News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Bitcoin ETFs Celebrate a Week of Wins, But Trouble Brews in the Derivatives Market | ETF News31inch launches on Solana, plans cross-chain swaps to boost liquidity

Urgent Warning: Why Firing Fed Chair Jerome Powell Could Trigger Financial Instability

BitcoinWorld·2025/04/19 18:00

Injective (INJ) Rebound in Sight? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe·2025/04/19 16:33

Solana (SOL) Gains Momentum With Key Breakout — Is Render (RENDER) Gearing Up For A Similar Move?

CoinsProbe·2025/04/19 16:33

Bittensor (TAO) Mirrors Past Bullish Breakout Setup — Minor Pullback Before Major Liftoff?

CoinsProbe·2025/04/19 16:33

Hyperliquid (HYPE) Leads the Way – Is Jupiter (JUP) Set to Follow the Same Fractal Path?

CoinsProbe·2025/04/19 16:33

Is Avalanche (AVAX) Poised for an Upside Move? This Solana (SOL) Fractal Says It Is!

CoinsProbe·2025/04/19 16:33

Kaspa (KAS) and Bittensor (TAO) at Decision Points – Will They Break Out?

CoinsProbe·2025/04/19 16:33

Vitalik Buterin Suggests RISC-V Architecture to Enhance Ethereum’s Scalability and Competitiveness

Coinotag·2025/04/19 16:00

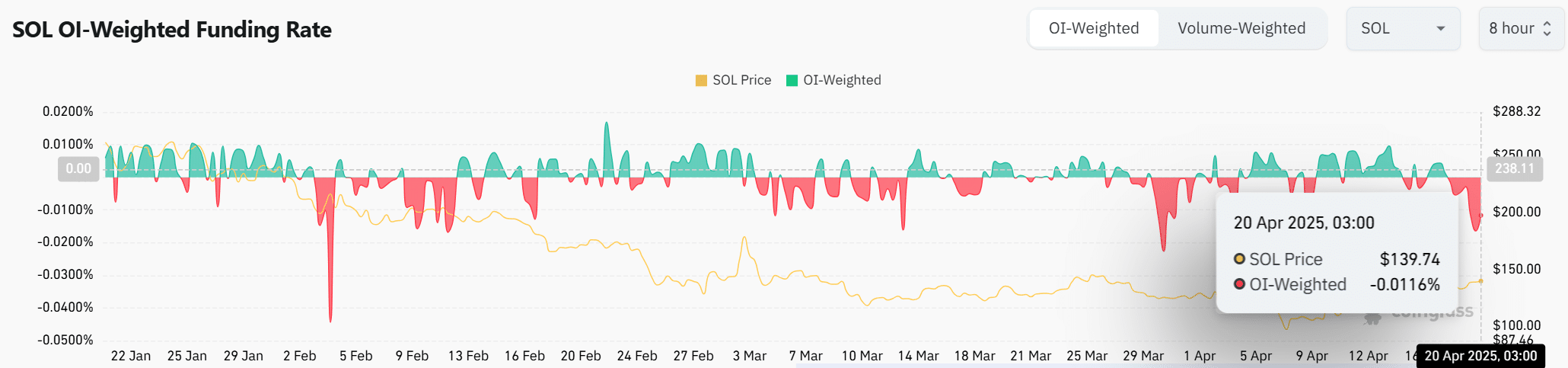

Could Solana’s Whale Accumulation and DeFi Growth Signal a Potential Breakout Above $144?

Coinotag·2025/04/19 16:00

Flash

- 18:28Fed's Mouthpiece: March Core PCE Price Index May Only Rise 0.08%According to Jinse, Nick Timiraos, known as the "Fed's Mouthpiece," stated that the PCE price index is expected to show a 0.08% increase in March core prices. This expectation is based on an analysis model mapping CPI (Consumer Price Index), PPI (Producer Price Index), and import prices to PCE. In addition, the overall prices in March are expected to remain virtually unchanged, with a slight decrease of 0.01%.

- 18:28Several Executives Say Tariff Impact Will Emerge in the Next 6 to 8 Weeks, Economic Outlook UncertainJinse reports that Fox Business journalist Charles Gasparino stated on social media, "Several CEOs have informed their investment banks that the impact of tariffs will emerge in the next 6 to 8 weeks. Nobody can predict the outcome currently, but the next couple of months will be critical in determining whether there will be an economic slowdown or inflation issues. The real unknown is how long the economic impact will last if it indeed occurs, and the situation is still developing."

- 18:28The U.S. SEC Delays Approval of Franklin's XRP Spot ETF to June 17According to official documents, the U.S. SEC has delayed the approval of Franklin's XRP Spot ETF to June 17.