Understand the intention of Polygon $MATIC renaming $POL in one article?

137 Lab2024/09/04 06:09

By:137 Lab

Ethereum scaling solution Polygon released a new proposal in June 2023 to upgrade the original main chain Polygon PoS to zkEVM Validium, and proposed a major update towards 2.0 the following month, proposing to upgrade the native token MATIC to POL to support the ecological protocols Polygon PoS, Polygon Supernets, and Polygon zkEVM.

On the evening of July 18th, Polygon officially announced on social platform X that the community has agreed to the proposal to upgrade MATIC to POL and will officially launch the upgrade on the mainnet

on September 4th . Polygon officials added that they have launched the testnet upgrade on July 17th to identify and fix potential issues.

On August 28th, the official X released

"POL Upgrade | Everything to Know" (POL Upgrade | Everything You Need to Know) and officially announced the details of the upgrade. In the last round of bull market Polygon ecology, both in terms of ecology and TOKEN price, the performance was remarkable. However, I did not see too many impressive performances in this special cycle.

How should we view the upgrade from $MATIC to $POL?

137Labs has detailed the upgrade for official documentation and AMA, taking you to understand the details of this upgrade.

First, let's learn about Polygon's official "Migration is Coming: Matic will migrate to POL on September 4th" AMA.

Spokesperson

Sandeep Nailwal - Co-founder

Mihailo Bjelic - Co-founder

Marc Boiron - CEO of Polygon Labs

David Silverman - Vice President, Products, Polygon Labs

Paul Gebheim - Product Team Director

Q1

Is there a deadline for migrating MATIC to POL?

There is no fixed deadline for migrating MATIC to POL. The migration process began in October last year, and the upgrade on September 4th was an important step in this transition. After this date, all MATICs on the Polygon PoS chain will be automatically converted to POL without user intervention. For users who are staking MATICs, you can continue to stake, and the staking contract will handle the transition process. If you choose to stake POL directly, you will benefit from lower gas costs than the migration process. Please note that although there is no deadline, migration on Ethereum will incur gas costs, while upgrades for Polygon PoS users will be automatic without additional fees.

Q2

Why does my wallet still show MATIC instead of POL after migration?

Your wallet may still display MATIC because the token name needs to be updated. Packaging MATIC may also continue to display as MATIC until the upgrade is fully processed. Some wallets may update automatically, but you may need to adjust manually.

Q3

Have POL tokens and migration contracts been audited?

Yes, POL tokens and migration contracts have been thoroughly audited. HEXENS and at least two other teams have audited the migration and token contracts. In addition, staking migration and PoS native token upgrades have also been audited twice. The Polygon Labs team, as well as external partners such as Stader, Lido, and Coinbase, have also contributed to improving the security and reliability of the code. All audit reports can be viewed in the Polygon token library.

Q4

What happens to MATIC held in smart contracts (such as liquidity pools) on Polygon PoS?

MATIC in smart contracts (including liquidity pools) will automatically upgrade to POL. If you are a liquidity provider, your positions (such as MATIC-ETH trading pairs) will seamlessly switch to POL on the first day without any changes. This process has been fully tested at various levels to ensure that your LP positions continue to operate normally. If MATIC is still displayed in the application UI, please contact the developer for updates.

Q5

What will happen to existing dApps or protocols on Polygon PoS during the migration process?

The migration is designed to be seamless with minimal impact on existing dApps or protocols. Most applications do not require any changes, but a few may have small practical fixes by the end of September. Some DAOs may propose updates, such as switching oracles from MATIC to POL. Overall, the impact of contracts is minimal, but it is best to confirm specific details with your exchange or development team.

Q6

What should I do if I hold MATIC (including staked MATIC) on a centralized exchange? How will the migration proceed?

If you hold or pledge MATIC on a centralized exchange, please follow the specific guidance provided by the exchange. Each exchange may handle the migration from MATIC to POL in different ways, so you must follow their instructions. Some exchanges, such as Kraken, have started sharing FAQs and guidelines. Remember, migration is not urgent, take your time to understand the process, and be careful of any possible scams. The best way is to keep the information updated and follow the instructions of the exchange to ensure a smooth transition.

Q7

What happens to Wrapped MATIC (wMATIC) during the migration? Do users need to manipulate other ERC20 tokens on Polygon POS?

Wrapped MATIC (wMATIC) on Polygon POS is similar to Wrapped ETH on Ethereum, represented by ERC20 as a native MATIC token. During the migration process, wMATIC will also be converted to POL, but the data on the chain will still be called wMATIC until the hard fork updates the packaging contract. This change will be made later, so users should expect the name to be updated to wPOL after the hard fork. As for other ERC20 tokens on Polygon POS, the migration will not affect them, and all applications should continue to operate normally.

Q8

What happens if I transfer MATIC to Polygon POS before or after the migration?

If you transfer MATIC to Polygon POS before migration, it will be automatically converted to POL during the migration process. After migration, if you transfer MATIC to POS, it will also be converted to POL on the POS side. Whenever you transfer, you will eventually get POL on the POS side. If you decide to extract POL later, you will receive POL, but you can use the migration contract to convert it back to MATIC (if necessary). This setting ensures smooth backward compatibility throughout the process.

Q9

Will my stMATIC tokens be automatically migrated to POS on DeFi platforms?

Your stMATIC token still represents the MATIC you staked. As the staking transition is completely backward compatible, no major changes are expected. The name and code of stMATIC will remain unchanged, and it will represent the combined balance of MATIC and POL staked in the Lido system. In fact, nothing will change for stMATIC holders - you can continue to stake and use the token. If you have any concerns, it is best to contact the Lido on Polygon team for specific details.

Q10

What happens if I hold MATIC on another Layer 2 such as zkEVM, Arbitrum, or Optimism? What steps should I take?

If you find yourself holding MATIC on another Layer 2, you have several options:

Liquidity pool: Liquidity pools may be set up on this Layer 2 chain, where you can exchange MATIC for POL or other assets. These pools are usually set up on permissionless decentralized exchanges.

Move to Layer 1: You can move MATIC from Layer 2 to Layer 1, convert it to POL using a migration contract, and then decide whether to move it back to Layer 2 or explore other options on Polygon POS or zkEVM.

If you use other Layer 2: Make sure it is secure and provides the flexibility you need. Always use other Layer 2 at your own risk!

Q11

How can the community participate in the governance of POL, and what future roles may POL play in the ecosystem? POL tokens play an important role in the governance and ecosystem of Polygon, providing several ways for community participation.

Governance participation:

Polygon Improvement Proposals (PIPs): Anyone can submit PIPs to propose changes or improvements to the network. This process is critical to the development of the Polygon ecosystem, including proposals for POL itself.

Governance Conference Call: The community can participate in Polygon Protocol Governance (PPG) meetings to discuss and provide feedback on proposed changes. This is an opportunity for anyone interested in the governance process to participate.

Agreement Committee:

Committee Election: The Agreement Committee is a team elected by the community to execute the agreement upgrade. Discussions are currently underway on how to use POL to elect committee members and introduce emergency measures if necessary.

Community finance:

Financial Management: POL participates in managing community finances, a self-sustaining fund that supports various parts of the Polygon ecosystem. POL may be used in the future for signaling or electing community finance committee members.

Overall, POL enhances community participation in governance and ensures that decisions are driven by the community, establishing multiple mechanisms to integrate POL into the governance and future development of the ecosystem.

The above is the official AMA Q & A on this upgrade. Next, we will delve into this upgrade from the official release "POL Upgrade | Everything to Know" (POL Upgrade | Everything You Need to Know).

The upcoming migration of MATIC to POL on September 4th marks an important evolution of the Polygon ecosystem, reflecting its broader and ambitious vision. Initially unveiled as Matic Network, Polygon has developed into a multi-faceted ecosystem known for its popular PoS chain. This migration is the final step since the Matic brand was rebranded as Polygon in 2020, aiming to align network tokens with its extended multi-chain architecture.

Polygon evolved from a single-chain network to a comprehensive multi-chain infrastructure because it realized that a single chain could not support the long-term growth required for global Web3 adoption. The rebranding of Polygon symbolizes the transition to a blockchain internet, promoting a more scalable and interconnected ecosystem. However, the original MATIC token did not fully reflect the expanded vision of the Polygon network. The upcoming POL migration is the culmination of this evolution, representing the final implementation of Polygon's multi-chain roadmap and its commitment to supporting decentralized, community-driven networks.

POL will not only enhance the technical capabilities of the Polygon ecosystem, but also empower the community through decentralized decision-making processes, especially in funding and network growth initiatives. Through POL, the community will play a greater role in driving ecosystem growth, benefiting from the publishing mechanism that was not possible during the MATIC era. This migration will also diversify the usage scenarios of POL, enabling it to support various networks within the Polygon ecosystem, from PoS chains to AggLayer and zkEVM chains, reducing dependence on a single network and paving the way for the continuous expansion and innovation of the Polygon ecosystem.

Token Economics of POL

1. From productive tokens to hyperproductive tokens

From Bitcoin's $BTC (mainly non-productive assets) to Ethereum's $ETH (productive tokens), this evolution demonstrates how native tokens enhance protocol functionality and incentivize participants. Polygon's POL represents the next step in this evolution, introducing the concept of hyperproductive tokens. POL enhances the utility and role of validators in the network through two key innovations:

Multi-chain validation: Validators can now participate in and secure multiple Polygon chains, expanding their scope of operations and potential rewards.

Multiple roles: Within each chain, validators can perform various roles, such as zero-knowledge proof generation and participation in data availability committees (DACs), each providing different incentives.

2. Main advantages

POL introduces several significant advantages to the Polygon ecosystem:

Ecosystem security: By incentivizing a large number of decentralized PoS validators, POL enhances the security and neutrality of each Polygon chain, encouraging validators to protect as many chains as possible.

Infinite Scalability: POL supports the exponential growth of the Polygon ecosystem, enabling it to scale efficiently and securely as new chains are added.

Ecosystem support: POL facilitates ongoing network support through sustainable protocol mechanisms, including development, research, funding, and adoption incentives.

Avoiding user friction: POL is designed to minimize friction, avoiding the need for users and developers to hold or stake tokens to access the network, thus improving the overall User Experience.

Community Ownership: POL allows for community governance, reflects Polygon's commitment to decentralization, and supports community-led decision-making processes.

The Utility and Incentive Mechanism of POL

The transition from MATIC to POL is not just a simple token upgrade - it is a strategic evolution aimed at laying the foundation for Polygon's long-term success and sustainable development. POL aims to become a self-sustaining engine driving the Polygon network, supporting its mission to become the value layer of the Internet. Here is how POL drives Polygon's growth and innovation through its utility and publishing model.

Validator incentive

One key utility of POL is its role in incentivizing validators. Validators are the backbone of the Polygon network, ensuring its security and scalability. The publish model of POL assigns some POL to validators. Here is how POL drives Polygon's growth and innovation through its utility and publish model.

Incentives for security: Most of the POL publish volume is designated as a staking reward for validators. This ensures that validators are always motivated to participate and protect the network, thus maintaining its resilience and integrity.

Support Scalability: With a stable supply of rewards, validator pools can grow efficiently to support ever-increasing chains and transaction numbers. This scalability is critical to maintaining Polygon's performance and reliability.

Community treasury

The Community Treasury is funded by another portion of the POL publishing volume and serves as the command center for the Polygon ecosystem. The fund is managed by the Community Treasury Committee and supports multiple key functions.

Ecosystem development: The Treasury allocates resources to protocol development, research, funding and adoption initiatives. This ensures that the network can continue to support its evolution and adaptation in the face of new challenges and opportunities.

Sustainable Growth: By continuously funding development and innovation, the Community Treasury helps Polygon stay at the forefront of blockchain technology. This continued investment supports the network's long-term growth and adaptability.

Sustainable innovation funds

POL's publishing model provides a steady stream of funding that drives Polygon's innovation and growth.

Research & Development: The community treasury funds new projects and research, pushing the boundaries of blockchain technology and ensuring Polygon stays ahead of the curve.

Funding and Incentives: By providing funding and incentives, the Treasury attracts new developers and projects and fosters a vibrant innovation ecosystem.

Cyber security and stability enhancement

POL's publish model also contributes to the security and stability of the network:

Reliable validator incentives: With guaranteed rewards, validators are more likely to commit to the network for the long term. This stability is critical as Polygon scales and handles increasing transaction volumes.

Decentralization: A well-incentivized pool of validators promotes decentralization and maintains the resilience and credibility of the network.

Flexibility and community governance

The publishing model includes flexibility and community governance.

Adjustable publish rate: The community can adjust the publish rate through governance mechanisms. This flexibility allows Polygon to adapt to changing needs and maintain its efficiency.

Community engagement: By involving the community in decision-making, the network aligns with users' priorities, fostering a sense of belonging and engagement.

Long-term vision

POL's publishing model supports Polygon's long-term vision

Sustainable ecosystem: Continuous funding ensures critical areas such as safety and development are fully supported, maintaining Polygon's competitive edge for years to come.

Mainstream adoption: By ensuring security, scalability and innovation, the model positions Polygon as a leading platform ready to support multiple applications and use cases.

The annual publishing model is not just a strategy; it is the lifeblood of the Polygon aggregation blockchain network. By providing continuous funding support for validator rewards and community treasury, POL ensures Polygon's security, innovation, and resilience. This model is like a constantly replenishing source of energy, driving the network's growth and adaptability, and preparing for future challenges and opportunities.

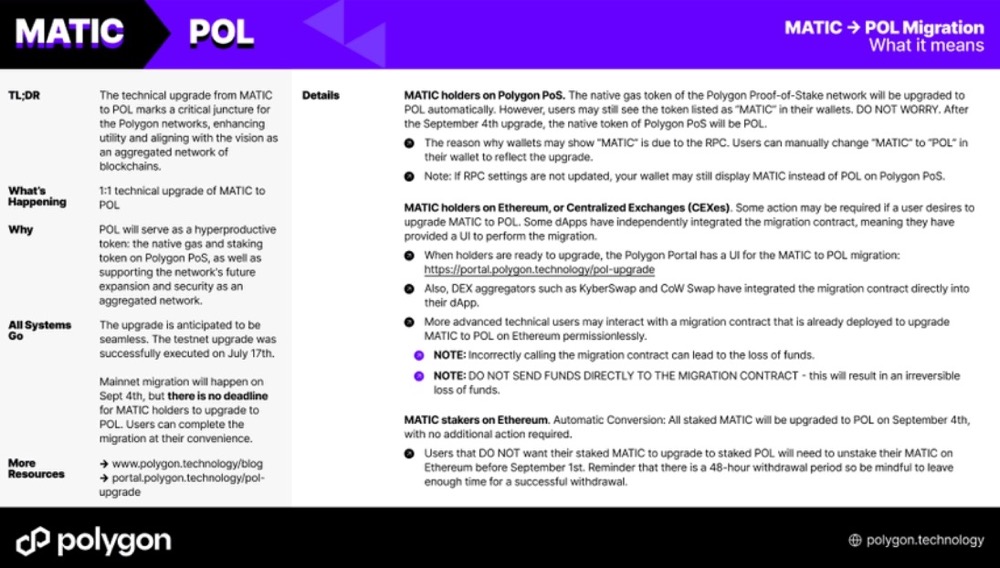

How to migrate from MATIC to POL?

Automatic Migration: No action is required for MATIC holders on Polygon PoS. Your MATIC tokens will be automatically converted to POL on September 4th. All liquidity pools, DeFi applications, and NFTs will seamlessly transition to POL, ensuring a smooth experience without any action.

Manual migration: If you hold MATIC on Ethereum, please use the migration link in Polygon Portal to upgrade from MATIC to POL. Just follow the provided instructions to complete the migration process.

CEX Migration: Centralized exchanges will handle MATIC to POL upgrades according to their own processes. Please check your exchange's official notice for specific details on the migration.

Conclusion

The migration from MATIC to POL on September 4th marks a key milestone in the development of the Polygon ecosystem. This transition represents the final step for Polygon to achieve its vision of becoming a comprehensive multi-chain network. Polygon's journey from single-chain to multi-chain architecture is now about to be completed through the introduction of POL, a token designed to match the network's scalability and ambition.

The transition to POL is not just a token upgrade; it is a strategic evolution that enhances Polygon's technical capabilities and decentralizes the decision-making process. With POL, validators will gain new incentives and roles to support the security and scalability of the entire network. This efficient token model will enable Polygon to scale infinitely, support diverse usage scenarios, and drive community-driven governance.

The utility of POL lies not only in its role as a token; it promotes the growth of the ecosystem by providing incentives for validators, establishing community finances for development and innovation, and promoting governance models for community participation. The migration process is designed to be seamless, with MATIC holders on Polygon PoS automatically upgraded, while users on Ethereum or centralized exchanges will receive clear migration guidelines.

Overall, POL will drive Polygon to achieve its long-term vision of becoming the value layer of the Internet. This migration represents an important step forward, ensuring that Polygon is at the forefront of blockchain innovation while promoting decentralized and community-driven networks.

It is worth noting that $MATIC faced regulatory scrutiny from the US SEC as early as mid-June last year, and was classified as a security by the SEC multiple times, leading to a price crash at that time. Although the official response stated that Polygon was developed and deployed outside the US, it is still unknown whether MATIC can evade the pressure of US regulatory agencies after upgrading to POL.

Whether this upgrade can bring another hot wave to the Polygon ecosystem and reignite the market's passion for its ecosystem, the performance of $POL needs more efforts from the official.

What new expectations do you have for the renamed Polygon token? What new opportunities will $POL have?

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

BlackRock Sets Record with 680,330 Bitcoin Acquisition

Theccpress•2025/06/18 16:40

Research Report|Tagger Project Overview & TAG Token Valuation Analysis

Bitget•2025/06/18 08:54

XRP price holds above $2 as SEC delays Franklin Templeton XRP ETF

Coinjournal•2025/06/18 08:00

Shiba Inu Slips to 7-Day Low—Can Bulls Turn the Tide Before Q2 Closes?

Shiba Inu (SHIB) has slumped to a seven-day low, driven by global uncertainty and bearish technical signals. The token faces critical support at $0.0000102, with further losses possible.

BeInCrypto•2025/06/18 05:30

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$104,849.31

+0.36%

Ethereum

ETH

$2,527.26

+0.51%

Tether USDt

USDT

$1

-0.02%

XRP

XRP

$2.17

+0.35%

BNB

BNB

$644.8

-0.55%

Solana

SOL

$147

-0.87%

USDC

USDC

$1.0000

-0.02%

TRON

TRX

$0.2728

-0.17%

Dogecoin

DOGE

$0.1707

+0.33%

Cardano

ADA

$0.6064

-1.21%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now