Bitcoin analysts target $95K as Trump’s trade war cools — Do BTC futures agree?

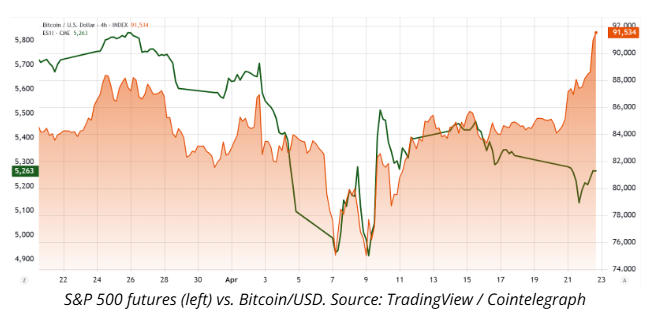

Bitcoin surged to a 45-day high above $91,000 on April 22, and the upward movement coincided with gold reaching a new all-time high. The price gains reflect investors' concerns over a potential economic recession amid ongoing global trade tensions.

The tides are shifting, but does data support a Bitcoin price rally above $95,000?

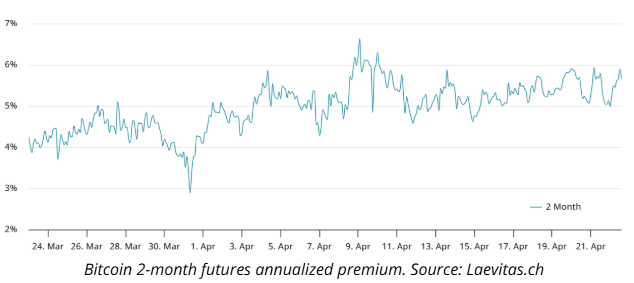

In neutral markets, the Bitcoin futures premium typically ranges between 5% and 10% to compensate for the longer settlement period. At present, the annualized premium stands at 6%, which is not considered particularly bullish, even though BTC appreciated by $6,840 between April 20 and April 22. Some analysts interpret this as a sign that Bitcoin is beginning to decouple from the stock market.

Traders’ PTSD could emerge around BTC’s $90K zone

Part of this skepticism among traders stems from Bitcoin’s repeated inability to sustain levels above $90,000 in early March. For example, Bitcoin tested the $95,000 mark on March 3, only to fall to $81,464 the following day. This inconsistent performance since the $109,346 peak on Jan. 20 has contributed to a lack of conviction among bullish investors, especially as gold has continued to set new all-time highs during the same period.

Currently, Bitcoin is trading 16% below its all-time high, a figure that closely mirrors the S&P 500’s decline of 14.5%. This suggests that the recent era of excessive risk-taking may be behind us. Notably, even at its lowest point below $75,000, Bitcoin’s 32% drawdown was less severe than those experienced by Nvidia (NVDA), Amazon (AMZN), Facebook (META), and Tesla (TSLA).

Comments from US Treasury Secretary Scott Bessent on April 22 contributed to easing investor concerns. As reported by Bloomberg, Bessent described the ongoing tariff standoff with China as “unsustainable,” suggesting an increased likelihood of de-escalation. In contrast, US President Donald Trump took to social media to assert that US Federal Reserve Chair Jerome Powell is hindering economic growth by not reducing interest rates.

Bitcoin’s gains contrast with investors’ shift to government bonds

Regardless of where the blame lies for the subdued economic growth in the United States, demand for short-term US Treasurys has risen, as evidenced by the yield on the 2-year note declining to 3.81% from 4.04% a month earlier. Essentially, investors are accepting lower returns in exchange for the perceived safety of government bonds. Against this backdrop, Bitcoin’s 6.3% price increase over the past 30 days stands out as particularly notable.

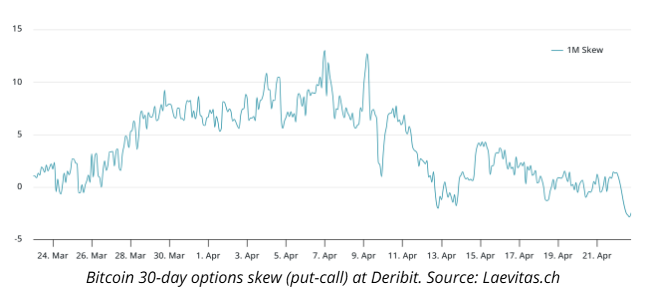

To determine whether these recent gains have affected professional traders’ sentiment, it is important to examine the BTC options markets. If traders expect a correction, put (sell) options tend to trade at a premium, causing the 25% delta skew metric to rise above 6%. Conversely, bullish sentiment pushes the indicator below -6%.

Currently, the Bitcoin options market reflects limited enthusiasm following the recent surge to $91,000, with the 25% delta skew indicator at -2%, which remains within the neutral range. According to this metric, the last period of bullish sentiment occurred on Jan. 30, when Bitcoin traded near $105,000. Therefore, there is no clear evidence that large investors or market makers are anticipating a sustained rally above $95,000.

Despite some weak macroeconomic data, market participants expect a relatively strong first-quarter earnings season. FactSet reports that the “Magnificent 7” companies are projected to achieve earnings growth of 14.8% for the first quarter compared to the prior year.

While Bitcoin still has a reasonable chance of revisiting $95,000 or higher, many traders appear to be waiting for further developments in the US-China trade war before placing additional bullish bets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin rally nears $100,000

Crypto Market Surges Amid Influential Institutional Moves

Top High ROI Cryptos in 2025: BlockDAG, Pi Coin, BNB, Stellar & Polkadot

Cardano Surges 17%, Eyes Potential $5 Target