News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Share link:In this post: SUI open interest continued to grow above $256M. The Sui network is highly active, with more than 400K reported daily wallet interactions. Sui is a VC-backed project, with 75% of the tokens still locked and waiting to enter the market.

Telegram-based Hamster Kombat said it has turned down multiple VC offers and has no external investors. The Web3 game claims it rejected VC offers to protect its players from becoming exit liquidity. Still no information on when the HMSTR airdrop will happen.

Grayscale’s two spot Ethereum ETFs posted no flows on Monday.

Share link:In this post: Ethereum (ETH) increased its inflation to 0.67% as network usage slows down. An additional 57,000 ETH increased the supply in the past month. L2 have a mixed effect on Ethereum, by taking away some of the traffic, but raising demand for blob payments.

The U.S. Producer Price Index (PPI) only went up by 0.1% in July, showing that inflation is slowing down more than expected. Investors are watching the Fed closely, wondering if they’ll cut interest rates in September as inflation cools off. Major stock indices and Ethereum prices are on the rise, with ETH seeing big inflows into spot ETFs.

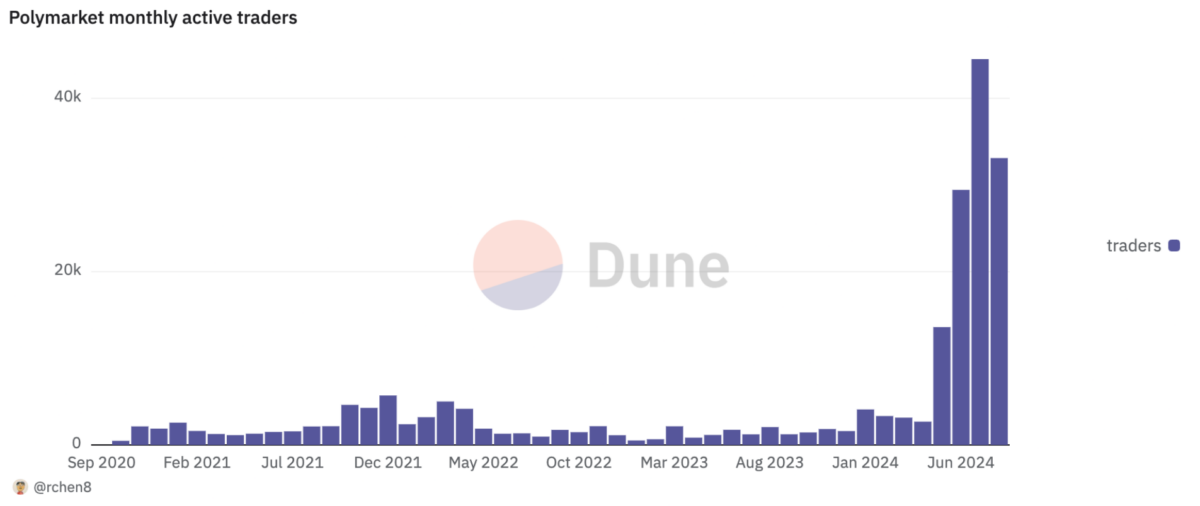

Share link:In this post: Polymarket and Perplexity are partnering to integrate advanced news summarization. The collaboration will enhance user engagement with features like customizable pages. Polymarket is seeing record growth due to interest in the US presidential election.

- 09:58Meteora Faces Class Action Lawsuit, Accused of Insiders Controlling 95% Supply in M3M3 Token IssuanceAccording to Cointelegraph, the decentralized exchange platform Meteora within the Solana ecosystem is facing a class action lawsuit. The lawsuit accuses it of causing investors a loss of $69 million through the M3M3 token issuance, with insiders controlling 95% of the token supply. This case is similar to the previous LIBRA token scandal involving the same parties.

- 09:57Strategy's Bitcoin Holdings Currently Show a Floating Profit of Approximately $141 BillionAt the current price of $94,026.1 per Bitcoin, Strategy's (formerly MicroStrategy) Bitcoin holdings show a floating profit of approximately $141 billion. As of April 21, 2025, Strategy holds a total of 538,200 Bitcoins, with a total purchase cost of approximately $36.47 billion and an average price of around $67,766 per Bitcoin. Previously, in December of last year, Strategy's Bitcoin holdings (then at 439,000 BTC) showed a floating profit of over $19.6 billion when the price of Bitcoin was about $106,000.

- 09:57A whale borrowed 10.20 million USDT through a loop loan to buy 109.2 WBTCAccording to on-chain analyst Ember's monitoring, a whale borrowed 10.20 million USDT from Aave through a loop loan 8 hours ago to purchase 109.2 WBTC at a price of 93,331 USD. He now holds a total of 256.2 WBTC (24.12 million USD), with an average cost of 87,162 USD. However, the health rate of this leveraged long BTC position is relatively low, at only 1.14. The corresponding liquidation price is at 82,457 USD.