News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Bitcoin Funding Rate Turns Positive Amid Long Position Dominance, Potential Long Squeeze Looms3Ethereum’s Bearish Breakdown: Will $1,400 Support Hold or Will ETH Drop Further?

How Many Bitcoins Can The U.S. Government Actually Buy?

Cointribune·2025/04/15 22:44

Expert Says XRP Case Win Won’t Guarantee Price Surge—Here’s Why

CryptoNewsFlash·2025/04/15 22:22

FIL Price Forecast: Explosive Growth Likely After Filecoin (FIL) v1.32.2 Upgrade

CryptoNewsFlash·2025/04/15 22:22

EURC Hits New Record as Demand Grows Across Blockchains

CryptoNewsFlash·2025/04/15 22:22

SEC Pushes Back WisdomTree Bitcoin ETF Verdict to June

CryptoNewsFlash·2025/04/15 22:22

Second Day of BTC ETF Inflows Hints at Confidence Amid Volatility | ETF News

BTC ETFs experienced notable inflows, including BlackRock’s IBIT, signaling institutional optimism. Despite market setbacks, futures traders maintain a bullish outlook.

BeInCrypto·2025/04/15 22:21

XRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

Newsbtc·2025/04/15 20:55

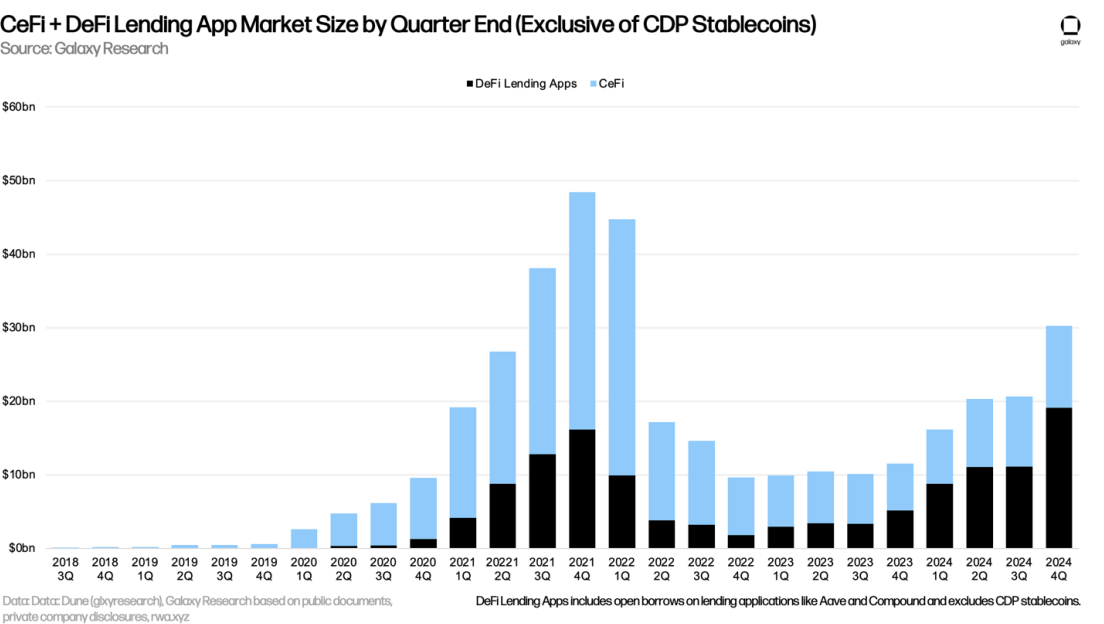

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

Blockworks·2025/04/15 17:23

Ardor (ARDR) Price Skyrockets 100% as Bulls Break Key Resistance

Newscrypto·2025/04/15 16:00

29% Jump for MANTRA, What Is Fueling the Rally?

Newscrypto·2025/04/15 16:00

Flash

- 10:01DWF Labs Announces Becoming Market Maker for JST TokenAccording to official news, DWF Labs has announced a collaboration with JUST DAO to invigorate the JST market. As a market maker for JST, DWF Labs will aid in the comprehensive upgrade of the JUST ecosystem.

- 09:20Circle Receives In-Principle Approval from Abu Dhabi Regulator to Operate as a Money Services ProviderApril 29 news, according to TheBlock, the Financial Services Regulatory Authority of Abu Dhabi Global Market (ADGM) has granted in-principle approval to stablecoin issuer Circle, allowing it to operate as a money services provider. This move follows Circle's establishment of a new legal entity within ADGM in December 2024, aimed at expanding its global business presence in the Middle East and Africa regions.

- 09:20Standard Chartered: Three Reasons BTC May Be in a New Rally and Hit New Highs This QuarterStandard Chartered analyst Geoff Kendrick has reiterated that despite Bitcoin's decline at the beginning of this year, three major reasons will drive Bitcoin into a new rally this quarter and reach new historical highs: 1. Economic turmoil increases Bitcoin's appeal, with the shift of funds among safe-haven assets already underway. Funds are moving from gold ETFs to Bitcoin ETFs, indicating that investors are starting to view Bitcoin as a better safe-haven asset than gold. 2. Buying behaviors triggered by tariffs show that "Bitcoin whales" (investors holding more than 1,000 bitcoins) have been accumulating Bitcoin during price drops caused by tariffs. 3. More catalysts are forming, such as the increased purchase by pension funds and sovereign wealth funds. Previously, Trump has highlighted that stablecoin legislation may be introduced this summer.