1. Project Introduction

Hyperlane is a cross-chain interoperability protocol aimed at providing permissionless, modular, and scalable cross-chain communication solutions for blockchains. It allows the secure transfer of information and assets between any chains and supports developers in customizing security models through the "Interchain Security Module" (ISM), moving away from the traditional bridge protocol's integrated limitations to achieve a modular paradigm where "security architecture is defined by the application."

As one of the first protocols to support cross-chain interactions in multiple virtual machine environments (EVM, SVM, CosmWasm), Hyperlane also introduces ready-to-use components like Warp Routes, Interchain Accounts, and Interchain Queries, supporting the cross-chain transfer of ERC20/ERC721 assets without whitelisting, providing a complete development stack for cross-chain application building. Hyperlane currently supports deployments in various ecosystems such as Ethereum, Cosmos, Polygon zkEVM, and Celestia.

The project was co-founded by former Celo core engineers Asa Oines and Nam Chu Hoai, and it has secured $18.5 million in seed funding from top institutions like Variant Fund and Galaxy Digital. Strategic partners include Circle, Injective, and Skip Protocol. Hyperlane is accelerating the construction of an open, flexible, decentralized inter-chain connection layer, aiming to become the infrastructure gateway for cross-chain communication.

2. Project Highlights

1. Truly "Permissionless" Cross-Chain Protocol, Breaking Centralized Access Limitations

Hyperlane is one of the few cross-chain protocols that supports developers'

complete autonomy in deployments. Any L1, Rollup, or AppChain project can access Hyperlane and build its inter-chain communication system without official approval. This "permissionless" design removes the dependency on central teams in traditional bridge solutions, greatly enhancing development freedom, and provides rare foundational infrastructure in the current modular blockchain ecosystem.

2. Unique Modular Security Architecture ISM with Customizable Verification Mechanisms

Hyperlane introduces the "Interchain Security Module (ISM)" mechanism, allowing developers to customize the security model for each application module. They can choose from decentralized verifiers, multi-signature verifications, light node verifications, or even on-chain logic verifications. This mechanism differs from LayerZero (fixed Relayer+Oracle) or Axelar (unified verifier set) security paths and for the first time achieves "security strategy determined by the application," truly extending composability to the security level.

3. Cross-VM Communication Capabilities, Adapts to Multi-Chain Heterogeneous Ecosystems

Based on the support for the Ethereum (EVM) ecosystem, Hyperlane is gradually extending to heterogeneous virtual machine architectures like Solana VM, CosmWasm, and FuelVM, supporting EVM ↔ non-EVM cross-chain asset transfers and information calls. As multi-chain architecture moves from "multiple coexisting chains" to "heterogeneous collaboration," Hyperlane's cross-VM capability becomes a highly forward-looking design reserve.

4. Built-in Warp Routes and Interchain Accounts, Asset Bridging Without Whitelisting

Through Warp Routes, Hyperlane enables bridging of ERC20/ERC721 assets without a whitelist, breaking the limitations on supported assets of traditional bridge protocols. Meanwhile, interchain accounts and interchain query functions allow DApps to call contract logic on one chain from another. This reduces development complexity, shortens launch cycles, and truly achieves integrated deployment between chains.

5. Strategic Ecosystem Collaborations, Strong Implementation Capability, High Project Integration

Hyperlane has completed product integration with several top ecosystems such as Celestia, Polygon zkEVM, Circle CCTP, Injective, and Skip Protocol, forming a complete loop of asset bridging + application calls + liquidity sharing. On Celestia Rollup, Hyperlane provides instant interoperability support; in Injective, the inEVM bridge connects the Ethereum ecosystem; and in collaboration with Circle, it helps achieve permissionless USDC cross-chain transfers—not just a protocol but an accelerator for inter-chain liquidity.

6. Supported by a Leading Team and Top Capital, Strong Resource Synergy

The Hyperlane team consists of former Celo core engineers with deep experience in blockchain protocol development. Cofounder Jon Kol was previously head of investments at Galaxy Digital, with strong strategic resource integration capabilities. The project's seed round received a total of $18.5 million from institutions like Variant Fund, Galaxy Digital, CoinFund, and Figment Capital, with a clear path for ecosystem expansion and sustainable growth potential.

3. Market Cap Expectations

Among current cross-chain communication protocols, Hyperlane is one of the few supporting modular security architecture and permissionless deployments. Its protocol scope covers not only traditional asset bridging but also extends to interchain calls, account management, and on-chain development toolsets, resembling more closely a fundamental communication layer for a "multi-chain world."

Compared to interoperability protocols like LayerZero and Wormhole, which have achieved large-scale on-chain deployments and built strong ecosystems, Hyperlane, although still in the early stage, has completed the implementation of core mechanisms and multi-chain integration, showing substantial progress in ecosystems such as Injective, Celestia, and Polygon zkEVM, holding potential to gradually catch up with and benchmark against leading protocols.

Considering Hyperlane's token $HYPER has a maximum supply of 1 billion, its future listing can refer to the market cap ranges of current major cross-chain protocols to assist in determining its initial valuation anchor points and long-term growth space after going live.

4. Economic Model

The total supply of $HYPER is

1 billion, with an initial supply of 802,666,667 at genesis, approximately 21.83% unlocked and in circulation at TGE, with the remainder under various unlocking mechanisms.

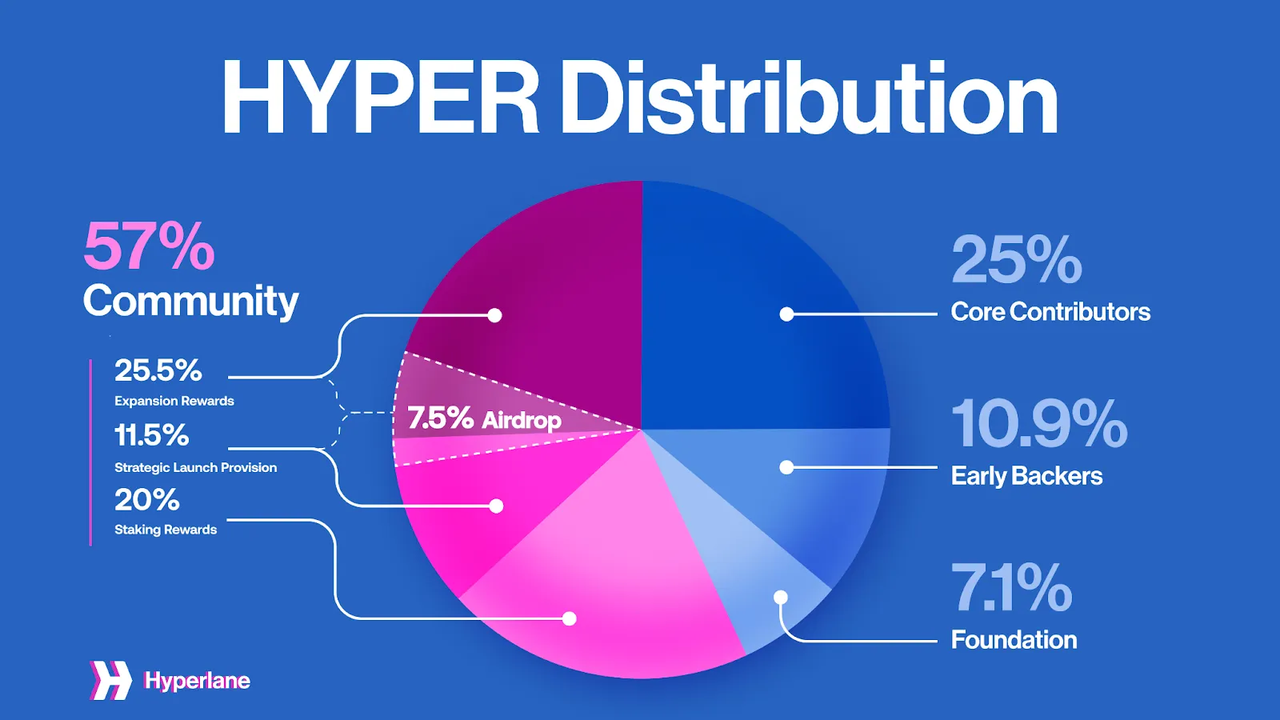

Token Distribution

Community 57.02% including expansion rewards, strategic launch provision, and staking rewards: ▸ Expansion Rewards 25.50%: Distributed quarterly based on interchain message fees, 85% for incentivizing end-users ▸ Strategic Launch Provision 11.52%: For liquidity and market entry, includes retroactive airdrops ▸ Staking Rewards 20%: Linear release for validator incentives, initially non-circulating

Core Team 25.00% Locked at TGE, 12-month cliff, followed by linear release over 24 months (3 years in total)

Early Backers 10.87% Same unlocking pace as the core team

Hyperlane Foundation Treasury 7.11% For long-term growth strategy intervention funds, including ecosystem grants and R&D incentives, with a 30-month linear release

Airdrop Mechanism

HODLer Airdrop: 20 million HYPER (2.49% of genesis supply) Distributed to early users and addresses with GAS fees reaching approximately $5, including multiple chains and ecosystem protocol end-users.

Token Utility

$HYPER serves multiple core purposes, covering network governance, fee payment, and network security in three main areas:

- Governance Function: Used for protocol governance, parameter adjustments, and crucial upgrade voting

- Cross-chain Transaction Fee Medium: Provides economic incentives to message relayers and validators

- Staking Mechanism: Users can stake HYPER to participate in the validator mechanism, thereby enhancing security and earning rewards

5. Team & Funding

Team Information:

Hyperlane was founded by a team of former Celo engineers in Connecticut, USA, with three co-founders who have profound backgrounds in protocol design, security architecture, and venture capital:

Asa Oines: Former core engineer at Celo, focused on blockchain protocol development, currently serves as Hyperlane's Technical Head.

Nam Chu Hoai: Former engineer at Coinbase and Celo developer, leads the SDK and multi-chain adaptation architecture at Hyperlane.

Jon Kol: Former head of venture investments at Galaxy Digital, actively involved in infrastructure project financing, currently leads strategy and ecosystem expansion at Hyperlane.

Funding Information:

In September 2022, Hyperlane announced it completed a $18.5 million seed round led by Variant Fund, with participating institutions including Galaxy Digital, CoinFund, Blockdaemon, Figment Capital, Triton Capital, XYZ, NFX, and Circle Ventures.

6. Potential Risk Warning

1. $HYPER releases over 21% of its supply at TGE, part of which is for liquidity initiation and ecosystem incentives. If the early market reception is inadequate, or if short-term capital competition is intense, significant price volatility might occur. Furthermore, although the team's and early backers' unlocking period is relatively long (12-month cliff + 24-month linear release), it's still essential to monitor the supply and demand impact from subsequent releases.

2. Hyperlane faces strong competitors in its field, including leading protocols like LayerZero, Axelar, and Wormhole, many of which have secured deep ties with capital and developer communities. If Hyperlane cannot maintain a continuous product advantage or achieve explosive ecosystem growth, there is a risk of marginalization.

7. Official Links