Solana-based restaking protocol Solayer introduces ‘InfiniSVM’ blockchain

Quick Take Restaking protocol Solayer is developing InfiniSVM, a hardware-accelerated blockchain solution based on the Solana Virtual Machine. Solayer published a litepaper outlining the capabilities of InfiniSVM, claiming a transaction confirmation time of 1 millisecond.

Solayer, a restaking protocol in the Solana ecosystem, said it's developing InfiniSVM — a hardware-accelerated Solana Virtual Machine (SVM) blockchain.

Termed “the grand finale of Solayer’s vision,” Solayer has published a litepaper on the solution. It claims that when launched, InfiniSVM will dynamically scale to meet application demands while maintaining a transaction confirmation time of just 1 millisecond.

SVM is the software infrastructure on the Solana blockchain that handles thousands of transactions per second using a parallel processing model for decentralized applications. The architecture differs from Ethereum’s Virtual Machine (EVM), which employs a sequential processing model.

Solayer, initially a restaking protocol akin to Ethereum's EigenLayer , currently has nearly $400 million in total value locked. The protocol secures other dapps through the economic value of SOL staked on the platform. Now, it has expanded to developing its own SVM blockchain.

This development comes as Solayer introduced a non-profit foundation that is expected to roll out a governance token.

InfiniSVM will feature a multi-execution cluster architecture using software-defined networking, supporting throughput up to 100Gbps. It will use a hybrid “proof of assigned stake” consensus mechanism to coordinate a network of provers for high-speed transaction verification.

The team explained that its SVM will horizontally scale Solana’s network infrastructure and meet the bandwidth requirements of decentralized applications.

Solayer also plans to integrate native yield-bearing assets such as sSOL and sUSD into InfiniSVM and allow users to stake them on the network.

While the SVM has traditionally been associated with the Solana mainnet, a new wave of projects is leveraging its capabilities in new ways, extending its reach beyond the main blockchain through alternate SVMs.

An alternative SVM instance, such as InfiniSVM, operates independently of the main Solana network. These alternate SVMs can be used to create Layer 2 solutions or even entirely new blockchains that leverage the SVM's performance while offering separate functionalities.

Besides InfiniSVM, Eclipse is noted as another project utilizing SVM for a Layer 2 solution on Ethereum, focusing on faster transaction processing and reduced gas costs by bundling transactions off-chain and settling on the mainnet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Duolingo prioritizes user growth over monetization, forecasts softer bookings

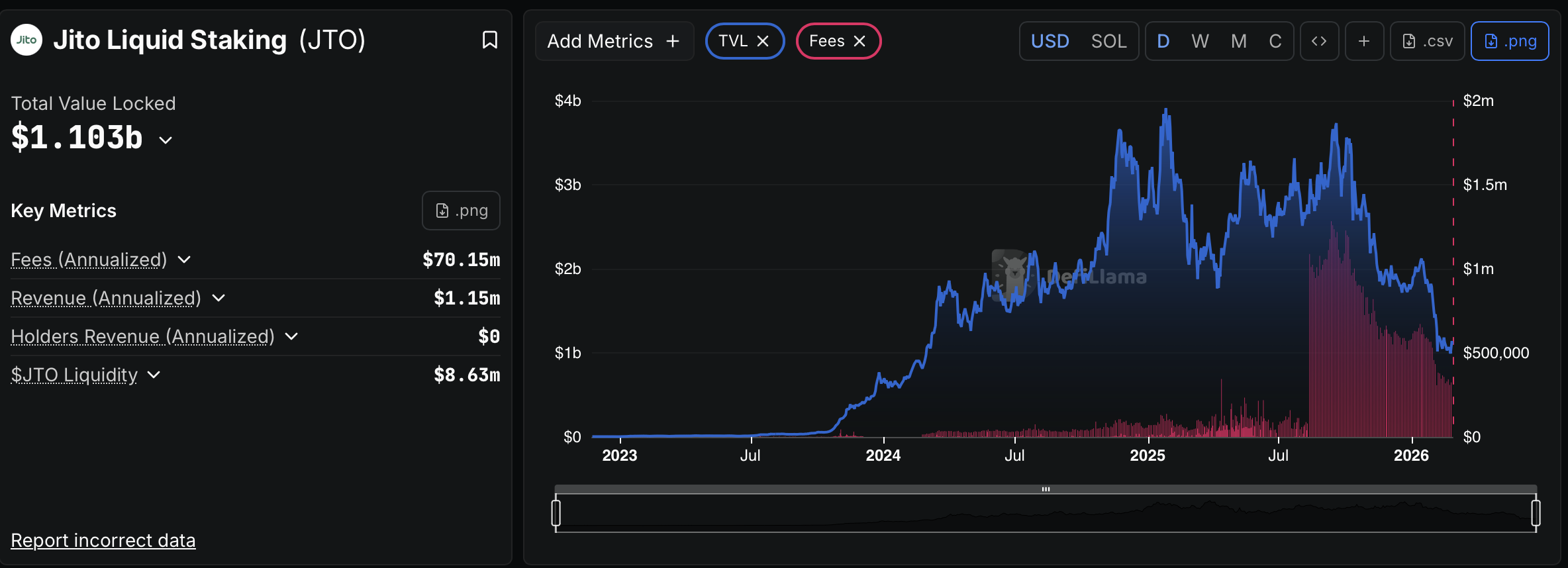

SEC approval sought for JitoSOL Solana-based liquid staking token ETF