Nearly 70% Supply of Ripple’s RLUSD Stablecoin is on Ethereum

Ripple’s entry into the stablecoin market through the launch of RLUSD has been a turning point for the Decentralized Finance (DeFi) sector. However, the latest data regarding the distribution of the stablecoin has surprised users as nearly 70% of RLUSD’s total supply is currently issued on Ethereum rather than on Ripple’s own XRP Ledger (XRPL).

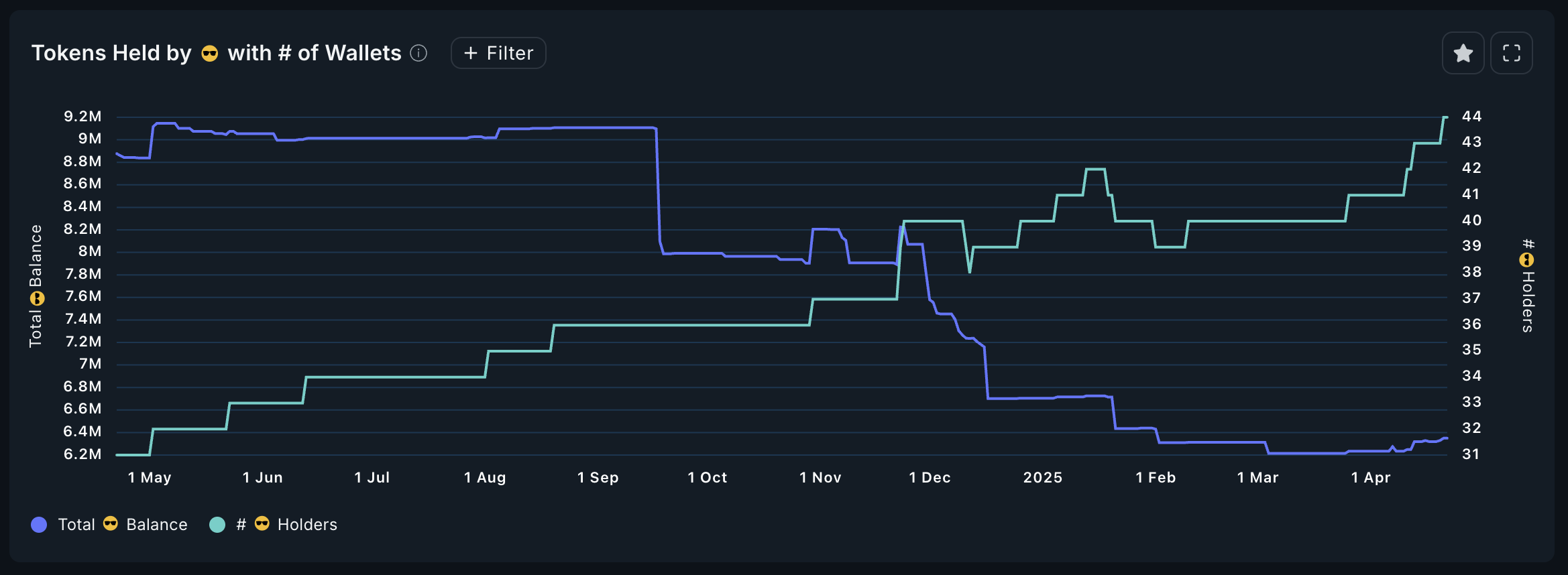

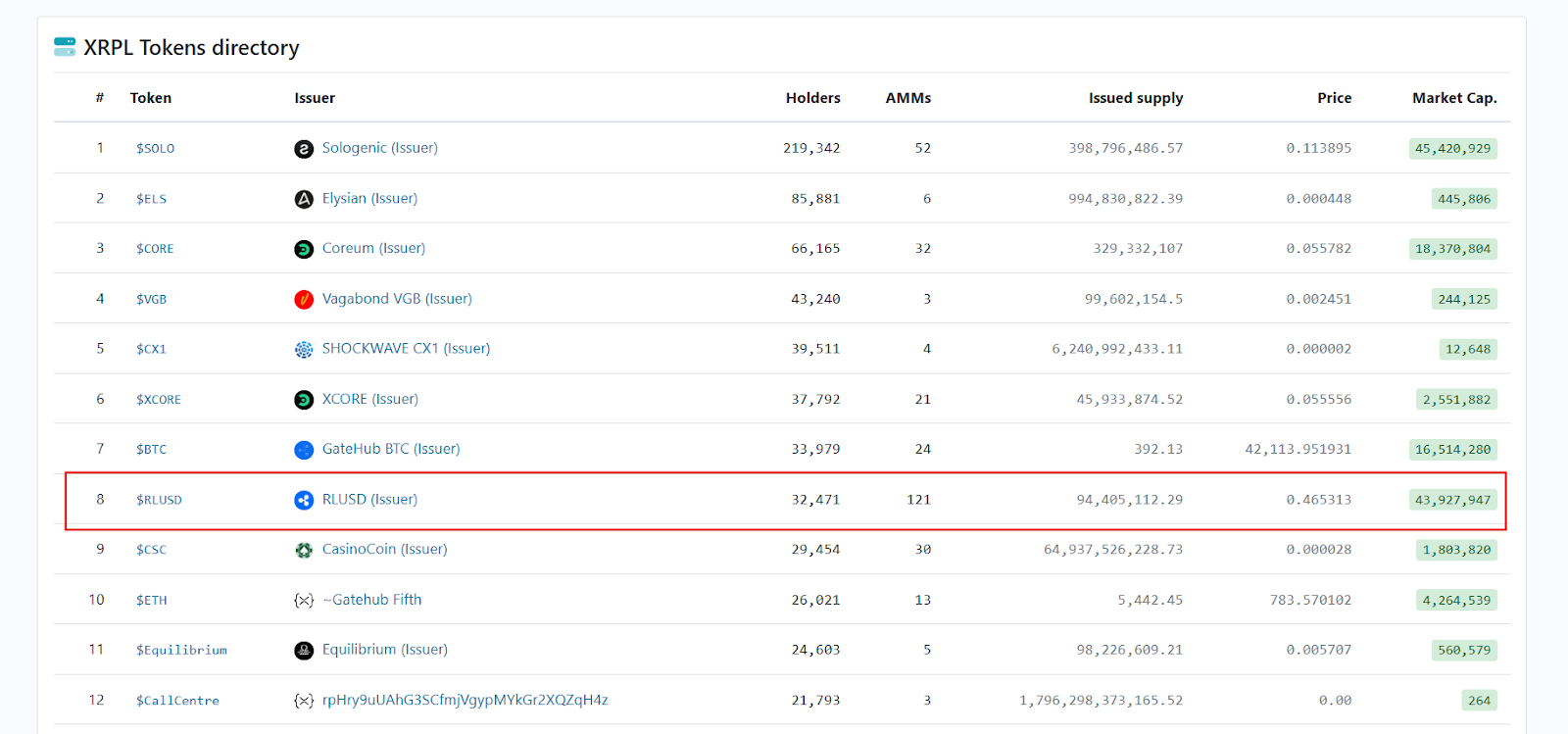

As of onchain data available on Arkham, RLUSD has a total supply of 294,042,711 tokens. Although XRPScan reveals that only 94,405,112 RLUSD exists on the XRP Ledger, which represents approximately 32% of the total supply.

Ripple USD (RLUSD) Supply on XRP Ledger – Source: XRPScan

Ripple USD (RLUSD) Supply on XRP Ledger – Source: XRPScan

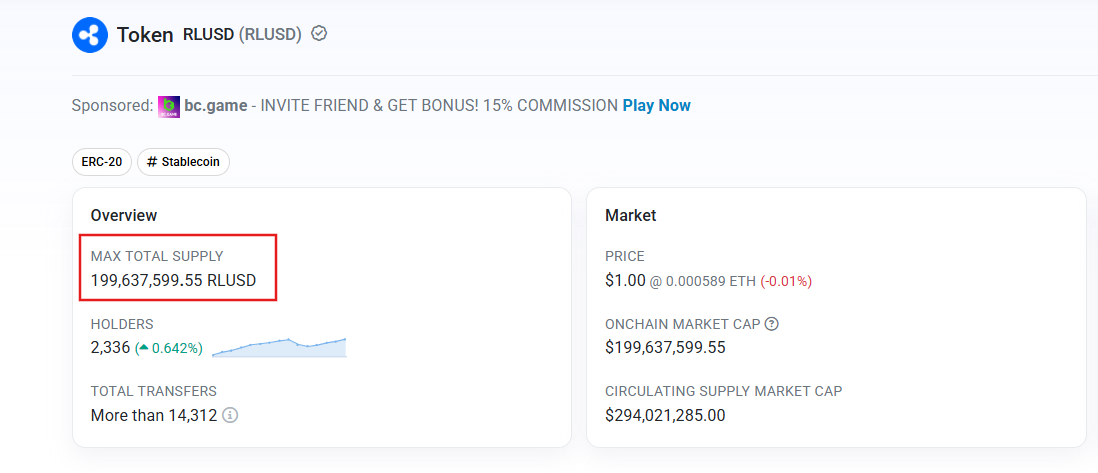

The remaining 199,637,599 RLUSD, or roughly 68%, resides on Ethereum — the home of most of today’s leading stablecoins like USDT, USDC, and DAI.

This allocation raises a key question: Why is the majority of Ripple’s own stablecoin being hosted on a rival blockchain?

Why is RLUSD on Ethereum?

Ethereum remains the most dominant blockchain in the decentralized finance (DeFi) world. With thousands of decentralized applications (dApps), massive liquidity pools, and widespread user adoption, Ethereum offers unparalleled infrastructure for token utility.

Ripple USD (RLUSD) Supply on Ethereum– Source: Etherscan

Ripple USD (RLUSD) Supply on Ethereum– Source: Etherscan

Launching RLUSD on Ethereum ensures immediate access to established platforms like Uniswap, Aave, Curve, and MakerDAO while allowing users to trade, lend, or stake RLUSD across a range of decentralized services. For developers and institutions looking for liquidity and composability, this cross-chain deployment makes RLUSD far more attractive than if it were limited to the XRPL alone.

A Strategic Play from Ripple?

Ripple has previously emphasized the importance of a multichain future – the one in which crypto assets can move freely across different blockchains, enabling broader financial inclusion and better efficiency.

In that context, RLUSD’s deployment strategy might not be surprising at all. Instead, it could be a reflection of Ripple’s long-term vision to ensure the stablecoin is usable wherever liquidity exists, whether that’s on XRPL, Ethereum, or eventually even other chains like Solana or Avalanche.

Moreover, by launching heavily on Ethereum, Ripple can capture market share in existing stablecoin-dominated sectors, build credibility among DeFi-native users, and demonstrate RLUSD’s practical utility outside the XRP community.

Looking ahead, RLUSD’s growth will likely depend on user adoption, integration with DeFi protocols, and regulatory clarity. Given that Ripple has a reputation, particularly in the enterprise and payments space, the availability of RLUSD stablecoin on Ethereum gives it an edge in gaining trust among all players including retail users, institutions and developers.

The fact that 70% of RLUSD’s supply is on Ethereum signals a significant shift in Ripple’s approach to adoption. Rather than restricting its ecosystem to the XRP Ledger, Ripple seems to be betting on a future where RLUSD plays a pivotal role across chains, not just within its own.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Embrace of DeFi: Exploring Potential Impacts on Ondo Finance and the Financial Landscape