Swiss National Bank Rejects Bitcoin as Reserve Asset Over Stability and Security Concerns

Schlegel’s stance contradicts a proposal from Swiss Bitcoin nonprofit think tank 2B4CH, which aims to constitutionally mandate the SNB to hold Bitcoin on its balance sheet.

Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of adding Bitcoin to Switzerland’s reserve assets, citing concerns over stability, liquidity, and security risks.

Schlegel’s stance contradicts a proposal from Swiss Bitcoin nonprofit think tank 2B4CH, which aims to constitutionally mandate the SNB to hold Bitcoin on its balance sheet.

The initiative, currently in its early stages, has gained traction among crypto advocates pushing for greater institutional adoption.

SNB President Schlegel Cites Bitcoin Volatility as Barrier to Reserve Adoption

In a March 1 interview with Swiss media outlet Tamedia, Schlegel argued that Bitcoin’s volatility makes it an unsuitable reserve asset for the country’s central bank.

“Our reserves need to be highly liquid so they can be used quickly for monetary policy purposes if needed,” he said, emphasizing that Bitcoin’s price swings and market fluctuations are incompatible with the SNB’s financial strategy.

Beyond volatility, Schlegel raised concerns over technical vulnerabilities associated with cryptocurrencies, stating that since Bitcoin is software-based, it remains susceptible to bugs and security flaws.

“We all know that software can have bugs and other weak points,” he noted, reinforcing the argument that Bitcoin lacks the reliability needed for central bank reserves.

Despite acknowledging the crypto market’s near $3 trillion valuation, Schlegel described Bitcoin as a “niche phenomenon” compared to the broader financial system.

He also dismissed the idea that Bitcoin could challenge the Swiss franc, stating, “We’re not afraid of competition from cryptocurrencies.”

The 2B4CH initiative, which was officially set in motion by the Swiss Federal Chancellery on Dec. 31, requires 100,000 signatures to qualify for a public referendum.

The group has until June 30, 2026, to gather enough support—meaning about 1.11% of Switzerland’s 8.97 million residents must sign the petition.

Bitcoin Reserves in Other Countries

While Switzerland remains cautious, other nations are actively exploring Bitcoin reserves.

El Salvador has continued accumulating Bitcoin since September 2021, while the U.S., Czech Republic, and Hong Kong are considering similar policies. Conversely, Poland recently ruled out adding Bitcoin to its reserves.

Despite Schlegel’s resistance, Switzerland remains a hub for Bitcoin adoption, particularly in Lugano, which hosts the annual “Plan ₿” conference.

It is worth noting that several U.S. states , including Illinois, Kentucky, Maryland, New Hampshire, New Mexico, North Dakota, Ohio, Pennsylvania, South Dakota, and Texas, have also introduced bills that could enable them to hold Bitcoin and other cryptos as reserve assets.

More recently, lawmakers in Ohio introduced House Bill 116 , aiming to prevent the state from imposing additional taxes on digital assets when used for payments.

Meanwhile, Bitcoin is currently trading at around $86,000, largely flat over the past day.

According to analysts at Time To Trade , should Bitcoin break above $86,500 with strong volume, traders might see a swift rally targeting $88,000, a psychologically notable round number and a level of interest to short-term speculators.

On the other hand, if the market encounters increased selling pressure—especially with lower trading volume—Bitcoin may revisit the $84,000 mark.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?

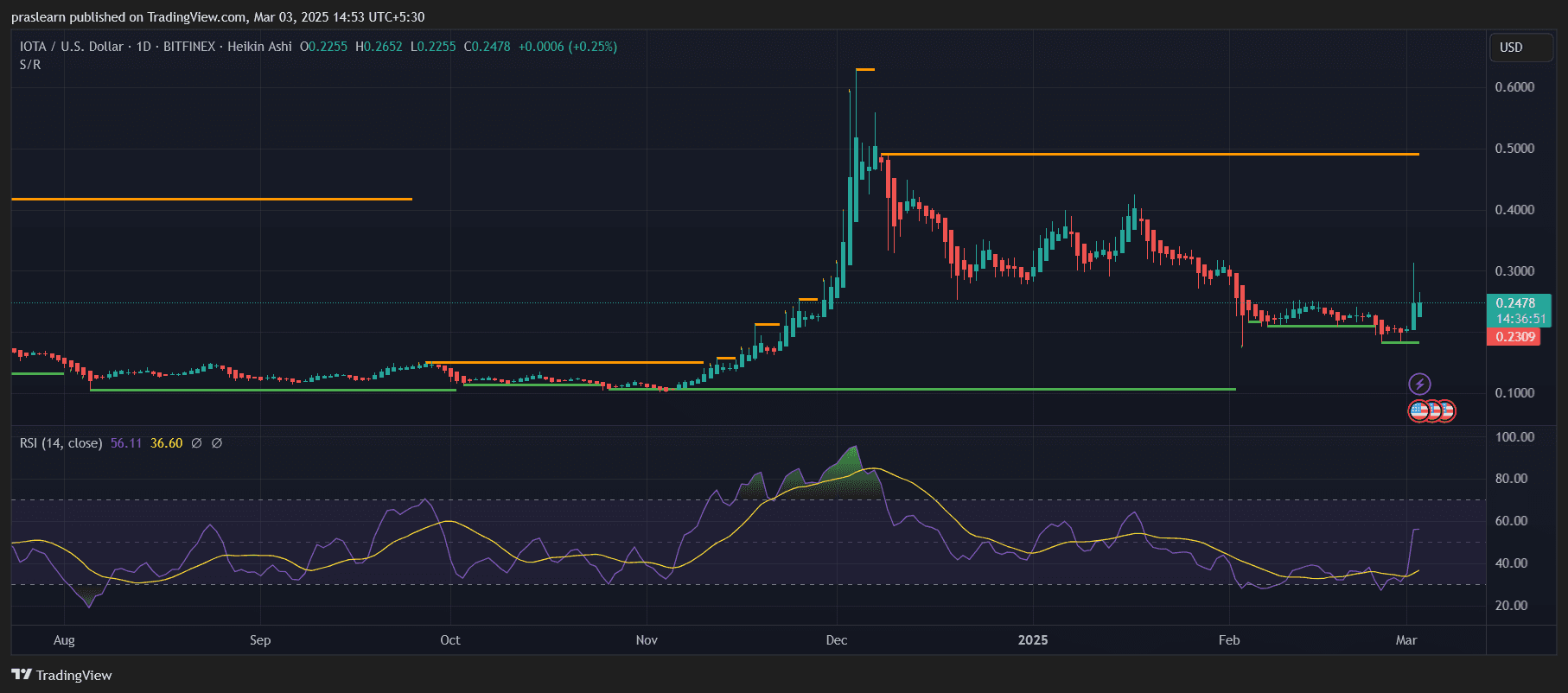

IOTA Price Prediction: Is This the Start of a Major Reversal?

Aave Price Prediction: Is the Correction Over or More Pain Ahead?

Why March 7 Is Crucial for Bitcoin and the Broader Crypto Market