News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Bitcoin Funding Rate Turns Positive Amid Long Position Dominance, Potential Long Squeeze Looms3Ethereum’s Bearish Breakdown: Will $1,400 Support Hold or Will ETH Drop Further?

Ethereum price shows signs of recovery amid bearish trend

Grafa·2024/09/04 07:05

AVAX and MATIC: Is the Bear Market Far from Over? Key Indicators Reveal

Cryptonewsland·2024/09/04 06:39

Understand the intention of Polygon $MATIC renaming $POL in one article?

137 Lab·2024/09/04 06:09

Bitcoin's price shows 'no clear direction' amid active address decline

Bitcoin active addresses are declining due to a large amount of the market being “gobbled up” by institutional cash, says one analyst.

Cointelegraph·2024/09/04 06:03

US Bitcoin ETFs bleed $288 million post-Labor Day weekend

Cryptobriefing·2024/09/04 06:03

US spot bitcoin ETFs see $287 million in net outflows, largest negative flows since May

On Tuesday, spot bitcoin ETFs in the U.S. recorded $287.78 million in net outflows.Bitcoin traded down 3.93% over the past 24 hours at $56,680 at the time of writing.

The Block·2024/09/04 05:33

Bitcoin and Altcoins Are Falling Again! Why Did BTC Fall? Is the Reason for the Fall Known? Here is the Answer!

The DOJ's move against Nvidia caused a drop in NVDA stock, the Nasdaq market, and the Bitcoin and crypto markets.

Bitcoinsistemi·2024/09/04 05:18

Market tensions hit in September, and the trend is heavily dependent on data

Odaily·2024/09/04 05:06

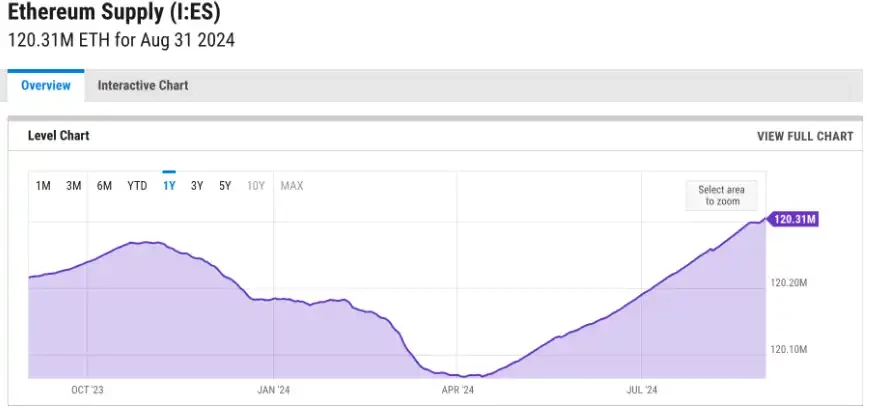

Why did Ethereum L1 network revenue drop sharply?

Odaily·2024/09/04 05:05

In-depth understanding of ETH staking economics: How to design the staking yield curve?

Odaily·2024/09/04 05:05

Flash

- 07:48Musk's Approval Rating Falls Below Trump; Federal Cuts ControversialA poll released last Friday shows that 35% of people approve of Musk's management of the "Department of Government Efficiency" (DOGE), while 57% disapprove, up from 49% in February having a negative view of Musk. The percentage of people approving of Musk's work has not changed significantly, with 34% approval two months ago. However, the poll found that Musk's popularity remains lower than Trump's. In this survey, Trump's approval rating is 39%, with a disapproval rate of 55%. After Tesla released dismal financial results for Q1 2025, Musk announced he would dedicate more time to company operations. The poll indicates that nearly 60% of people believe President Trump's efforts to downsize the federal government through layoffs have gone too far.

- 07:461inch Expands to Solana NetworkThe multi-chain decentralized exchange aggregator 1inch has launched on the Solana network. The project team stated that this integration brings their Fusion Protocol, on-chain swap feature, and six developer APIs to empower this speed-renowned crypto network. (The Block)

- 07:24Orderly Network: Upgrade Completed, New Features Include Maximum Open Contract Limit DisplayOrderly Network, the cross-chain derivatives liquidity layer, announced via a tweet that it has completed an upgrade. New features include the display of a maximum open contract limit, support for LayerZero v2, and optimized strategy Vault. All systems are now back online.