News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 14) | U.S. grants reciprocal tariff exemptions on selected goods, Michael Saylor shares new Bitcoin Tracker update2Bitcoin Price Hits $83K as Stagflation Fears Drive Investors Toward Inflation-Proof Assets: What’s Next?3Sei (SEI) Holds Strong at Key Support — Is a Bullish Rebound on the Horizon?

Bitget Research: Bitcoin Continues to Rise Breaking $66,000, Memecoin Sector Demonstrates Significant Wealth Creation Effect

Bitget Research·2024/07/17 07:21

FET, RNDR, STX Technical Analysis: Bitcoin Pairings & Key Levels

Coinedition·2024/07/17 07:10

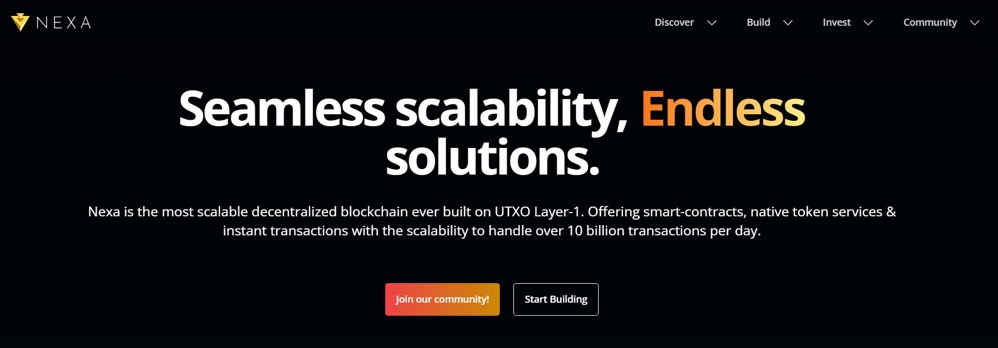

Nexa (NEXA): Scalable Layer1 blockchain under fair startup principles

远山洞见·2024/07/17 06:03

Donald Trump and Web3: The Fourth NFT Is Coming, Crypto Donations Reach $3 Million

BeInCrypto·2024/07/17 03:43

Cypherpunk Holdings ‘significantly’ ups its Solana holdings

Cypherpunk Holdings “significantly” increased its solana holdings, the company disclosed Tuesday.It now holds 63,000 SOL worth around $14 million — up from its initial $1 million investment.The firm is also running its own Solana validator and staking a majority of its tokens using its own node.

The Block·2024/07/16 22:37

Toncoin (TON) Whales Increase Holdings Despite Price Stagnation

BeInCrypto·2024/07/16 21:56

Best Crypto to Buy Now July 16 – Pepe, MANTRA, Floki

Cryptonews·2024/07/16 21:43

US Spot Bitcoin ETFs See $300.9M Inflows Amid Price Rebound

Newscrypto·2024/07/16 20:37

LI.FI loses estimated $9 million in exploit

Quick Take Cross-chain blockchain protocol LI.FI has lost around $9 million in an exploit, security firms say. The team has asked users to avoid the protocol and revoke permissions. Security firm Peckshield alleges a similar attack affected LI.FI in 2022.

The Block·2024/07/16 14:34

Flash

- 11:08Google will implement new cryptocurrency advertising regulations under the MiCA framework in Europe starting April 23rdAccording to Cointelegraph, Google announced that it will begin implementing stricter cryptocurrency advertising policies in Europe on April 23rd. Cryptocurrency exchanges and wallet service providers must obtain permissions under the EU's "Markets in Crypto-Assets Regulation" (MiCA) or the regulatory framework of Crypto Asset Service Providers (CASP). This policy will apply to 26 European countries including Germany, France, Italy etc., and violators will receive a warning at least 7 days before their accounts are suspended.

- 11:07CoinShares: Last week, net outflows from digital asset investment products amounted to $795 millionAccording to the latest weekly report from CoinShares, as of the week ending April 12, 2025, net outflows from digital asset investment products reached $795 million, marking three consecutive weeks of capital outflow. This brings the total outflow since early February to $7.2 billion, nearly erasing all net inflows for the year. Bitcoin led the outflows at $751 million but still maintains a net inflow of $545 million year-to-date. Ethereum saw an outflow of $37.6 million. In contrast, XRP recorded an inflow of $3.5 million, while Ondo, Algorand, and Avalanche each experienced slight net inflows. After Trump temporarily withdrew tariffs, prices rebounded and total assets under management rose to $130 billion.

- 11:04Matrixport: Bitcoin implied volatility rises, and mixed tariff signals increase market uncertaintyPANews, April 14 - According to Matrixport analysis, although the major tariff events have passed, the chaotic messages from Trump regarding tariffs have created market uncertainty, and Bitcoin's implied volatility remains high. The current implied volatility is nearly 20 points higher than recent lows, indicating that the market is pricing in uncertainty. Bitcoin traders need to respond cautiously in an environment of rising risks.