News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

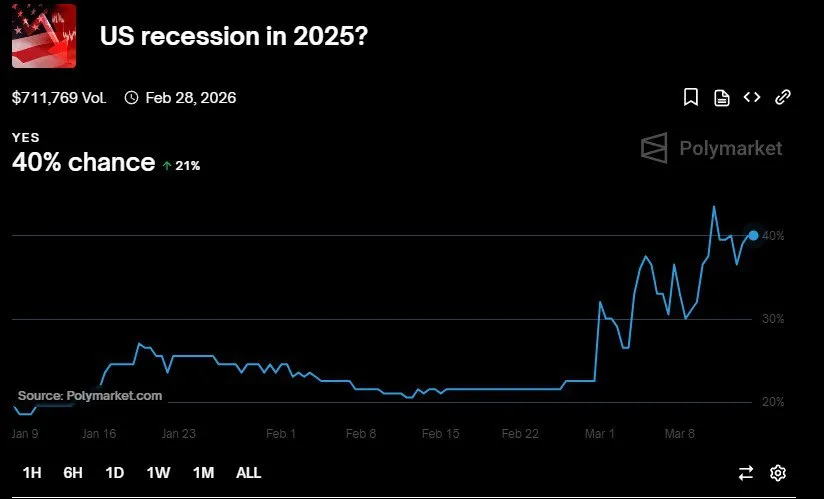

Share link:In this post: A recent poll revealed that 51% of Americans believed that President Trump’s economic policies would harm the economy in the next year. In the same poll, over 70% of the respondents considered the current economic conditions poor, compared to 28% who believed the conditions were good. Another recent poll also revealed that a majority of Americans saw Trump’s economic policies as too erratic, pointing out the recent enactment of import tariffs.

Pi Network's migration deadline has led to widespread confusion and massive token forfeitures, contributing to an 11% drop in the asset's price. While the project's future remains uncertain, its passionate community may help it recover.

Sonic (S) has seen a 15% surge in the last 24 hours, with its price reaching $0.51. The token eyes further gains as it moves toward key resistance levels.

XRP has regained 50% of its losses, with strong investor support, particularly from long-term holders, fueling the potential for further gains. A successful breach of the $2.33 resistance could drive XRP towards $2.70, confirming a bullish recovery.

The choice between centralized exchanges (CEX) and decentralized exchanges (DEX) often comes down to a trade-off between convenience and security. EVEDEX, a next-generation hybrid exchange, is eliminating that dilemma by offering the best of both worlds. In an exclusive Ask Me Anything (AMA) session with BeInCrypto, the EVEDEX team shared insights into how their hybrid …

Cardano's ADA faces mounting selling pressure, with short-term holders reducing their positions as the cryptocurrency market remains bearish. ADA's price below the 20-day EMA suggests further declines unless a bullish shift occurs.

PiFest 2025 aims to drive PI Coin adoption globally, but legal and regulatory uncertainties, alongside a 10% drop in its price, cast a shadow over the event's success.

Solana’s network struggles with decreased activity, leading to a significant drop in its TVL and SOL price. The decline in daily transactions and user engagement indicates a challenging outlook for the blockchain and its native token.

BTC price action decides that good news on inflation is in fact bad news thanks to persisting US trade war fears dampening risk-asset trader appetites.

- 10:08A whale deposited the remaining 800 BTC into CEX 3 hours ago, with a total loss of $25 millionAccording to Lookonchain, a Bitcoin whale deposited the remaining 800 BTC (worth $74 million) into CEX 3 hours ago, resulting in a total loss of $25 million. Between April 10 and 12, 2024, he withdrew 2,000 BTC (worth $197.8 million) from CEX at a price of $98,896 each and staked them. About a month ago, he started to unstake and gradually deposited the Bitcoins back into CEX.

- 10:00Analysis: The Correlation Between Bitcoin and US Stocks Continues to Weaken, Gold May Become a Leading Indicator for BTCCryptoQuant analyst Timo Oinonen released a report stating that the most important current trend for Bitcoin is its decoupling from US stock indexes. Over the past seven days, Bitcoin has significantly diverged from the S&P 500 and the Nasdaq Composite Index, with its correlation to traditional stocks and tech stocks weakening. The correlation coefficient between Bitcoin and the S&P 500 has decreased from 0.88 at the end of 2024 to 0.77, and its correlation with the Nasdaq has also dropped from 0.91 in January to 0.83. Notably, the correlation between Bitcoin and gold is strengthening, with the coefficient rising from -0.62 at the beginning of the month to the current -0.31. Historically, Bitcoin has often lagged behind gold's performance by several months. If the current decoupling trend from stock indexes continues, with other conditions remaining unchanged, gold may become a leading indicator for Bitcoin.

- 10:00Suspected Sale of 100 WBTC to Take Profit by a Cyclical Long Position WBTC Whale 40 Minutes Ago, Equivalent to $9.19 MillionAccording to on-chain analyst Ai Yi's monitoring, "the whale that has been in a cyclical long position on WBTC at an average price of $69,079 since July 2024" is suspected to have sold 100 WBTC to take partial profit 40 minutes ago, equivalent to $9.19 million. Currently, the whale still has 1,053.79 WBTC (approximately $97.36 million) as collateral and has borrowed 43.68 million USDT, with the remaining portion still having a floating profit of $24.47 million.