News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.25) | Trump Considers Tiered Tariff Plan for China, Federal Reserve Eases Crypto Regulation2ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand3US spot bitcoin ETFs log $442 million in net inflows as BTC price shows resilience

Liberation Day for Bitcoin Price – Is $100k Within Reach?

CryptoNews·2025/04/06 00:00

Pi Network (PI) Bounces Off Key Support – Is a Breakout Ahead?

CoinsProbe·2025/04/05 23:44

FARTCOIN’s Chart Resembles Textbook Bull Flag – Breakout or Consolidation?

CoinsProbe·2025/04/05 23:44

Is Ethena (ENA) in the Final Accumulation Zone Before a Reversal? This Fractal Says Yes!

CoinsProbe·2025/04/05 23:44

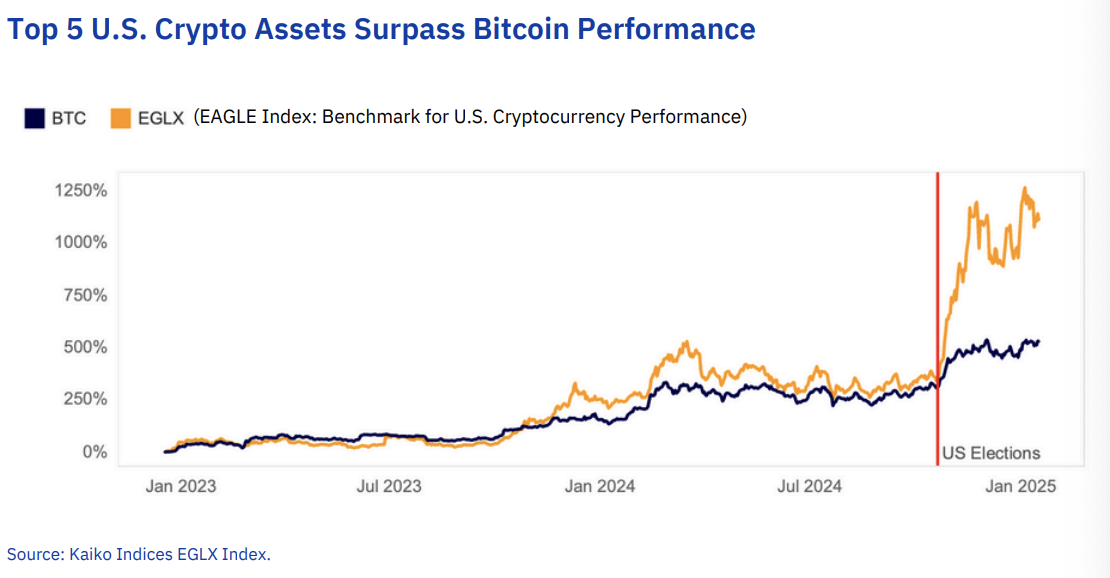

Altcoin volumes are ‘more concentrated’ than ever

Altcoin trade volume has returned to pre-FTX levels, but with a shrinking pool of market leaders

Blockworks·2025/04/05 18:57

Urgent Alert: Bitcoin ETF Outflows Hit $64.88M – Is This a Market Shift?

BitcoinWorld·2025/04/05 17:00

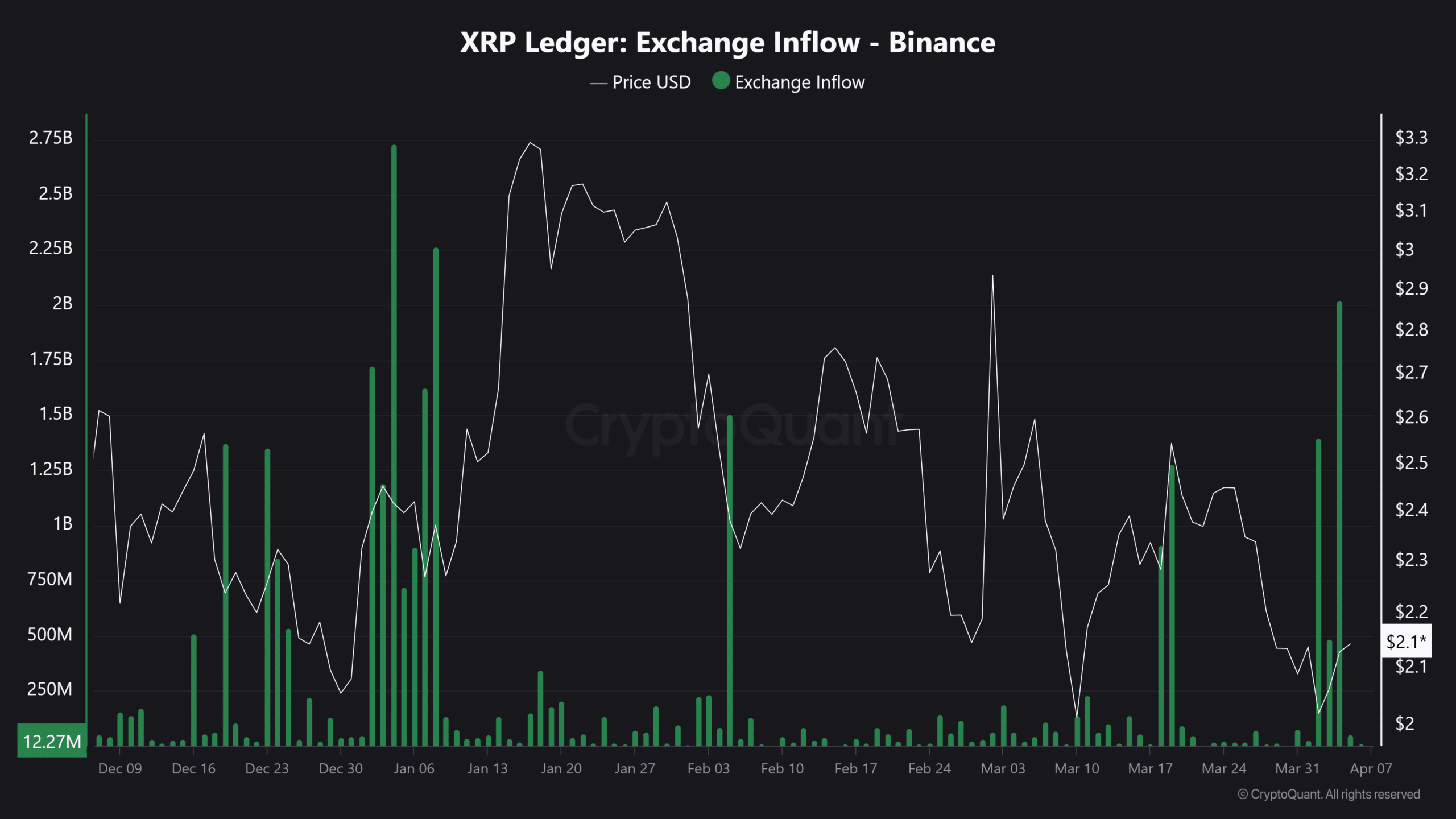

Bitcoin’s Market Sentiment: Slowing Tether Reserves and Trade Wars Indicate Possible Bearish Trends

Coinotag·2025/04/05 16:00

The Funding: Why stablecoins are a top bet for crypto VCs

Quick Take This is an excerpt from the 25th edition of The Funding sent to our subscribers on April 6. The Funding is a fortnightly newsletter written by Yogita Khatri, The Block’s longest-serving editorial member. To subscribe to the free newsletter, click here.

The Block·2025/04/05 16:00

Flash

- 21:55Citi estimates stablecoins will drive widespread blockchain adoption, reaching a $3.7 trillion marketCiti predicts that 2025 could become a turning point for blockchain adoption, primarily due to the development of stablecoins. The report indicates that the stablecoin market size is expected to grow from the current $230 billion to between $1.6 trillion and $3.7 trillion by 2030. This growth is largely attributed to the United States' proactive regulation of digital assets and a stable market environment, which will facilitate their further integration into the financial system, increase payment speed, enhance transparency, and optimize asset settlement. Additionally, stablecoin issuers are expected to become major buyers of U.S. Treasury bonds, with holdings projected to reach $1.2 trillion, potentially surpassing all foreign sovereign holders. However, the report also highlights risks, such as stablecoins de-pegging nearly 1,900 times in 2023, with large-scale redemptions under extreme circumstances potentially disrupting the liquidity of the crypto market and impacting financial markets.

- 21:54U.S. Judge Blocks Trump's Attempt to Abolish Federal Employees' Collective Bargaining RightsA U.S. federal judge has temporarily blocked Trump's attempt to abolish federal employees' collective bargaining rights. The National Treasury Employees Union stated that Trump's executive order to revoke collective bargaining agreements for federal departments relieved more than a dozen federal agencies of the obligation to negotiate with unions, violating federal employees' labor rights and the United States Constitution.

- 21:54SOL Falls Below 150 USDTMarket data shows that SOL has fallen below 150 USDT, currently reported at 149.99 USDT, with a 24-hour drop of 0.4%.