Bitcoin analysts forecast pre-election surge, warn of potential post-election sell-off

Bitcoin is poised for a potential increase in value as the U.S. elections on November 5 approach; however, analysts caution that a sell-off could follow.The largest digital asset by market capitalization is now trading just below the $69,000 mark, with just over one week to go before the U.S. presidential election on November 5.

The price of bitcoin may surge ahead of the U.S. elections on November 5, but analysts caution that a sell-off could occur in the days following the election results, regardless of the winner.

"Profit-taking could weigh on the price of bitcoin in the days following the result announcement, yet dip buyers should maintain support strong below $60,000," Tyr Capital Chief Investment Officer Edouard Hindi told The Block. He added that irrespective of the election outcome, bitcoin will likely regain momentum in the medium term and aim for new highs in 2024.

Bitget Research Chief Analyst Ryan Lee reiterated this perspective, emphasizing that bitcoin is poised for significant growth in the coming week as Americans prepare to head to the polls next Tuesday.

"Several factors support bitcoin's potential rise, particularly the anticipated interest rate cut by the U.S. Federal Reserve. The broader market expects a 25 basis point cut on November 7, which would lower rates to the 4.5% to 4.75% range, reflecting a need for adjustments to stabilize economic growth," Lee said.

Lee emphasized that the two-day gap between the U.S. elections and the Federal Reserve’s rate decision could significantly influence bitcoin’s price.

"The direction of this impact will depend on whether a pro-bitcoin candidate emerges victorious," he said.

Potential bitcoin sell pressure factors

Lee also highlighted that upcoming events, such as the Microsoft Board's impending vote on investing in bitcoin, could influence market dynamics following the election. Microsoft has placed an "assessment of investing in bitcoin" on the ballot for its 2024 annual shareholder meeting, which is scheduled for early December.

“If the board votes against investing in Bitcoin, it could dampen market enthusiasm and hinder Bitcoin's growth,” Lee stated. Conversely, he noted that if Microsoft decides to invest, it could spark a significant upward movement in the market.

With a 70% confidence interval, Lee predicts bitcoin could trade between approximately $66,000 and $75,000 over the next week, while Ethereum may range from $2,350 to $3,200. He also suggested that improving liquidity could lead to increased activity in altcoins .

Amid these discussions, Donald Trump's recent interview on the Joe Rogan Experience podcast has garnered over 32 million views, boosting his Polymarket odds to above 66%. However, despite crypto being associated with the "Trump Trade," Bitcoin’s correlation with Trump's odds appears to be weakening, according to analysts at QCP Capital.

"Bitcoin is only up 8% this October, compared to an average increase of 21%. If bitcoin holds at its current levels, this would mark its fourth-worst performance for October in the past decade," the analysts added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Price Today (April 22, 2025): Bitcoin Eyes $90k, XRP & SOL Lag while LEO Token Drops 6%

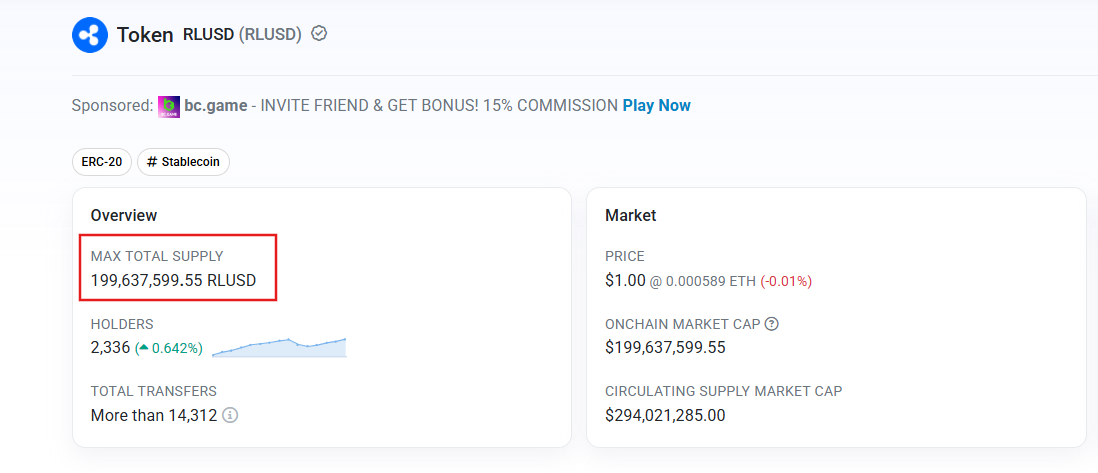

Nearly 70% Supply of Ripple’s RLUSD Stablecoin is on Ethereum

Bitcoin MACD Bullish Crossover Confirmed, Analyst Expects Significant Wave Up for BTC Price

XRP Network Activity Jumped by 67.50% as Bull Signals Suggest a Bullish Wave Leading to a Pump of Over 3.84X