News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

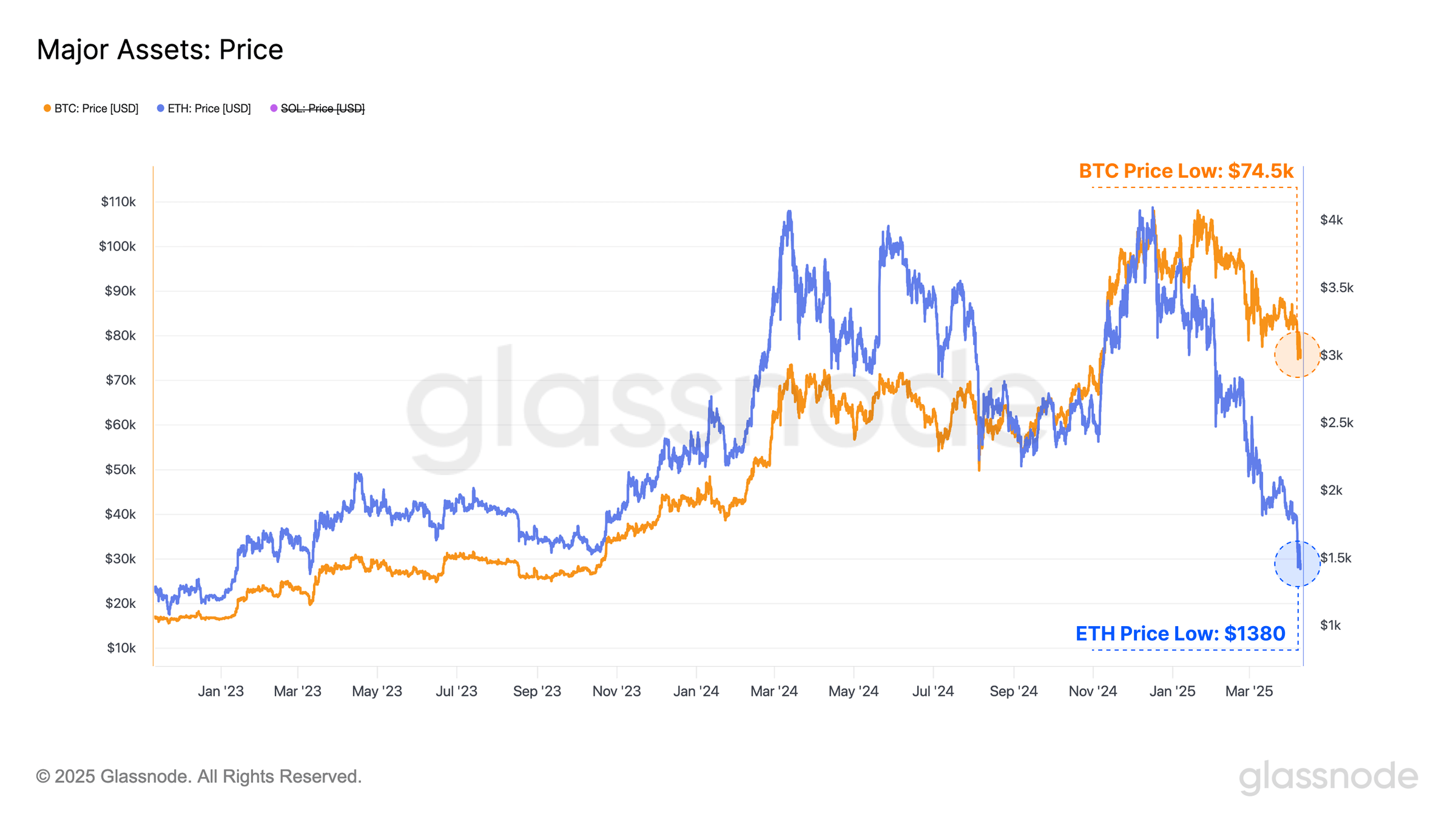

An analyst compares Ethereum to Nokia, suggesting it may lose relevance as Solana outperforms in scalability and user experience. While Ethereum maintains dominance in DEX volume, it must accelerate its development to avoid being overtaken.

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

Over $2.5 billion in Bitcoin and Ethereum options expire today, with analysts anticipating market volatility due to fading call premiums and global uncertainty. Traders are eyeing these expirations for clues on short-term price direction.

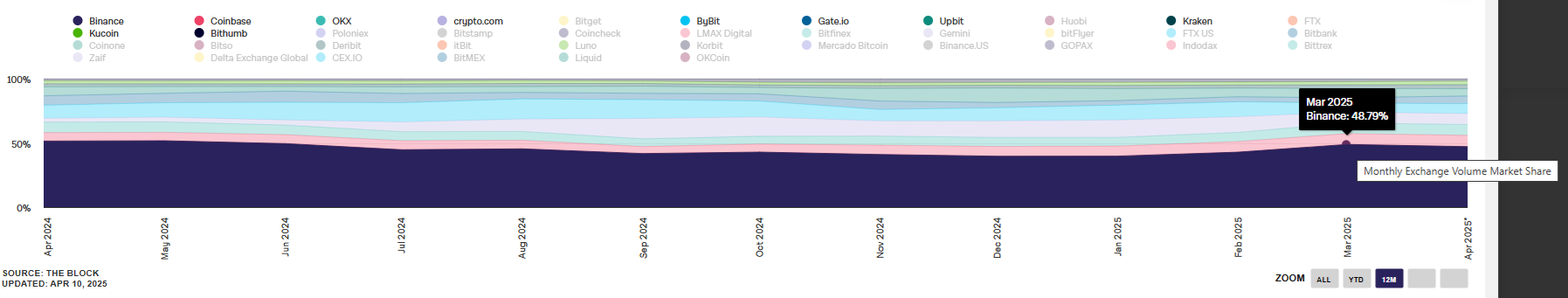

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.

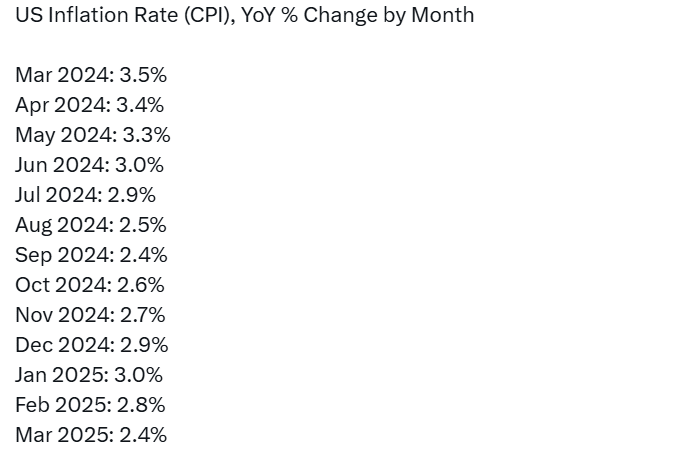

- 14:00U.S. March JOLTs Job Openings 7.192 millionU.S. March JOLTs Job Openings 7.192 million, expected 7.48 million, previous value revised from 7.568 million to 7.48 million.

- 11:58Scroll Co-Founder: Scroll Becomes the First zk-Rollup to Reach Stage 1Scroll co-founder Ye Zhang tweeted that Scroll achieved a critical upgrade with the Euclid update, becoming the first zk-Rollup to reach Stage 1. This ensures that users have sufficient time to exit before system changes, supports Layer 1 forced transaction submission, and allows the network to automatically open if the sequencer or provers go down, ensuring system activity.

- 11:52Strategy's Bitcoin Holdings Currently Have Unrealized Profits Exceeding $14.839 BillionAs Bitcoin rises above $95,000, currently priced at $95,266, Strategy (formerly MicroStrategy) has unrealized profits of $14.839 billion from its Bitcoin holdings. As of April 27, 2025, Strategy holds 553,555 BTC, having spent $37.9 billion with an average holding price of $68,459.