically, a weaker dollar means that U.S. goods are more competitively priced compared to other options, but the U.S.'s new tariff policy is undermining this effect—and it seems that this policy will continue. On Monday, the dollar index fell by 1%, crude oil prices dropped by 2.9%, Chicago Board of Trade wheat prices decreased by 1.3%, and the gold futures main contract rose by 3% as investors sought safe havens to store funds amid market turmoil.