- Sui soars 175%, while Bitcoin rises 57%, and Solana gains 50%, showing strong 2024 performances across the crypto market.

- Bitcoin, Ethereum, Solana, and Sui all post impressive gains in 2024, with bullish sentiment and growing market interest.

- Ethereum climbs 3.14%, joining Bitcoin, Solana, and Sui in leading the crypto market’s strong 2024 performance.

Crypto markets have seen notable gains in 2024, with Sui (SUI), Bitcoin (BTC), Solana (SOL), and Ethereum ( ETH ) emerging as top performers.

These assets have seen substantial price increases, with Sui posting a remarkable 175% surge. Bitcoin’s dominance continues to grow, while Solana remains a strong contender in the smart contract space.

Sui’s 175% Surge

Sui has experienced a remarkable 175% price surge in just 30 days, capturing the attention of the crypto market. Its price stands at $2.24 , with a 24-hour trading volume of $961.7 million. Although Sui has increased only 0.37% in the last 24 hours, its market cap of $6.2 billion and a circulating supply of 2.76 billion SUI coins demonstrate its growing presence.

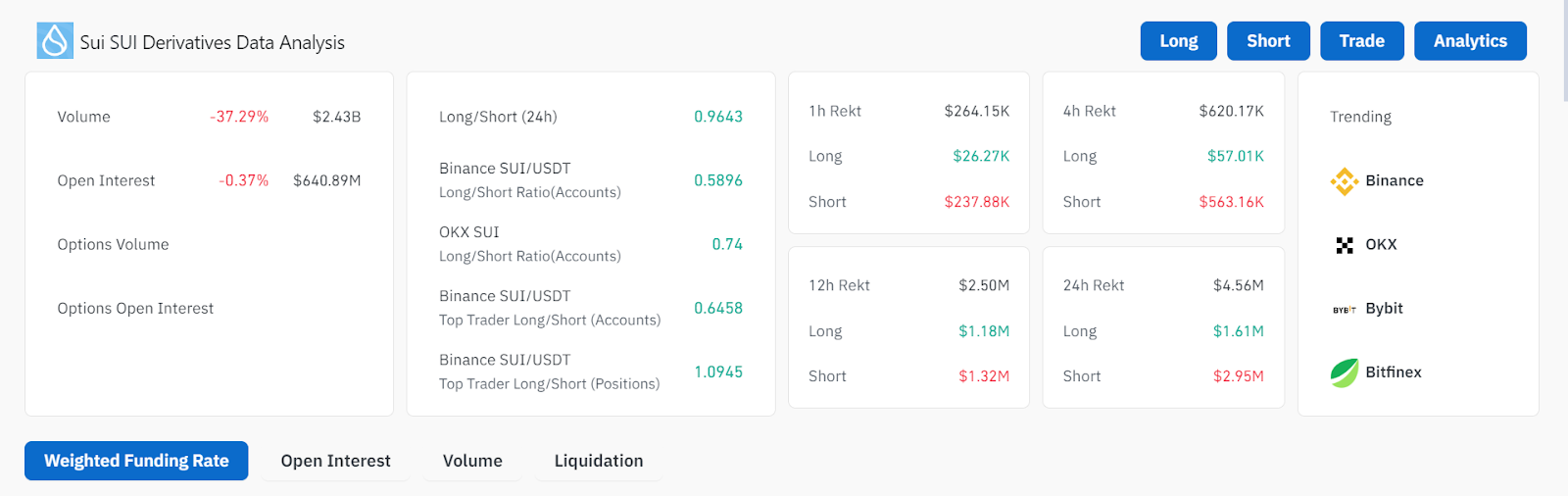

Source: Coinglass

Source: Coinglass

Circle’s launch of native USDC support on the Sui blockchain is a key factor in its success. Sui’s derivatives market shows mixed activity. Trading volume has fallen by 37.29%, while open interest has dipped slightly by 0.37% to $640.89 million. Binance traders are slightly bearish, with a short position ratio of 0.5896. However, long positions still slightly dominate overall, hinting at future volatility.

Bitcoin’s 57% Gain

Bitcoin’s price has surged by 57% this year, reflecting its continued dominance in the crypto market. At the time of writing, BTC is priced at $65,669.61 , Bitcoin holds a market cap of $1.29 trillion. Its trading volume remains robust at $38.87 billion, and its circulating supply is nearing its cap of 21 million coins.

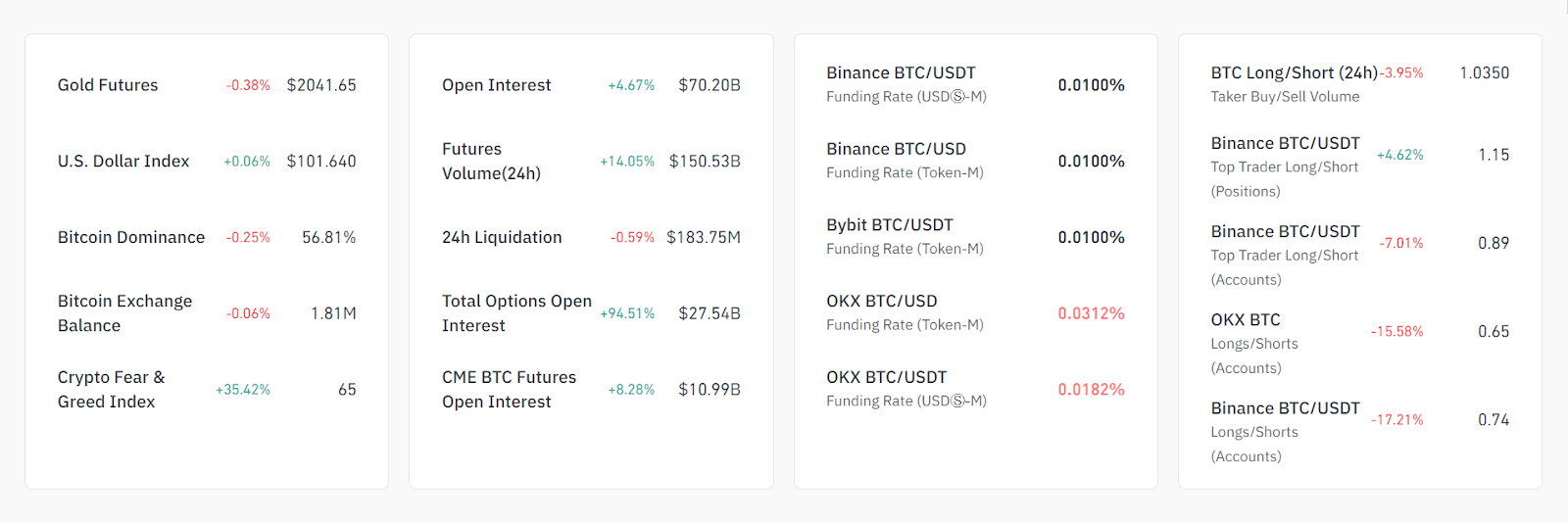

Source: Coinglass

Source: Coinglass

The Bitcoin derivatives market shows increased activity, with open interest up 4.67% to $70.2 billion. Futures volume also rose by 14.05% to $150.53 billion in the past 24 hours. Furthermore, Bitcoin’s options market surged by 94.51%, signaling increased trader engagement.

Despite mixed sentiment from long/short ratios, growing institutional interest and higher liquidity suggest Bitcoin’s market maturity. Traders should watch for shifts as the Crypto Fear Greed Index rises to 65, indicating optimistic sentiment.

Solana’s 50% Return

Solana has continued its upward trend in 2024, achieving a 50% year-to-date return. Currently priced at $154.69, with a trading volume of $2.58 billion, Solana remains a key player in the smart contract space. Its market cap is $72.67 billion, supported by a circulating supply of 469.7 million SOL coins.

According to a report by Standard Chartered, Solana could rally significantly if Donald Trump wins the 2024 U.S. Presidential election, potentially surging 400%. Beyond this speculation, Solana’s derivatives market shows strong bullish sentiment. Trading volumes are up 4.09% to $5.25 billion, while open interest has grown by 1.05% to $2.49 billion.

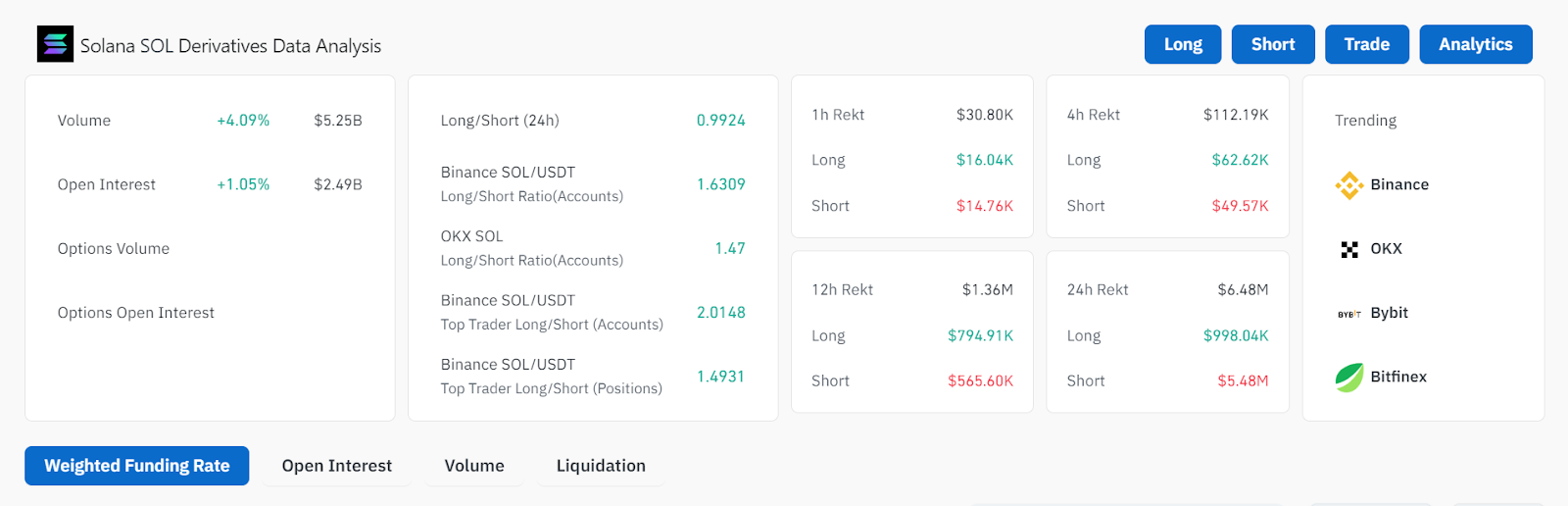

Source: Coinglass

Source: Coinglass

Long positions dominate, particularly on Binance, suggesting traders are preparing for potential volatility. Liquidations totaled $6.48 million in the past 24 hours, mostly affecting short positions, pointing to a possible short squeeze.

Ethereum Sees Bullish Momentum Surge

Ethereum is priced at $2,617.23 , experiencing a 3.14% increase in the last 24 hours. With a trading volume of over $19.1 billion and a market cap surpassing $315 billion. ETH has a circulating supply of 120,385,428 ETH coins, while market activity signals growing optimism. A closer look at derivatives shows a 14.06% rise in volume to $25.84 billion and a 6.79% increase in open interest to $13.14 billion.

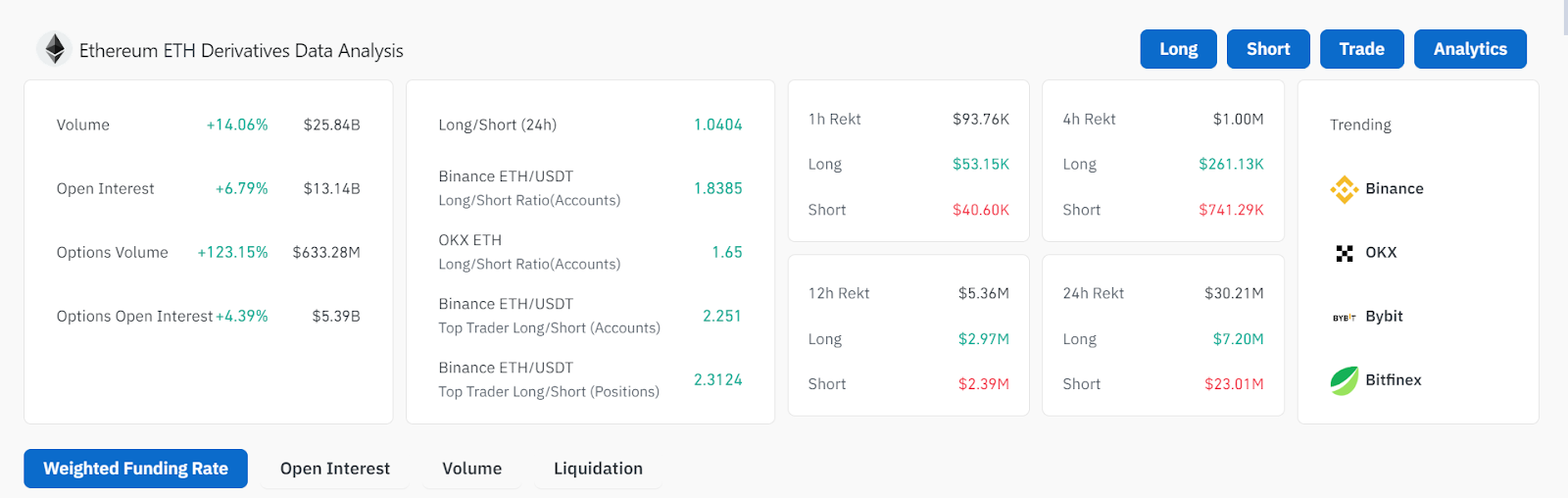

Source: Coinglass

Source: Coinglass

Traders are especially bullish, as shown by long/short ratios on major exchanges like Binance (1.8385) and OKX (1.65), with Binance’s top traders leading the way. Liquidation data indicates heightened market volatility, with $30.21 million liquidated in the past day, primarily from short positions ($23.01 million). This short squeeze suggests that traders betting against Ethereum were forced to close their positions, driving the upward price movement.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.