News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.24)|New US SEC Chairman Supports Crypto, Top $TRUMP Holders to Dine with Trump2Ethereum (ETH) Price Jumps Over 10%: Can It Keep Rising?3Publicly Traded Company Initiates $5 Billion 'Buy Buy Buy' Mode, SOL Becomes MicroStrategy's Next BTC

Floki Inu Delays Valhalla Launch to Q1 2025 for Audit Updates

CryptoNewsFlash·2024/11/27 11:30

XRP Price About To Trigger A Bullish Technical Flag

Insidebitcoin·2024/11/27 11:11

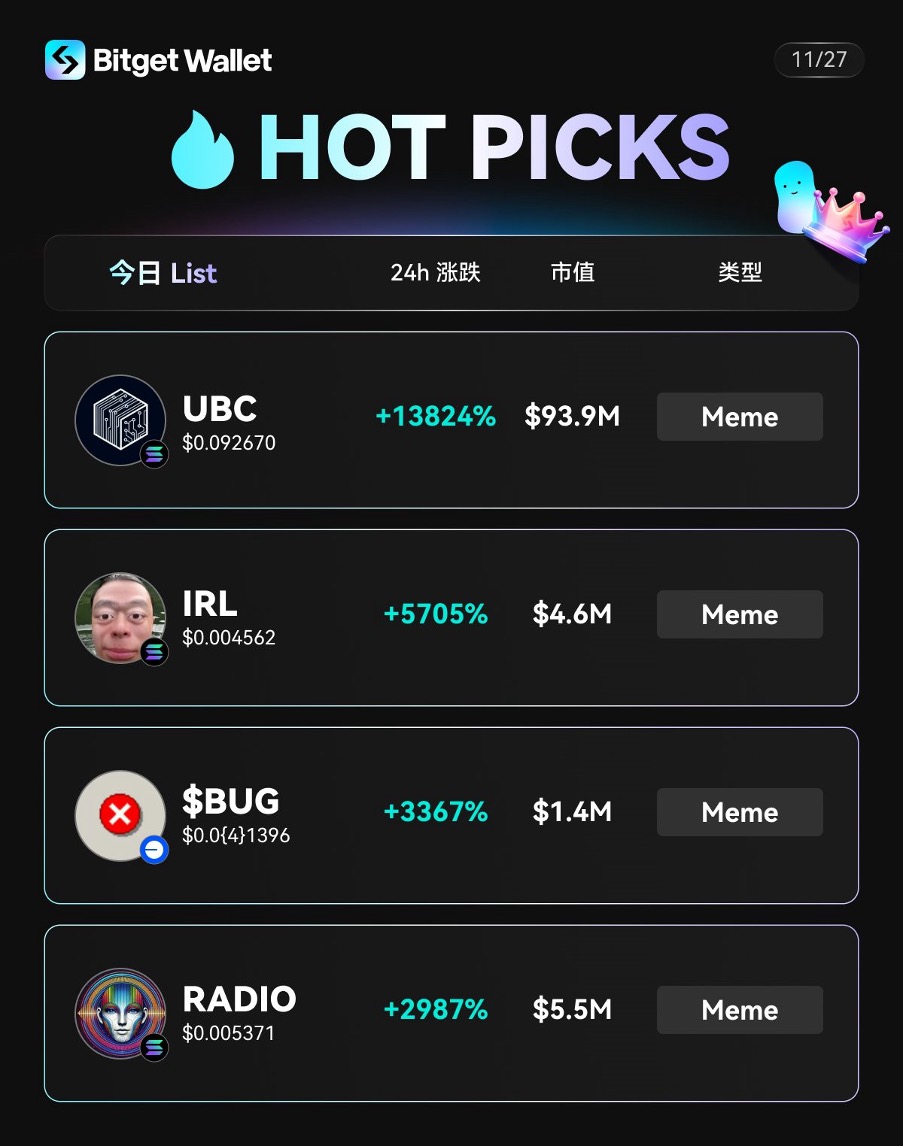

Today's Popular MEME Inventory

币币皆然 ·2024/11/27 10:32

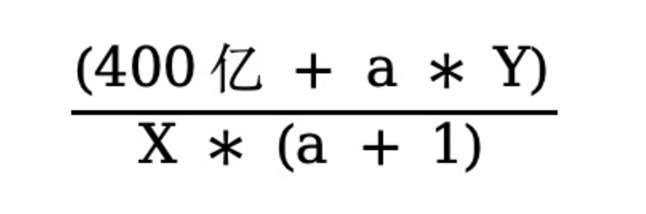

An Overview of Anti & Pro Mechanisms: The Value Gap of DeSci Infrastructure

Timo·2024/11/27 08:47

Record Inflows for Bitcoin ETFs, Solana Outpaces Ethereum in Weekly Fund Flows

Bitcoin ETFs experienced record inflows of $3.12 billion last week, while Solana outpaced Ethereum with $16 million in inflows, according to CoinShares.

Blockchainnews·2024/11/27 08:43

MicroStrategy's Role as a Bitcoin (BTC) Proxy: A Strategic Analysis

Discover how MicroStrategy has become a leading corporate Bitcoin holder, leveraging financial strategies to align with digital asset growth and institutional adoption.

Blockchainnews·2024/11/27 08:43

Flash

- 14:30Trader Eugene: Aggressively Going Long and Watching for Mainstream Altcoins to Reprice and Surge AgainTrader Eugene stated on his personal channel: “I am currently 'aggressively' going long, and soon I will know if I'm right or wrong. This consolidation phase typically sees significant upward or downward swings in a relatively short period. I am also watching to see if mainstream altcoins will reprice with a 10%-20% surge.”

- 14:30BTC Surpasses $93,000The market data shows that BTC has surpassed $93,000 and is currently priced at $93,022.69. The 24-hour decline is 0.08%. The market is experiencing significant fluctuations, so please ensure proper risk management.

- 14:29The U.S. SEC Meets with Ondo Finance to Explore Compliance Paths for Issuing Tokenized SecuritiesAccording to the meeting memorandum released on April 24 by the U.S. Securities and Exchange Commission (SEC) Crypto Asset Special Working Group, representatives from Ondo Finance and Davis Polk & Wardwell LLP held a meeting with the SEC's crypto working group to discuss compliance paths for the issuance and sale of tokenized U.S. securities. The meeting topics included structural models for tokenized securities, registration and broker-dealer requirements, market structure regulations, financial crime compliance, and state corporate laws. Ondo Finance proposed seeking a regulatory sandbox or other forms of regulatory exemptions to advance the issuance of its tokenized asset products. The meeting aimed to provide a clear regulatory framework for tokenized securities in the U.S. market.