News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

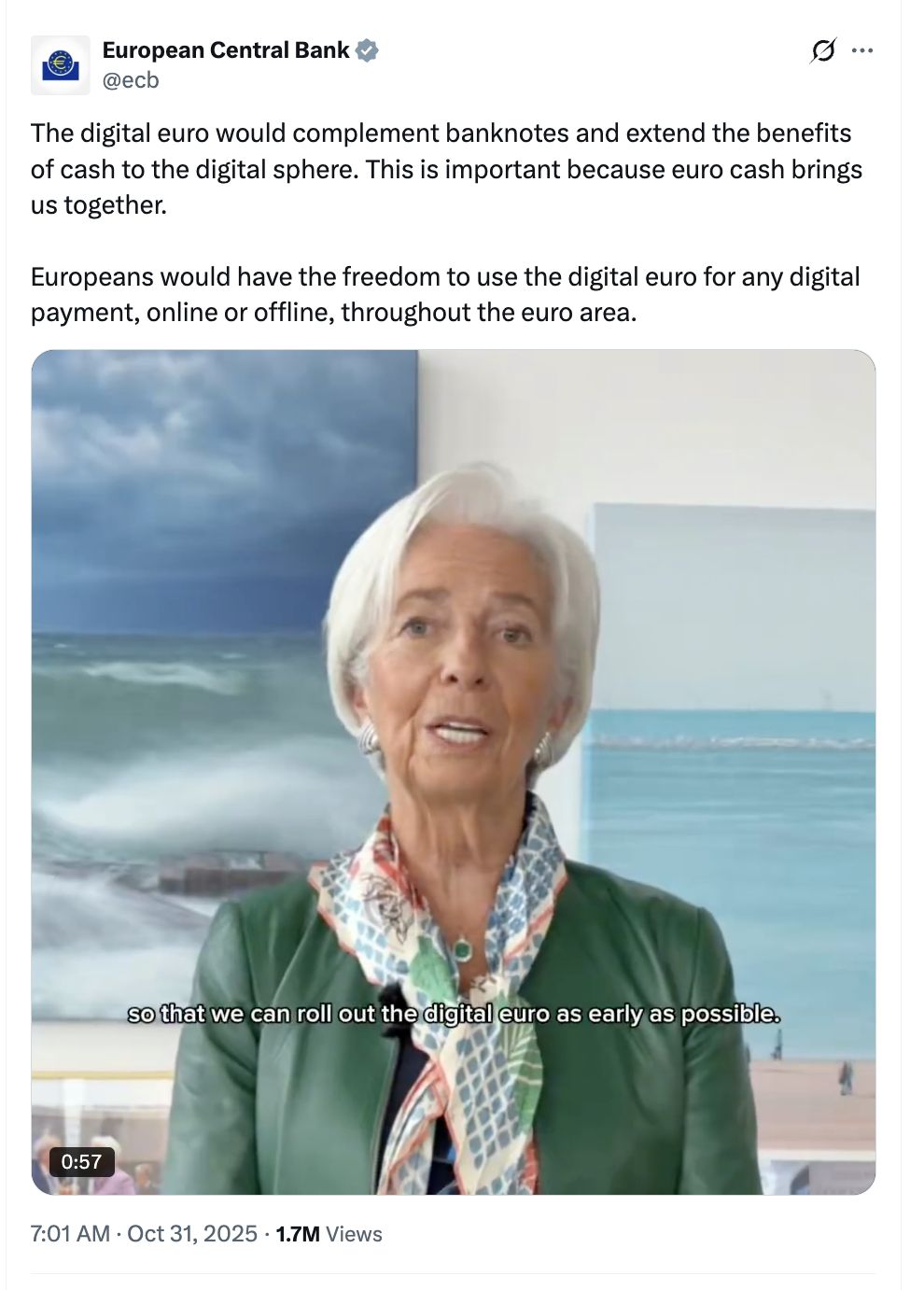

Digital euro CBDC is 'symbol of trust in our common destiny' — ECB head

CryptoNewsNet·2025/11/01 23:00

Is November the New October? Analyst Says It’s Bitcoin’s Strongest Month — Here’s the Data

CryptoNewsNet·2025/11/01 23:00

X Chat : Elon Musk promises an app safer than WhatsApp

Cointribune·2025/11/01 22:51

Bitcoin down in October: November, month of revenge?

Cointribune·2025/11/01 22:51

Aster (ASTER) Bounces Off Key Support — Can This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/01 22:51

FET Testing Key Resistance — Will This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/01 22:51

Bittensor price pops 18% to lead top gainers: what next for TAO?

Coinjournal·2025/11/01 22:30

Sui Launches AI Surge Platform for Retail Investors

Coinlineup·2025/11/01 21:39

Galaxy Digital: From Volatility to Predictability

Quarter after quarter, Galaxy is looking less like a trader and more like a banker.

Chaincatcher·2025/11/01 21:06

Flash Crash of $19 Billion, Fed Turns Hawkish Again: Could November Be Bitcoin's Comeback Month?

In October, the cryptocurrency market experienced two major setbacks: a flash crash that caused $19 billion in liquidations and hawkish signals from the Federal Reserve that dampened expectations for rate cuts. Despite these challenges, bulls still believe bitcoin could reach $150,000 by the end of the year, citing seasonal trends and macroeconomic tailwinds. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

MarsBit·2025/11/01 20:47

Flash

19:37

Arizona bill allowing government to accept Bitcoin passes second readingA bill in Arizona allowing the government to accept bitcoin has passed its second reading, with specific details yet to be announced. (The Bitcoin Historian)

19:27

Belgian bank KBC will allow customers to purchase bitcoinBelgium's second largest bank, KBC, with assets totaling $375 billion, will allow all customers to purchase bitcoin starting next month. (The Bitcoin Historian)

19:26

Federal Reserve's Paulson supports keeping interest rates unchangedAccording to ChainCatcher, as reported by Golden Ten Data, Federal Reserve's Paulson stated that he supports keeping interest rates unchanged at the upcoming meeting.

News