News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Bitcoin ETFs Celebrate a Week of Wins, But Trouble Brews in the Derivatives Market | ETF News31inch launches on Solana, plans cross-chain swaps to boost liquidity

Hamster Kombat GameDev Cipher Code And Combo Card April 19

Cryptotimes·2025/04/20 05:55

Bitcoin, ETH, and XRP Price Prediction For Next Week!

Cryptotimes·2025/04/20 05:55

Solana Faces Correction: Key Support at $118 and $109 Levels

Cryptonewsland·2025/04/20 05:22

MELANIA Plunges to All-Time Low After $14.75 Million Sell-Off By Insiders

MELANIA crashes 97% as team-linked wallets dump $14.75 million in tokens, sparking renewed concerns over insider activity and market manipulation.

BeInCrypto·2025/04/20 04:02

US China Tariff War Over: Will BTC Price Hit $100K?

Cryptoticker·2025/04/20 03:22

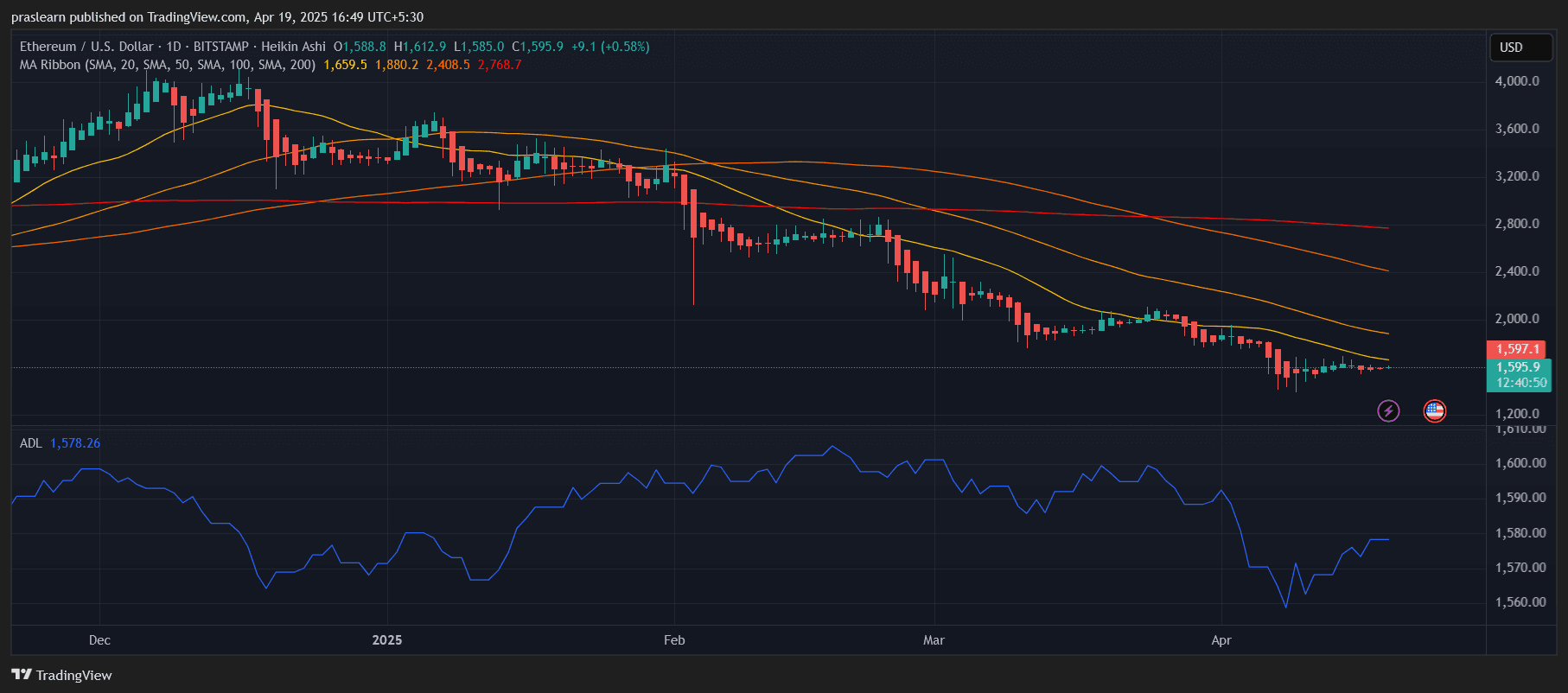

Can Ethereum Hit $1,800 Again?

Cryptoticker·2025/04/20 03:22

TRUMP Coin (TRUMP) Analysis: Here’s What the Chart Says (Bearish!)

CryptoNews·2025/04/20 01:00

Cardano Price Analysis: What Needs to Happen for a 400% Rally

CryptoNews·2025/04/20 01:00

XRP Price Analysis: Can Bulls Push Past $2.15 Resistance This Week?

CryptoNews·2025/04/20 01:00

Bitcoin Reclaims $85,000 as ETF Inflows Surge—Can Bulls Push BTC to a New All-Time High?

CryptoNews·2025/04/20 01:00

Flash

- 21:59Trump Signs Executive Order to Ease Auto Tariff Policy, Industry Still Faces PressureAccording to Jinse, U.S. President Trump signed an executive order to mitigate the impact of auto tariffs, making concessions after weeks of intensive lobbying by automakers, parts suppliers, and car dealers. The industry had warned that exorbitant tariffs might increase car prices, lead to factory shutdowns, and cause unemployment. Under the executive order signed aboard Air Force One, imported cars will be exempt from additional aluminum and steel tariffs to avoid the cumulative effect of overlapping tariffs. A senior official from the U.S. Department of Commerce stated that the White House will also adjust a 25% tariff on auto parts originally set to take effect on May 3, allowing car companies manufacturing and selling vehicles in the U.S. to apply for a tariff deduction of up to 3.75% (25%X15%) of the vehicle's value. This deduction will decrease to a maximum of 2.5% (25%X10%) after one year and will be eliminated the following year. The policy applies to cars produced after April 3. Although the latest adjustments will somewhat alleviate cost pressures on automakers, parts suppliers, and dealers, it remains challenging to determine the actual financial relief. The entire industry is still dealing with a 25% tariff on imported cars, which could significantly increase industry costs and exacerbate supply chain pressures.

- 21:54PumpBTC Airdrop Claim Window to Close on April 30According to Foresight News, PumpBTC has announced that its airdrop claim window will close on April 30, reminding eligible users to complete their claims in time.

- 21:54Nasdaq Files to List 21Shares DOGE Spot ETFAccording to a report by Foresight News, documents submitted by Nasdaq to the SEC reveal that Nasdaq intends to list and trade the 21Shares Dogecoin ETF under Rule 5711(d). The trust is managed by 21Shares US LLC, with Coinbase Custody serving as the custodian for Dogecoin assets, tracking the DOGE-USD settlement price index published by CF Benchmarks. The ETF will only allow for cash subscriptions and redemptions, with each basket consisting of 10,000 shares. The trust does not use leverage or derivatives and does not engage in staking or yield generation.