Significant Outflows Hit Grayscale Ethereum Trust Amid Mixed ETF Performance

On August 2, U.S. spot Ether ETFs experienced notable financial shifts.

The Grayscale Ethereum Trust (ETHE) recorded a significant outflow of $2.1 billion, contributing to a total net outflow of over $54 million from all spot Ethereum ETFs that day, according to SoSoValue data.

ETHE, which has offered Ethereum exposure without direct cryptocurrency purchase since 2017, saw a single-day net outflow exceeding $61 million. Despite ETHE’s substantial withdrawals, the Grayscale Ethereum Mini Trust ETF (ETH) remained stable with no outflows and a net inflow of $201 million.

In contrast, the Fidelity Ethereum Fund (FETH) saw the highest net inflows on August 2, with an addition of over $6 million, bringing its total to $297 million. Similarly, the Franklin Ethereum ETF (EZET) reported a positive inflow of over $1 million, totaling $30.6 million in net inflows.

READ MORE:

Genesis Completes Restructuring, Begins $4 Billion Payout to CreditorsAs of August 3, the combined net asset value of spot Ether ETFs was $8.3 billion, with a net asset ratio of 2.29%. Since their introduction on July 23, these ETFs have experienced cumulative net outflows of $511 million. However, on August 1, spot Ether ETFs collectively posted a positive net inflow of $26.7 million, led by BlackRock’s iShares Ethereum Trust (ETHA) with $89.6 million.

ETH was trading at $2,987 at the time, down approximately 5.71% since the ETFs’ launch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Price Today (April 22, 2025): Bitcoin Eyes $90k, XRP & SOL Lag while LEO Token Drops 6%

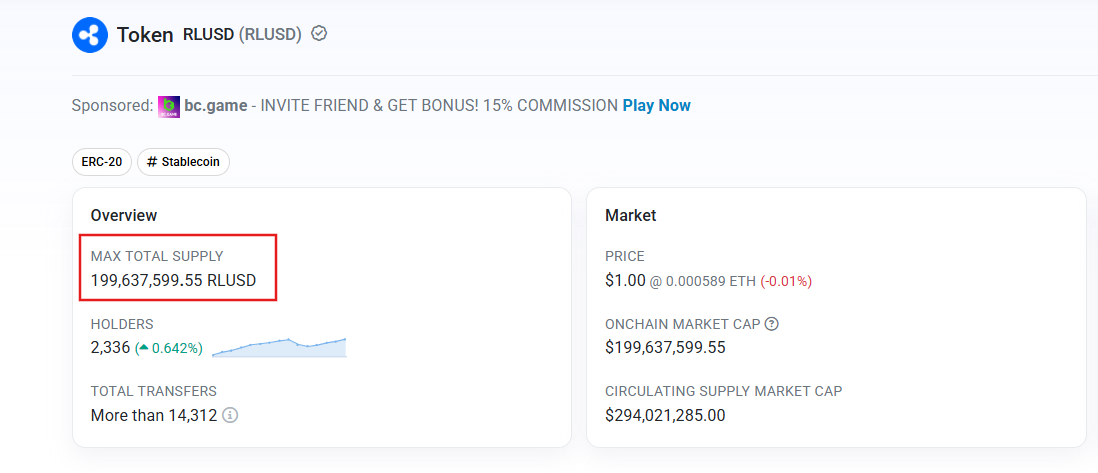

Nearly 70% Supply of Ripple’s RLUSD Stablecoin is on Ethereum

Bitcoin MACD Bullish Crossover Confirmed, Analyst Expects Significant Wave Up for BTC Price

XRP Network Activity Jumped by 67.50% as Bull Signals Suggest a Bullish Wave Leading to a Pump of Over 3.84X