News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.24)|New US SEC Chairman Supports Crypto, Top $TRUMP Holders to Dine with Trump2Ethereum (ETH) Price Jumps Over 10%: Can It Keep Rising?3Publicly Traded Company Initiates $5 Billion 'Buy Buy Buy' Mode, SOL Becomes MicroStrategy's Next BTC

Solana TPS "Fake"?

Solana is 6.5x misleading, while ADA is 26.5x misleading.

BlockBeats·2024/08/19 08:13

Next Cryptocurrency to Explode Sunday, August 18 — Klaytn, SuperRare, Lido DAO, GALA

Insidebitcoin·2024/08/19 08:10

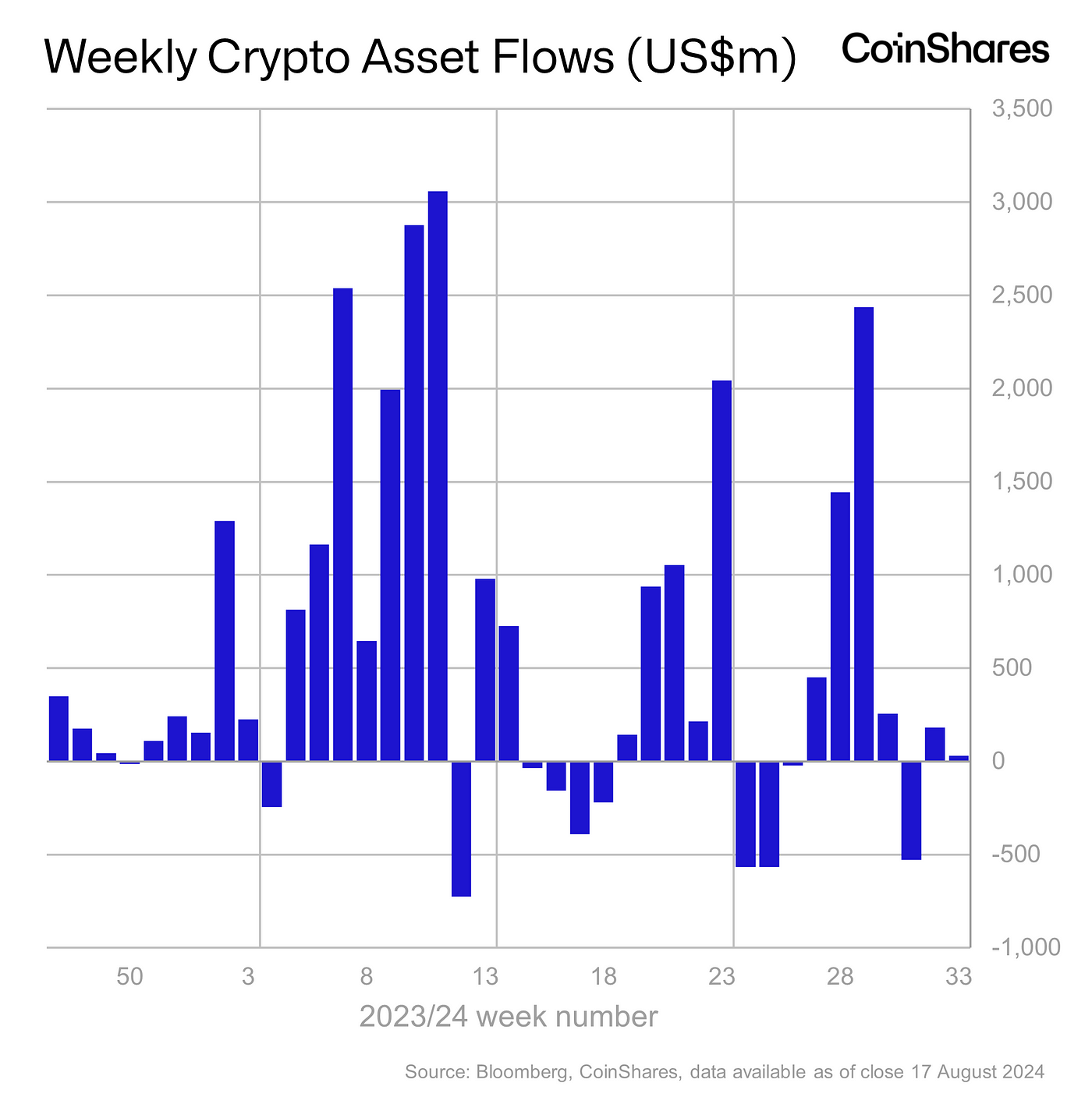

Volume 196: Digital Asset Fund Flows Weekly Report

Cointime·2024/08/19 08:06

Best Cryptocurrencies to Invest in Right Now August 18 – Pyth Network, Optimism, Hedera

Insidebitcoin·2024/08/19 06:58

Stablecoin market sees $2.21 billion growth driven by Tether and PYUSD

Grafa·2024/08/19 06:45

Bitcoin hashrate surges as miners face losses and increased selling

Grafa·2024/08/19 06:45

75% of circulating Bitcoin hasn't been moved for six months: Glassnode

Cryptobriefing·2024/08/19 06:03

Ethereum ETFs Set to Challenge Bitcoin Dominance, Claims VC Expert

Cryptodnes·2024/08/18 18:06

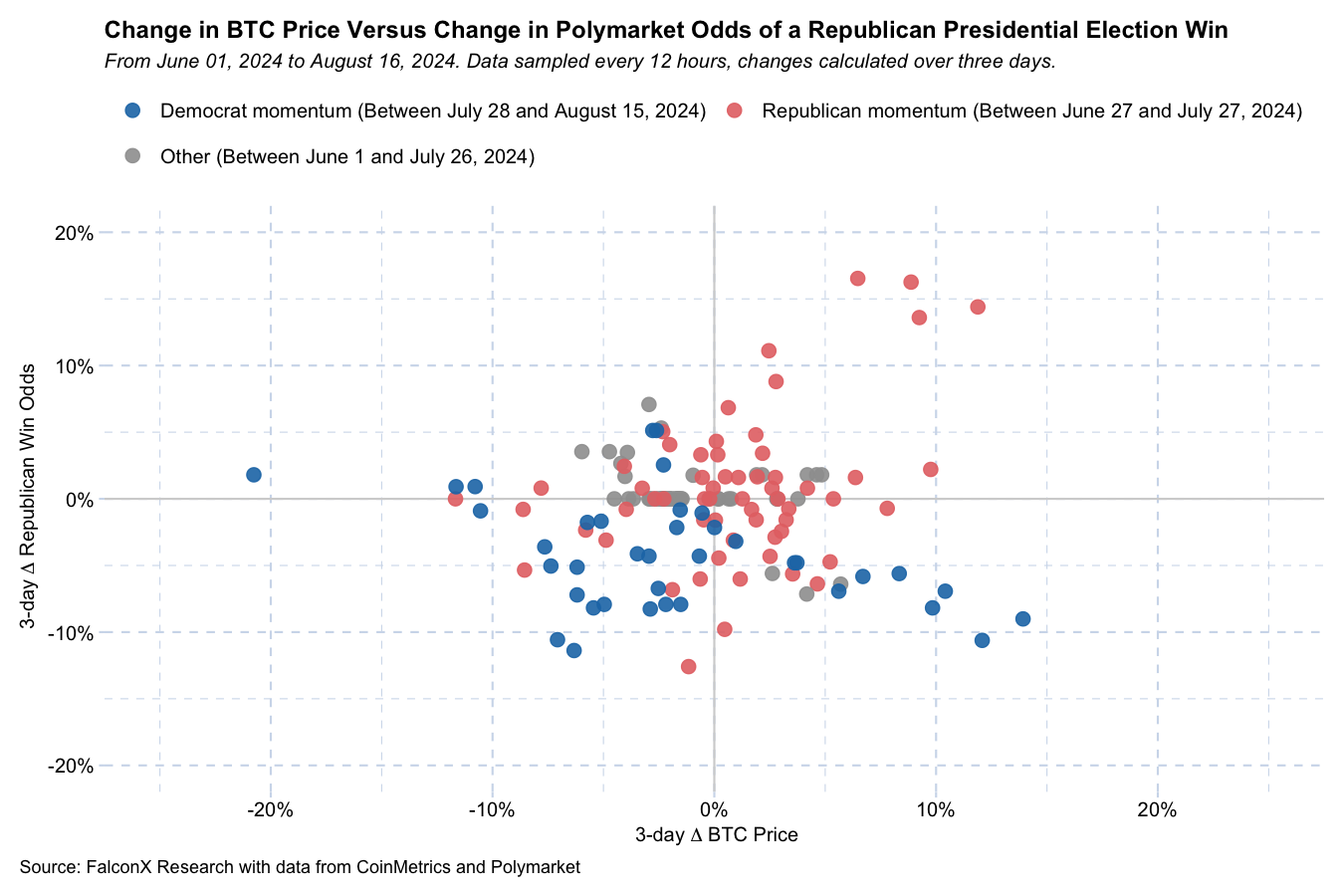

Bitcoin’s price actions and the U.S. election have NO connection whatsoever

Share link:In this post: Trump’s making passive income from NFTs and memecoins, but the big money from NFTs is drying up. His crypto wallets are pulling in tens of thousands of dollars each month without him having to do anything. Despite the hype, there’s no solid connection between Trump’s election odds and Bitcoin’s price.

Cryptopolitan·2024/08/18 16:00

Flash

- 14:30Trader Eugene: Aggressively Going Long and Watching for Mainstream Altcoins to Reprice and Surge AgainTrader Eugene stated on his personal channel: “I am currently 'aggressively' going long, and soon I will know if I'm right or wrong. This consolidation phase typically sees significant upward or downward swings in a relatively short period. I am also watching to see if mainstream altcoins will reprice with a 10%-20% surge.”

- 14:30BTC Surpasses $93,000The market data shows that BTC has surpassed $93,000 and is currently priced at $93,022.69. The 24-hour decline is 0.08%. The market is experiencing significant fluctuations, so please ensure proper risk management.

- 14:29The U.S. SEC Meets with Ondo Finance to Explore Compliance Paths for Issuing Tokenized SecuritiesAccording to the meeting memorandum released on April 24 by the U.S. Securities and Exchange Commission (SEC) Crypto Asset Special Working Group, representatives from Ondo Finance and Davis Polk & Wardwell LLP held a meeting with the SEC's crypto working group to discuss compliance paths for the issuance and sale of tokenized U.S. securities. The meeting topics included structural models for tokenized securities, registration and broker-dealer requirements, market structure regulations, financial crime compliance, and state corporate laws. Ondo Finance proposed seeking a regulatory sandbox or other forms of regulatory exemptions to advance the issuance of its tokenized asset products. The meeting aimed to provide a clear regulatory framework for tokenized securities in the U.S. market.