Bitget:全球日交易量排名前 4!

BTC 市占率62.63%

Bitget 新幣上架 : Pi Network

BTC/USDT$77220.74 (-3.36%)恐懼與貪婪指數18(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$326.3M(1 天);-$595.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率62.63%

Bitget 新幣上架 : Pi Network

BTC/USDT$77220.74 (-3.36%)恐懼與貪婪指數18(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$326.3M(1 天);-$595.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率62.63%

Bitget 新幣上架 : Pi Network

BTC/USDT$77220.74 (-3.36%)恐懼與貪婪指數18(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$326.3M(1 天);-$595.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Distributed Autonomous Organization 價格DAO

未上架

報價幣種:

TWD

數據來源於第三方提供商。本頁面和提供的資訊不為任何特定的加密貨幣提供背書。想要交易已上架幣種? 點擊此處

NT$0.7226-0.35%1D

價格走勢圖

最近更新時間 2025-04-09 13:47:04(UTC+0)

市值:--

完全稀釋市值:--

24 小時交易額:--

24 小時交易額/市值:0.00%

24 小時最高價:NT$0.7245

24 小時最低價:NT$0.7220

歷史最高價:NT$247.77

歷史最低價:NT$0.7028

流通量:-- DAO

總發行量:

100,000,000DAO

流通率:0.00%

最大發行量:

100,000,000DAO

以 BTC 計價:0.{6}2852 BTC

以 ETH 計價:0.{4}1497 ETH

以 BTC 市值計價:

--

以 ETH 市值計價:

--

合約:

0x037b...cb9fd78(BNB Smart Chain (BEP20))

您今天對 Distributed Autonomous Organization 感覺如何?

注意:此資訊僅供參考。

Distributed Autonomous Organization 今日價格

Distributed Autonomous Organization 的即時價格是今天每 (DAO / TWD) NT$0.7226,目前市值為 NT$0.00 TWD。24 小時交易量為 NT$0.00 TWD。DAO 至 TWD 的價格為即時更新。Distributed Autonomous Organization 在過去 24 小時內的變化為 -0.35%。其流通供應量為 0 。

DAO 的最高價格是多少?

DAO 的歷史最高價(ATH)為 NT$247.77,於 2022-09-04 錄得。

DAO 的最低價格是多少?

DAO 的歷史最低價(ATL)為 NT$0.7028,於 2025-04-03 錄得。

Distributed Autonomous Organization 價格預測

DAO 在 2026 的價格是多少?

根據 DAO 的歷史價格表現預測模型,預計 DAO 的價格將在 2026 達到 NT$0.8892。

DAO 在 2031 的價格是多少?

2031,DAO 的價格預計將上漲 +17.00%。 到 2031 底,預計 DAO 的價格將達到 NT$1.36,累計投資報酬率為 +87.59%。

Distributed Autonomous Organization 價格歷史(TWD)

過去一年,Distributed Autonomous Organization 價格上漲了 -82.56%。在此期間, 兌 TWD 的最高價格為 NT$4.39, 兌 TWD 的最低價格為 NT$0.7028。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h-0.35%NT$0.7220NT$0.7245

7d+0.06%NT$0.7028NT$0.7304

30d-10.94%NT$0.7028NT$0.8080

90d-38.84%NT$0.7028NT$1.17

1y-82.56%NT$0.7028NT$4.39

全部時間-97.61%NT$0.7028(2025-04-03, 6 天前 )NT$247.77(2022-09-04, 2 年前 )

Distributed Autonomous Organization 市場資訊

Distributed Autonomous Organization 持幣

Distributed Autonomous Organization 持幣分布矩陣

Distributed Autonomous Organization 持幣分布集中度

巨鯨

投資者

散戶

Distributed Autonomous Organization 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Distributed Autonomous Organization 評級

社群的平均評分

4.6

此內容僅供參考。

Distributed Autonomous Organization (DAO) 簡介

分散式自治組織代幣(DAO)概述及其對SEO的影響

一種創新、前沿的工作方法、資訊技術與商業模式變革正在全球範圍內深入人心,相信讀者們已經猜出這是什麼。沒錯,就是分散式自治組織代幣(DAO)技術。本文將介紹DAO的基本概念,重要功能,以及其對於搜索引擎優化(SEO)的可能影響。

DAO的定義與特點

DAO,即分散式自治組織(Distributed Autonomous Organization),是基於區塊鏈和智慧合約技術的一種組織形式。它可以根據預定規則自動運行,不受任何外部干預。DAO的運行規則在創建之初就已經訂定,並用程式碼寫入區塊鏈中。一旦規則訂定,它將不可改變,也無法被任何人干預。

DAO的主要特點有以下幾點:

- 完全去中心化:DAO不依賴任何單一實體運行,而是多個節點共同運行,使得 DAO無法被任何人控制或使其停止。

- 透明度:由於 DAO的所有規則和交易記錄都存儲在區塊鏈上,因此所有的操作都是透明的,無法被修改或删除。

- 自治:DAO不需要人工介入,一切操作都按照智慧合約的規則自動運行。

- 參與:任何人都可以參與 DAO,只要他們擁有 DAO的代幣,就可以參與 DAO的決策。

DAO對於SEO的影響

由於DAO具有以上的特性,尤其是透明、去中心化、自治的特性,使得其對傳統的搜索引擎優化(SEO)有相當大的影響。

首先,因為所有的操作和交易記錄都是公開和透明的,這對於SEO的數據分析提供了很大的便利。SEO人員可以利用這些數據,對網站的SEO策略進行調整和優化。此外,由於這些數據是真實的,不會在後期被修改或刪除,因此 SEO人員可以放心地依據這些數據進行策略的開發和調整。

其次,由於DAO的去中心化和自治特性,使得 SEO不再依賴於某個特定的搜索引擎或平台。SEO人員可以均衡地向各個平台著眼,不必再過度地追求某一平台的優化。

總而言之,隨著科技的進步和互聯網的發展,DAO已經成為一種全新的網路世界組織形式,其對於SEO的影響與否,還需要時間進一步的驗證和研究。但無庸置疑的是,DAO將會顛覆傳統的網路世界,帶來全新的網路生態。

DAO 兌換當地法幣匯率表

1 DAO 兌換 MXN$0.461 DAO 兌換 GTQQ0.171 DAO 兌換 CLP$22.021 DAO 兌換 UGXSh81.791 DAO 兌換 HNLL0.561 DAO 兌換 ZARR0.431 DAO 兌換 TNDد.ت0.071 DAO 兌換 IQDع.د28.831 DAO 兌換 TWDNT$0.721 DAO 兌換 RSDдин.2.331 DAO 兌換 DOP$1.371 DAO 兌換 MYRRM0.11 DAO 兌換 GEL₾0.061 DAO 兌換 UYU$0.931 DAO 兌換 MADد.م.0.211 DAO 兌換 AZN₼0.041 DAO 兌換 OMRر.ع.0.011 DAO 兌換 KESSh2.851 DAO 兌換 SEKkr0.221 DAO 兌換 UAH₴0.9

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-04-09 13:47:04(UTC+0)

Distributed Autonomous Organization 動態

首階段 400 萬美元提案獲批,Aave DAO 正式啟動 AAVE 回購計劃

Zombit•2025-04-09 04:55

投票權委託交易如何摧毀 DAO 的去中心化願景?GovernFi 能有未來嗎?

Abmedia•2025-04-08 21:03

孫宇晨:波場TRON和火幣HTX將始終堅守產業建設,為波動的加密市場提供避風港

Panews•2025-04-08 07:54

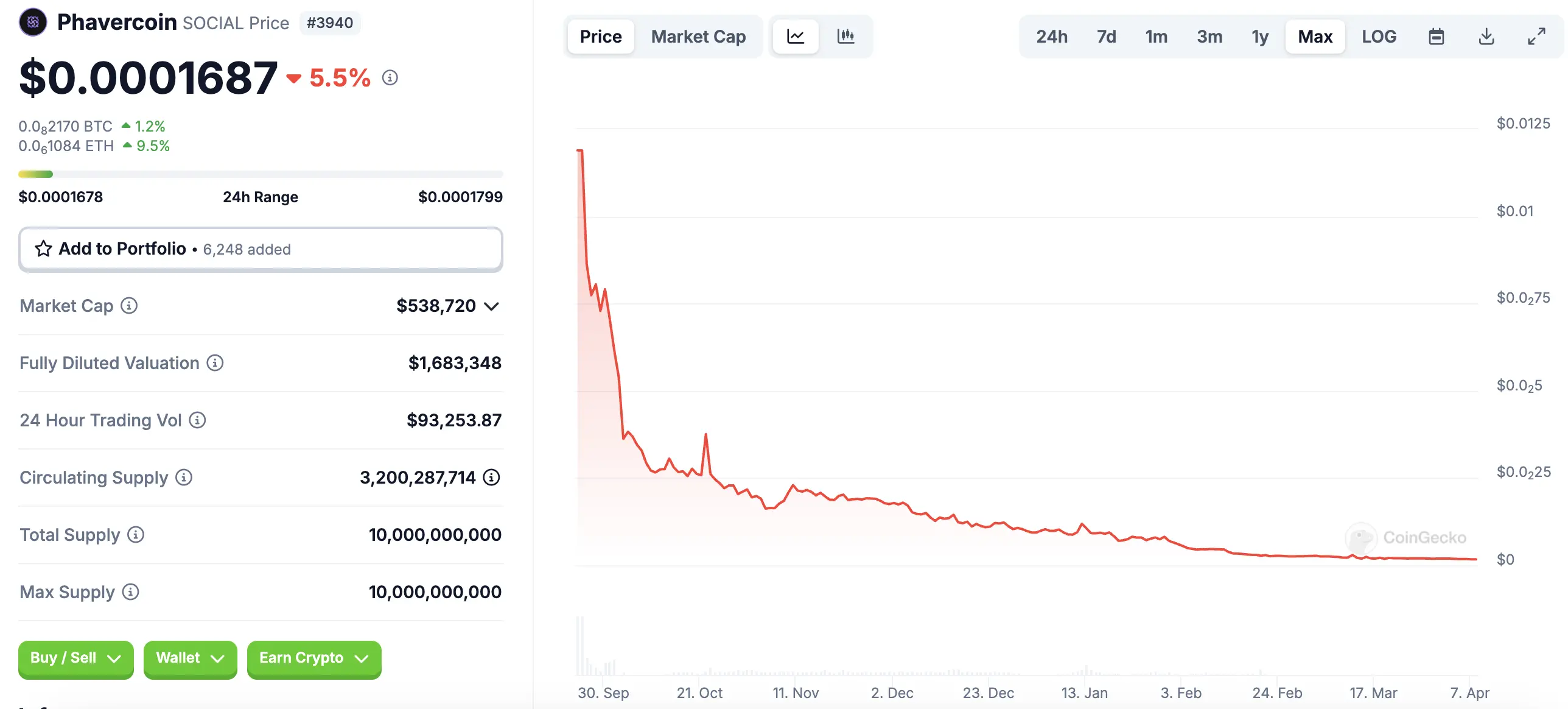

Lens 龍頭項目 Phaver 停止運營,加密市場即將迎來新一波關停潮?

垃圾時間的確是 BUIDL 的最好機會。但玩家的第一要務是,活下來,留在這裡。

Chaincatcher•2025-04-08 02:00

嘴砲拳王 Conor McGregor 發幣首戰失利!REAL 預售「募不到 4 成」被迫退場

Blockcast•2025-04-07 19:22

購買其他幣種

用戶還在查詢 Distributed Autonomous Organization 的價格。

Distributed Autonomous Organization 的目前價格是多少?

Distributed Autonomous Organization 的即時價格為 NT$0.72(DAO/TWD),目前市值為 NT$0 TWD。由於加密貨幣市場全天候不間斷交易,Distributed Autonomous Organization 的價格經常波動。您可以在 Bitget 上查看 Distributed Autonomous Organization 的市場價格及其歷史數據。

Distributed Autonomous Organization 的 24 小時交易量是多少?

在最近 24 小時內,Distributed Autonomous Organization 的交易量為 NT$0.00。

Distributed Autonomous Organization 的歷史最高價是多少?

Distributed Autonomous Organization 的歷史最高價是 NT$247.77。這個歷史最高價是 Distributed Autonomous Organization 自推出以來的最高價。

我可以在 Bitget 上購買 Distributed Autonomous Organization 嗎?

可以,Distributed Autonomous Organization 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 Distributed Autonomous Organization 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Distributed Autonomous Organization?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

在哪裡可以購買加密貨幣?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Distributed Autonomous Organization)具有市場風險。Bitget 為您提供購買 Distributed Autonomous Organization 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Distributed Autonomous Organization 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

CoinnessGL

2小時前

Cakepie opposes PancakeSwap's plan to scrap $veCAKE

Cakepie, a key sub-DAO of PancakeSwap, voiced strong opposition to PancakeSwap’s Tokenomics Proposal 3.0, which includes removing veCAKE. The team warned that the move would harm projects relying on veCAKE, citing risks such as

MOVE-0.03%

S+1.69%

Bitcoin_World

12小時前

Urgent Crypto News: Treasure DAO’s Alarming Cuts & Gaming Exit in Desperate Survival Bid

The world of blockchain gaming, often touted as the next frontier of digital entertainment, is facing a stark reality check. One of its prominent players, Treasure DAO, the platform behind the MAGIC token, has just announced a series of drastic measures to stay afloat. This isn’t just another project tweaking its roadmap; it’s a critical pivot involving significant cuts and a complete exit from game distribution. For anyone invested in crypto, particularly in the gaming sector, this news signals a potentially seismic shift and raises urgent questions about the sustainability of current models.

Treasure DAO, known for its ecosystem built around the MAGIC token and its interoperable metaverse, has revealed a concerning financial situation. The numbers paint a clear picture of unsustainability. According to reports, their quarterly spending reached a staggering $11.3 million in the last quarter of 2023. Juxtapose that with a meager $40,000 in revenue during the same period, and you have a gaping financial chasm. This massive disparity has left Treasure DAO with a rapidly dwindling runway, estimated to last only until July. The implications are serious, forcing the project to take drastic action to ensure its continued existence.

To address this alarming situation, Treasure DAO has implemented a series of tough decisions:

Treasure DAO’s predicament isn’t happening in a vacuum. It highlights the broader challenges facing the entire blockchain gaming sector. While the promise of play-to-earn and decentralized gaming experiences is enticing, the reality of building sustainable and profitable platforms is proving complex. Several factors contribute to these difficulties:

The situation at Treasure DAO raises questions about the operational and financial management within Decentralized Autonomous Organizations (DAOs) in general. While DAOs offer a vision of decentralized governance and community ownership, they also present unique challenges. The concept of a DAO crisis, while perhaps dramatic, is relevant in this context. Some potential contributing factors to Treasure DAO’s financial woes could include:

For holders of the MAGIC token, the news of Treasure DAO’s financial difficulties and strategic shifts introduces significant uncertainty. Token prices often react sharply to such announcements, and MAGIC is likely to be no exception. Investors need to carefully consider the following:

The question now is: can Treasure DAO successfully navigate this crisis and turn the tide? Their strategy hinges on:

The situation with Treasure DAO serves as a potent reminder of the challenges and risks inherent in the crypto space, particularly in the rapidly evolving field of blockchain gaming. While the promise of decentralization and innovative gaming experiences remains, projects must demonstrate financial prudence, strategic agility, and a strong focus on building sustainable business models. The coming months will be critical for Treasure DAO as they attempt to execute their survival plan and navigate this turbulent period. The entire crypto gaming community will be watching closely to see if they can emerge stronger on the other side.

To learn more about the latest crypto news trends, explore our article on key developments shaping crypto market price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

MAGIC+4.39%

S+1.69%

CoinnessGL

20小時前

Aavegotchi DAO passes Base migration plan

Aavegotchi DAO ( $GHST ) has passed a governance proposal to migrate from Polygon to Base, The Block reported. In addition, Aavegotchi developer Pixelcraft Studios will be shutting down its Base-based layer-3 network, Geist.

LAYER+11.91%

DAO+0.56%

tradingpalestia

22小時前

$PEOPLE gains nearly 9%, tied to the ConstitutionDAO movement. Originally launched to crowdfund a copy of the U.S. Constitution, it evolved into a community symbol of decentralized governance. Despite the failed auction, the token lives on as a cultural icon. Now, it represents meme value and DAO nostalgia. While it lacks technical use, its historic status makes it a unique speculative hold — especially during meme token resurgences.

HOLD+4.99%

AUCTION+1.26%

EntropyAdvisors_

22小時前

.@arbitrum has one of the largest DAOs in crypto with 245k delegates backed by 380k delegators.

Delegates play a crucial role in DAO governance. Our latest @Dune dashboard allows you to track all delegates' voting power, participation, voting patterns, and more.

A 🧵👇

DAO+0.56%

ONE+5.80%

相關資產

最近新增

最近新增的加密貨幣

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 Distributed Autonomous Organization。