Cardano Is Vulnerable To Selling As Short-Term Holders; Profits Hit 5-Month High

Cardano's price is under threat as short-term holders are poised to sell their profitable positions. With resistance at $0.63 and negative market sentiment, ADA's future remains uncertain.

Cardano (ADA) has been struggling to maintain its price levels, with recent price action reflecting a lack of growth amid bearish market conditions.

As the market continues to face pressure, short-term holders (STHs) are becoming increasingly likely to sell their positions rather than hold on for a potential rebound.

Cardano Investors Close To Selling

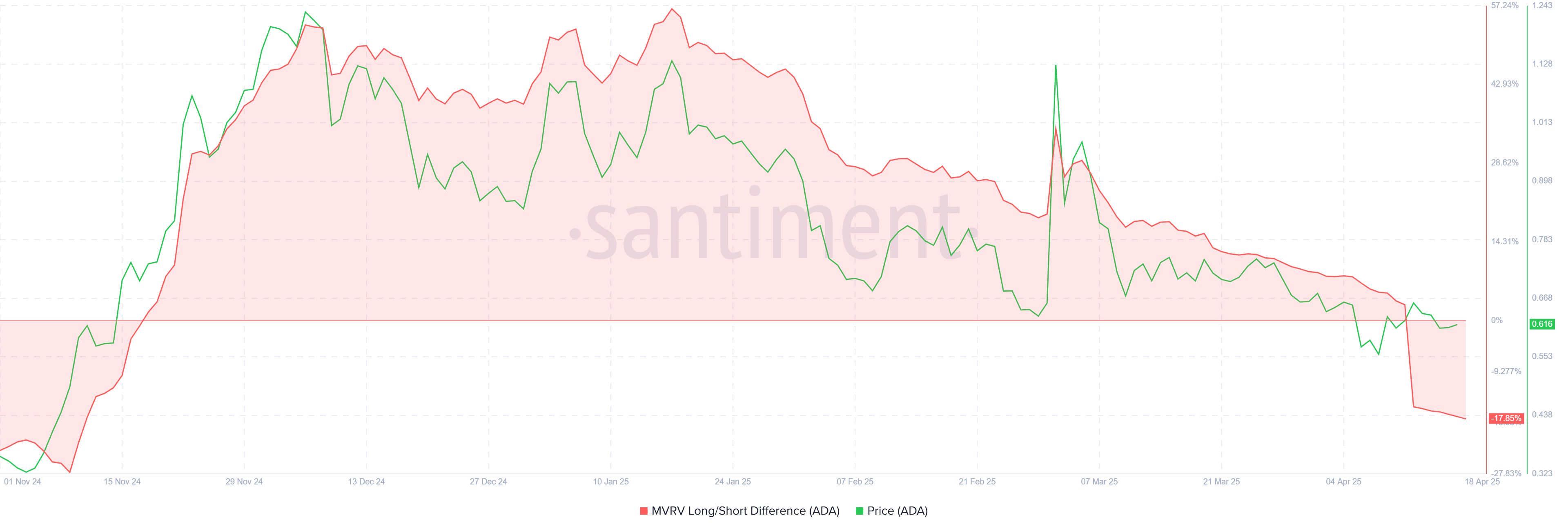

The MVRV (Market Value to Realized Value) Long/Short Difference for Cardano has dropped to -18%, marking a five-month low. This suggests that STHs are in a position to realize substantial profits, the highest since November 2024.

This trend can be detrimental to Cardano’s price because STHs typically sell when they see profits, potentially triggering downward pressure. As these holders are currently sitting on gains, their selling actions are likely to exacerbate the ongoing bearish momentum.

The situation is made worse by the market’s current sentiment. This could further weaken Cardano’s ability to maintain its support levels and add to the volatility of ADA’s price.

Cardano MVRV Long/Short Difference. Source:

Santiment

Cardano MVRV Long/Short Difference. Source:

Santiment

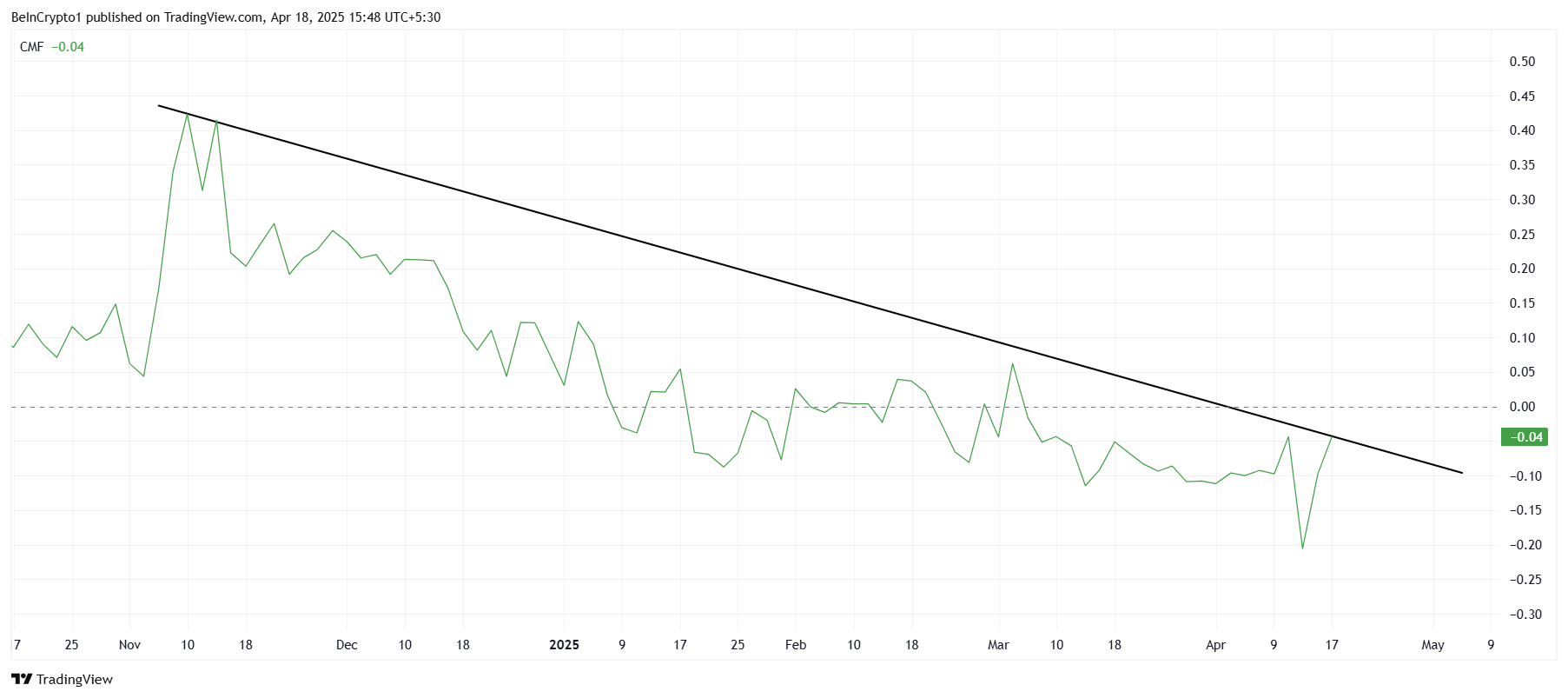

Cardano’s broader market momentum shows additional signs of weakness. The Chaikin Money Flow (CMF) indicator, which tracks the flow of money in and out of a cryptocurrency, has been in a steady decline since November 2024.

Currently stuck below the zero line, this suggests that outflows are dominating inflows, signaling a lack of investor confidence. The CMF reflects cautious behavior from investors, as they are less inclined to enter the market given the ongoing bearish conditions. The absence of confidence in the market is pulling investors away from Cardano.

Cardano CMF. Source:

TradingView

Cardano CMF. Source:

TradingView

ADA Price May Witness Decline

Cardano’s price currently stands at $0.61, just below the critical resistance of $0.63. Despite attempts to recover, the altcoin has faced a nearly month-long decline, preventing any meaningful upward movement. Without a change in market conditions, Cardano will struggle to reclaim lost ground and break through the $0.63 resistance.

If market conditions continue to worsen, Cardano’s price could dip further, potentially heading toward the $0.57 support level. This decline would extend investors’ losses and make recovery even more difficult. As market sentiment remains largely negative, it seems unlikely that Cardano will breach $0.63 in the short term.

Cardano Price Analysis. Source:

TradingView

Cardano Price Analysis. Source:

TradingView

However, if broader market cues improve and investor confidence returns, Cardano could reverse its bearish trend. Successfully flipping the $0.63 resistance into support would invalidate the current bearish outlook and potentially push the price toward $0.70. A breach of this level would mark a significant shift in momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | HyperLane Project Overview & HYPER Market Cap Analysis

Bitcoin risks 10%-15% BTC price dip after key rejection near $89K

Bitcoin faces "overbought" stochastic RSI conditions while the 200-day exponential moving average swats price down after it sets fresh April highs.

Research Report | Detailed Analysis of Zora Project & ZORA Market Cap

Is Aptos (APT) Poised for an Upside Move? This Fractal Says It Is!