News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April.21) | $SOL's staking market cap surpasses $ETH; Strategy may increase $BTC holdings again2Gold hits new ATH at $3,390, is Bitcoin close behind?3Bitcoin Stock-to-Flow model creator PlanB slams Ethereum, calls it ‘premined shitcoin’

US Bitcoin ETFs Attract $2 Billion in July, Surpass 900,000 BTC in Holdings

BeInCrypto·2024/07/21 10:31

Bitcoin Price Analysis: Here’s the Next Target for BTC Before Bulls Can Hope for $70K

Cryptopotato·2024/07/21 07:47

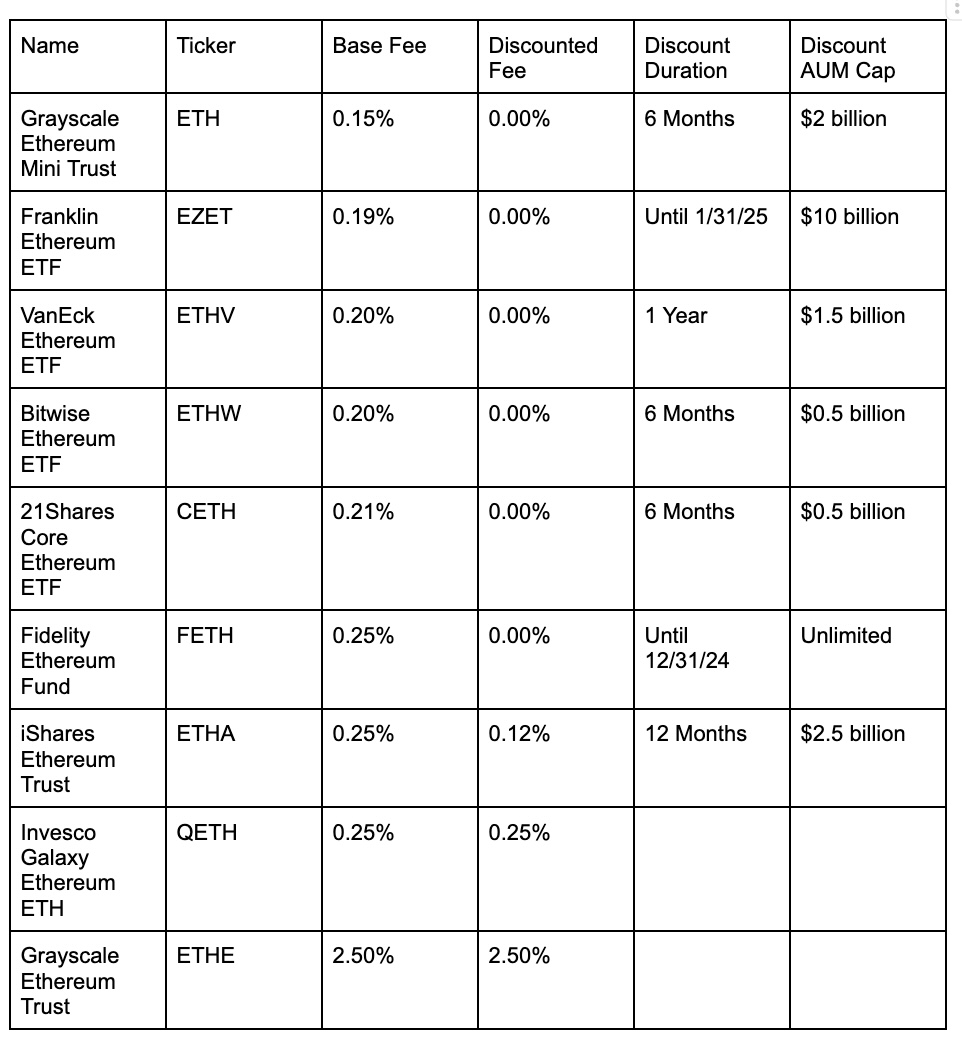

Ethereum ETFs are coming — Here’s what you need to know

Are you ready for the July 23 launch of nine spot Ethereum ETFs? Here's what you need to know to start trading.

Cointelegraph·2024/07/20 19:52

Ethereum’s spot ETFs will trigger a dip, not a rally

Share link:In this post: Ethereum’s supply has been increasing by 60,000 ETH per month since April, which could lead to a market dip instead of a rally when spot ETFs are introduced. Historical patterns from 2016 and monetary policy trends suggest that ETH/BTC might see a huge drop before potentially rising next year. Benjamin Cowen warns that if the current supply trend continues, Ethereum’s supply will revert to pre-Merge levels by December 2024.Disclaimer. The information provided is not trading advice.

Cryptopolitan·2024/07/20 18:13

If Joe Biden bails on the presidential race, what’s next?

Cryptopolitan·2024/07/20 18:13

Is It Too Late To Buy TURBO? Turbo Price Skyrockets 45% As Traders Rush To Buy This AI Crypto Before It’s Too Late

Insidebitcoin·2024/07/20 17:56

Bitcoin Shines as ‘Blue Screen of Death’ Cripples Global Systems: Senator Lummis Reacts

Coinedition·2024/07/20 14:55

The Trump Effect: Bitcoin, Solana, XRP Soar on Renewed Investor Optimism

Coinedition·2024/07/20 14:55

Bitcoin Whales Signal Bullish Trend: $5.6 Million Options Bet Fuels Price Rally

Coinedition·2024/07/20 14:55

Can Ethereum ETFs Propel ETH Price to $4,000?

Newscrypto·2024/07/20 14:52

Flash

- 22:30Analyst: Concerns about Federal Reserve's independence render weak dollar no longer supportive of commoditiesJinse reports that institutional analysts have pointed out that in recent trading sessions, the weakening dollar has been a force supporting commodity futures such as agricultural products and energy. However, due to concerns about the Federal Reserve's independence leading to a broad price decline, the weak dollar was ignored today, with few exceptions other than precious metals. Typically, a weaker dollar means that U.S. goods are more competitively priced compared to other options, but the U.S.'s new tariff policy is undermining this effect—and it seems that this policy will continue. On Monday, the dollar index fell by 1%, crude oil prices dropped by 2.9%, Chicago Board of Trade wheat prices decreased by 1.3%, and the gold futures main contract rose by 3% as investors sought safe havens to store funds amid market turmoil.

- 22:30Trump Criticizes Powell as U.S. Treasury Yields Show Mixed ResultsAccording to Jinse, the 10-year U.S. Treasury yield rose while the 2-year yield fell, driven by investor concerns over the fate of Federal Reserve Chair Powell and the impact of the trade war on market sentiment. The Conference Board Leading Economic Index for March deteriorated for the fourth consecutive month. Trump used social media to call for interest rate cuts and criticized Powell, heightening fears of dovish intervention. Data scheduled for release by the U.S. Treasury Department on Wednesday is expected to show whether foreign investors are increasingly reluctant to fund the U.S. government.

- 22:30Featured Poll: Trump's Approval Rating Falls to Lowest Level of New TermAccording to a report by Jinse, a Reuters/Ipsos survey indicates that U.S. President Trump's approval rating has dropped to 42%, marking the lowest level since his return to the White House. 57% of respondents believe Trump's freeze on university funding due to policy disagreements is inappropriate, and 74% of Americans oppose President Trump running for a third term.