News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.25) | Trump Considers Tiered Tariff Plan for China, Federal Reserve Eases Crypto Regulation2ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand3US spot bitcoin ETFs log $442 million in net inflows as BTC price shows resilience

Ethereum’s $43 Billion Volume Powers Price Surge Past $3,600 — Altcoin Season Nears

Ethereum’s price surge past $3,600 is supported by massive trading volume and strong market demand. Despite some profit-taking, bullish indicators suggest a potential climb toward $4,000.

BeInCrypto·2024/11/28 05:00

5 DePIN Altcoins to Watch in December 2024

From Filecoin’s steady gains to Arweave’s bullish reversal, these DePIN altcoins could be December’s top crypto picks. Will they sustain momentum?

BeInCrypto·2024/11/28 04:00

Shiba Inu could rally 50% with key resistance break

Grafa·2024/11/28 03:21

Dogecoin reaches $57.8B market cap

Grafa·2024/11/28 03:21

Bitcoin could reach $132K in 2025 on rising money supply

Grafa·2024/11/28 03:21

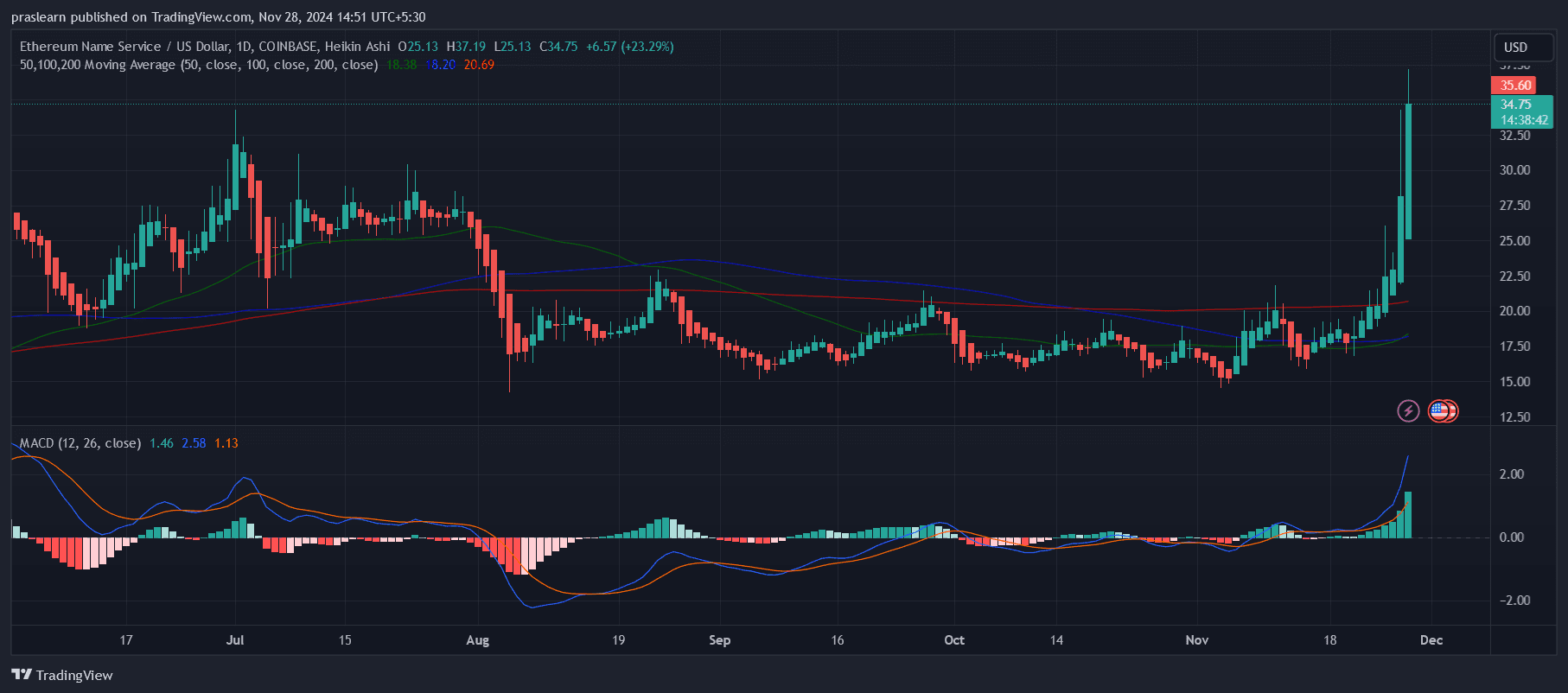

Ethereum Name Service (ENS) Soars to New Yearly High of $37.29, Leads Top 100 Gainers

Ethereum Name Service (ENS) leads the crypto rally, reaching a new yearly high amid a surge in trading volume and open interest. However, its overbought RSI indicates potential for a price pullback.

BeInCrypto·2024/11/28 03:00

Why is Ethereum Name Service (ENS) Price UP?

Cryptoticker·2024/11/28 01:47

XLM, UNI and AAVE gain double-digits as BTC reclaims $94k

Coinjournal·2024/11/27 21:55

Flash

- 17:58Trump: We Will Remain Rational on Tariff Issues, Believing the Market is Adapting to Tariff PoliciesU.S. President Trump stated that we will remain rational on tariff issues, believing the market is adapting to tariff policies. (Jinshi)

- 17:42Bitcoin ETF Records Largest Weekly Inflow Since Trump's Inauguration, Institutions Drive ReboundSantiment data shows that as Bitcoin rebounds to a high of $95,800 today, BTC ETF is experiencing the largest weekly inflow since Trump's inauguration. Institutions, including BlackRock, have driven a strong rebound across the entire crypto market.

- 17:41Nasdaq Informs US SEC: Precise Cryptocurrency Labels will be Key to Future RegulationThe Nasdaq exchange has written to the US SEC's cryptocurrency task force, advising regulators to carefully categorize digital assets and clearly identify regulatory "referees." The document, signed by Chief Regulatory Officer John Zecca, proposes four classifications: the first is financial securities tokens (such as tokens tied to stocks, bonds, and ETFs, which should be treated equivalently to the underlying assets) under SEC regulation; the second is digital asset investment contracts (tokenized contracts that meet the revised Howey test) subject to securities rules; the third is digital asset commodities (meeting the US definition of commodities) under CFTC jurisdiction; and the fourth is other digital assets (which do not fit into the previous three categories and are not mandatorily subject to securities or commodities rules). The SEC and CFTC will collaborate to clarify regulatory boundaries, and new cryptocurrency laws could serve as guiding principles. Nasdaq also recommends establishing cross-trading qualifications for platforms handling multiple asset types and emphasizes its credibility in the digital asset field, calling for enhanced security constraints for companies comprehensively handling investor activities, aligning with industry practices.