XRP Surges Towards Key Resistance Levels Amid Overbought Signals and Bullish Momentum Indicators

-

XRP’s remarkable price rally this week marks a significant milestone, bringing the altcoin back into the spotlight amidst recovering market sentiments.

-

The surge in XRP price is attributed to a combination of technical indicators showing strong bullish signs, captivating trader and investor attention.

-

“XRP’s price action suggests that it may soon test critical resistance levels as momentum builds,” stated a COINOTAG analyst.

XRP gains momentum, surging nearly 6% as it enters overbought territory, signaling potential for further gains in the crypto market.

XRP’s Remarkable Price Surge and Market Recovery

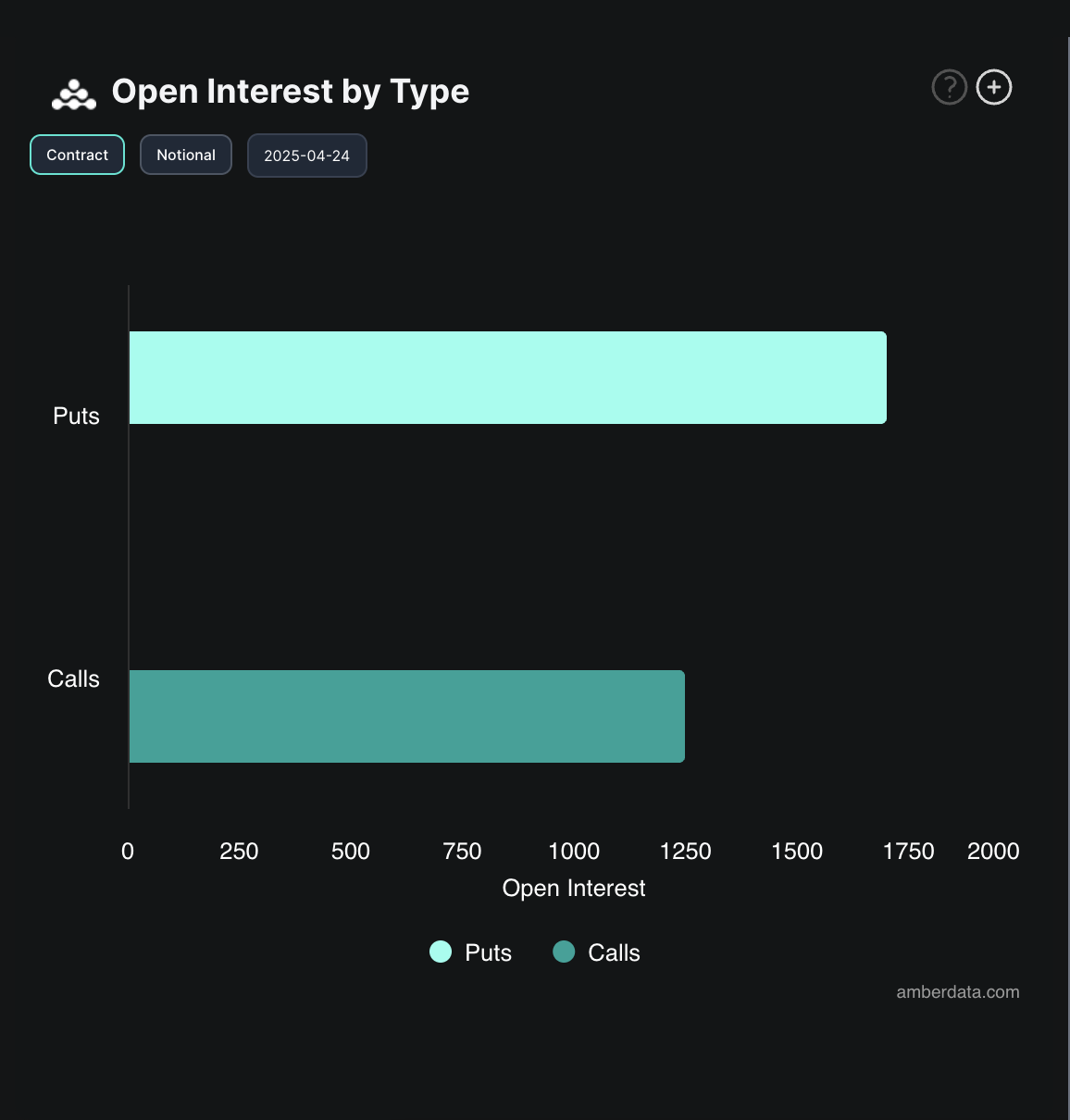

XRP has demonstrated substantial growth recently, increasing nearly 6% over the past week as it reclaims a market cap exceeding $130 billion for the first time in months. This resurgence is notably characterized by XRP’s Relative Strength Index (RSI), which has surged to 76.19, indicating that the asset is now in overbought territory following a prolonged period of consolidation.

Yesterday’s RSI reading of 51.4 illustrates a sharp uptick in buying momentum, indicating heightened interest from traders. The current RSI status suggests a critical juncture where XRP’s price action might slow down or reverse, contingent on broader market dynamics.

As XRP registers an RSI reading above 70, traders are on alert for potential profit-taking or market corrections. Historically, an overbought condition invites scrutiny over momentum sustainability, yet it can also pave the way for breakout scenarios if bolstered by substantial trading volume.

XRP RSI. Source: TradingView.

Technical Indicators Favoring a Bullish Trend

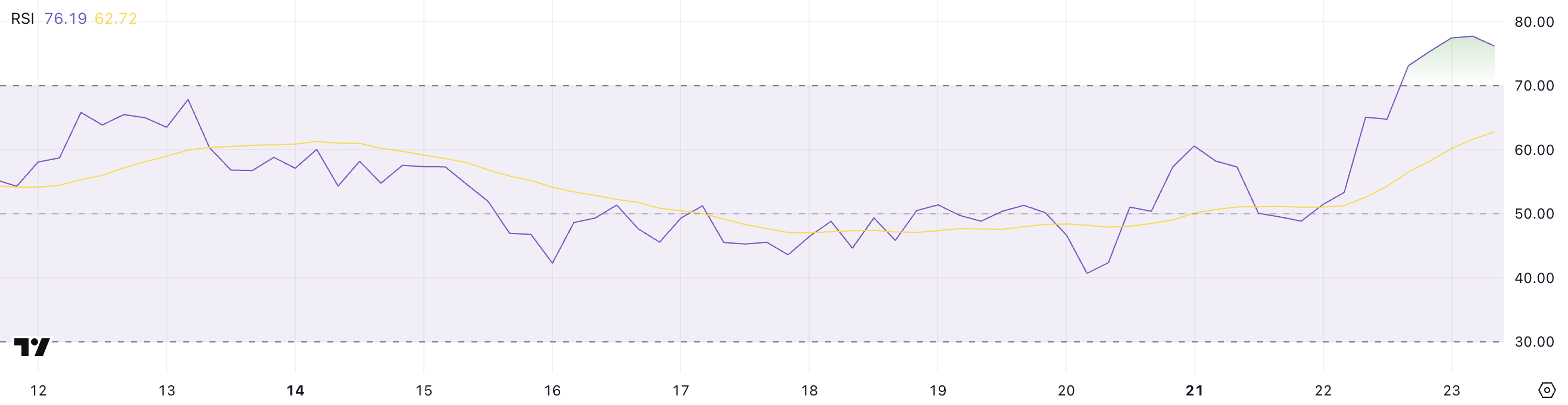

The technical framework for XRP remains supportive of a bullish outlook. The Ichimoku Cloud structure reveals a pronounced bullish configuration, with XRP consistently trading clear of the Kumo (cloud). This positioning not only underscores the prevailing momentum but also indicates the market’s favorable sentiment towards XRP.

The width of the cloud has notably diminished, implying that while bullish sentiment is present, it may not be as robust as before. However, XRP’s sustained position above the cloud continues to suggest a mildly optimistic short-term view.

Current indicators also highlight a positive crossover between the Tenkan-sen and Kijun-sen lines, adding further credence to the short-term bullish narrative. In this context, the Chikou Span, falling well above the cloud, reaffirms that past strength persists in supporting current market movements.

XRP Ichimoku Cloud. Source: TradingView.

Exponential Moving Averages Signal Possible Trend Reversal

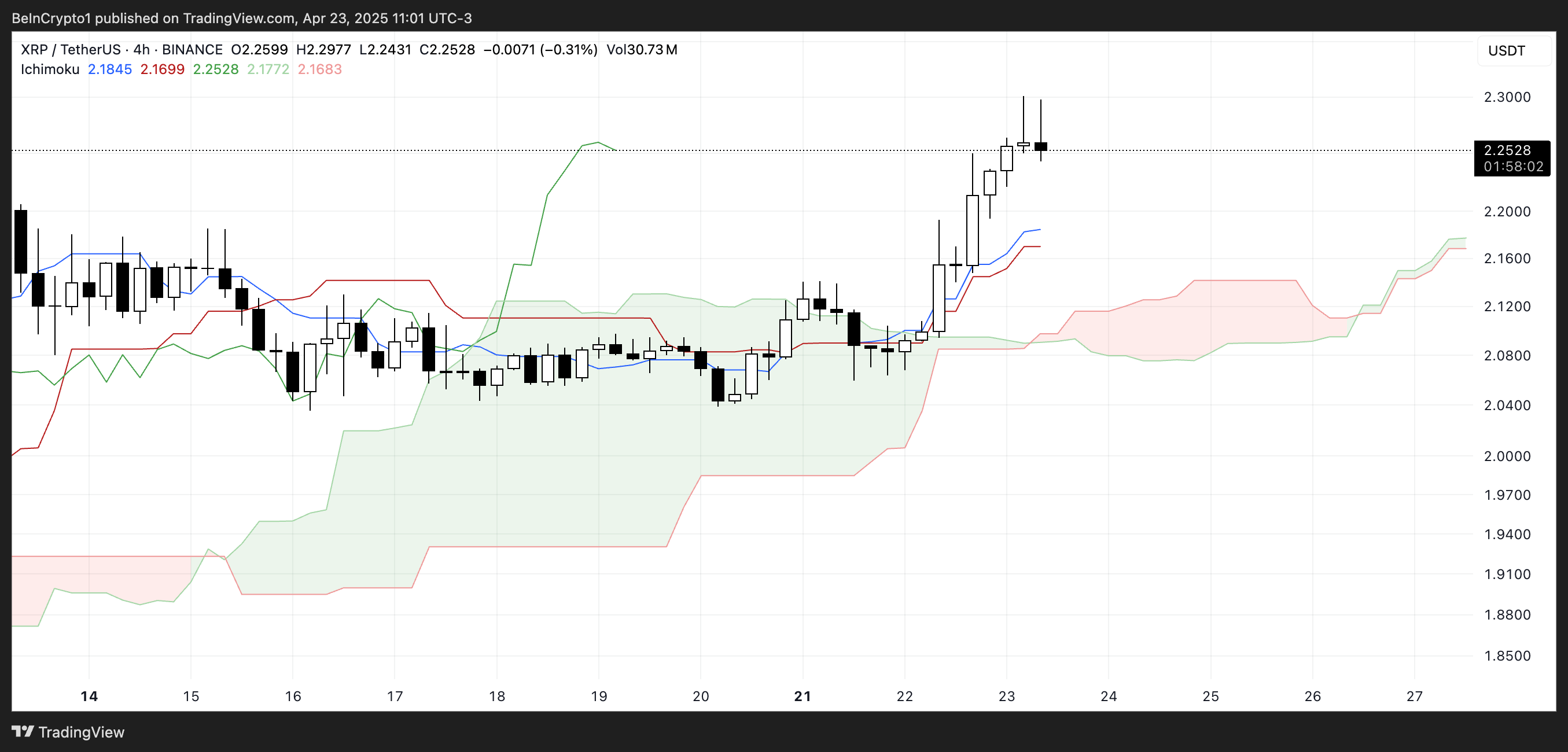

Recent trading activity is underscored by significant developments in XRP’s exponential moving average (EMA) configuration. The formation of consecutive golden crosses this week has instilled confidence among traders, indicative of a potentially strong uptrend emerging in the near future.

These golden crosses occur when short-term EMA values surpass their long-term counterparts, a bullish signal traditionally associated with significant upward price movements. Should this momentum persist, XRP may push towards key resistance levels at $2.50, $2.64, $2.74, and potentially $2.83.

XRP Price Analysis. Source: TradingView.

Looking Ahead: Potential Price Targets and Support Levels

As the bullish landscape unfolds, a broader market uptrend could see XRP reattain the $2.99 level, with aspirations of breaking through $3 for the first time in many months. However, caution is warranted as diminishing momentum may instigate a pullback towards the $2.18 support level. Loss of this critical support could lead to more pronounced corrections with lower targets set at $2.03 and even down to $1.61.

With such volatility and price action, traders are advised to closely monitor fluctuations and adjust strategies accordingly, maintaining a readiness for both bullish and bearish scenarios.

Conclusion

In summary, XRP’s recent bullish performance highlights a significant recovery phase, marked by critical technical signals including overbought RSI conditions, bullish Ichimoku Cloud patterns, and EMA golden crosses. For traders and investors, the landscape remains dynamic, necessitating vigilance as market conditions evolve. The next few weeks could be pivotal in defining XRP’s trajectory and confirming its place within a rebounding crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARC and VIRTUAL Show Potential for Rebound Amid Recovery in AI Crypto Sector

XRP Price Recovery Sparks Analysts’ Speculation on Double-Digit Targets Amid Rising Futures Interest

Twenty One Capital Seeks to Challenge Michael Saylor’s Strategy as a Leading Bitcoin Treasury Firm

Bitcoin ETF Inflows Continue, But Market Sentiment Shifts Towards Caution Amid Bearish Signals