XRP Price Recovery Sparks Analysts’ Speculation on Double-Digit Targets Amid Rising Futures Interest

-

XRP’s recent resurgence has sparked interest as its price climbs amid rising futures open interest, raising questions about potential future valuations.

-

The momentum seen in XRP is juxtaposed with a mixed sentiment in the derivatives market, as positive spot activity continues to unfold.

-

According to Sistine Research, the bullish outlook for XRP includes audacious long-term price targets that could redefine its market standing.

XRP’s price is recovering with forecasts suggesting potential double-digit prices, underpinned by rising open interest and bullish market indicators.

Analyzing XRP’s Price Movement and Market Sentiment

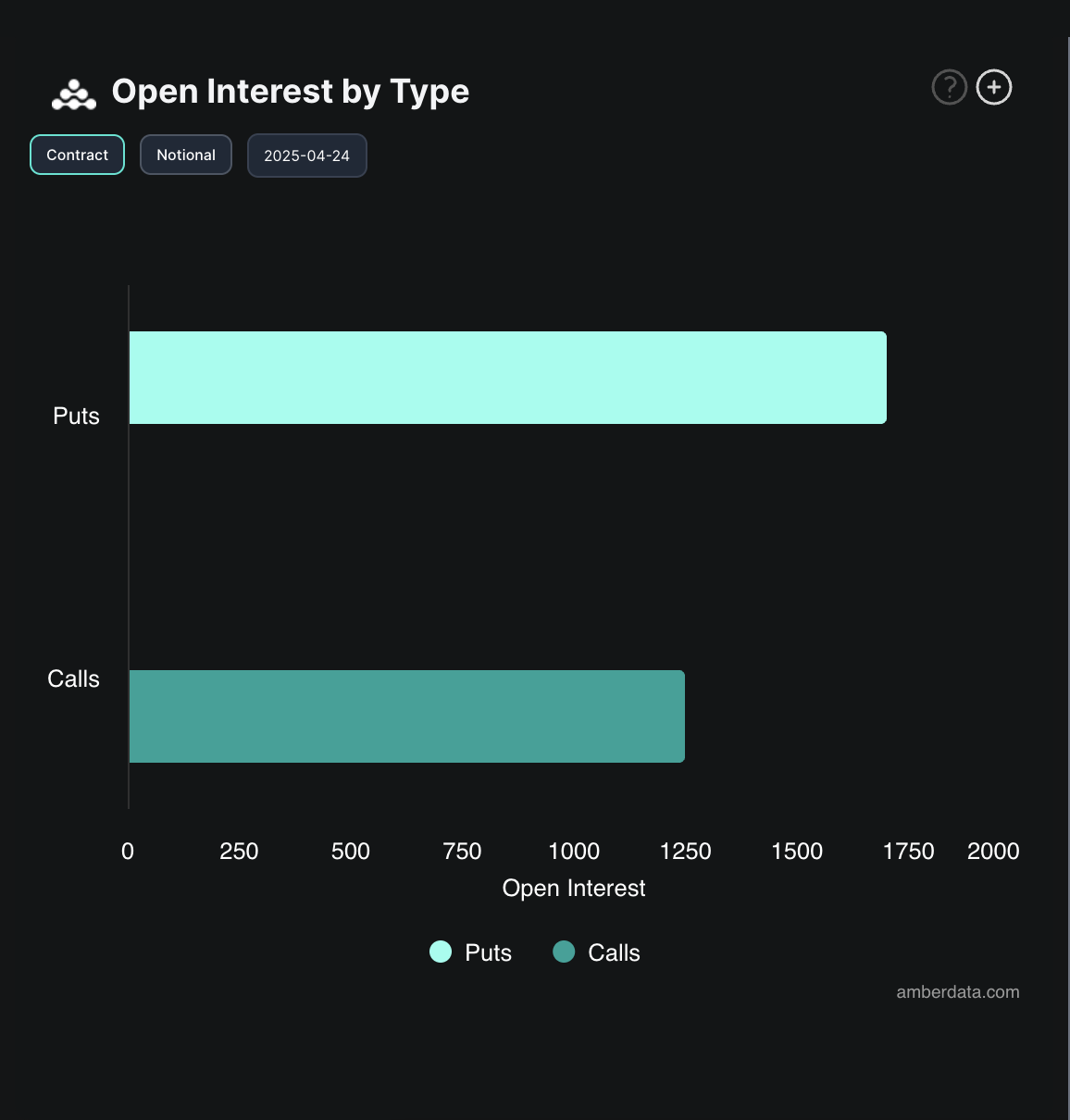

The recent **25% gain** in XRP’s price since April 7 correlates with a significant **32% rise in futures open interest**, which climbed from $3.14 billion to $4.13 billion in just a few days. This surge indicates a resurgence of interest from derivatives traders correspondingly aligned with the broader recovery in the crypto market. However, while rising open interest typically signals bullish sentiment, the underlying data from platforms such as Velo indicates a different narrative.

Futures Market Dynamics

Currently, the XRP futures market exhibits a mostly neutral funding rate, hovering near zero. This suggests an ongoing **tug-of-war** between bullish and bearish traders. The negative premium observed in aggregated open interest indicates that traders are predominantly prepared for a downward adjustment, despite recent price increases. Furthermore, even though the aggregated spot tape has recently shown increased buying pressure—marked by a positive volume delta from trading activities—the persistent bearish sentiment in the futures market remains a key deterrent in achieving sustained price escalation.

Spot Market vs. Futures Market: A Bipolar Outlook

The current dynamics in the crypto markets exemplify a classic battle between spot market activity and derivatives market expectations. With spot buy trades currently outpacing sell trades, the market sentiment for XRP appears optimistic. Traders should, however, be cautious, as indications from futures markets may suggest potential pullbacks or corrections in price activity. It is vital for investors to monitor both markets for comprehensive insights into potential price movements.

The Bullish Forecast: Is Double-Digit XRP Viable?

Recently, Sistine Research made headlines with their audacious long-term price targets for XRP, projecting a range between **$33** and **$50**, reflecting on patterns reminiscent of the 2017 bull run where such rapid gains were common. They further speculate that, should bullish sentiment continue to drive prices, targets could extend as far as **$77-$100**. The shift from a current valuation of **$2.23** to these predicted levels entails an astronomically higher market capitalization, surpassing that of Bitcoin, which presents both enticing prospects and realistic challenges for XRP’s future.

Technical Analysis Insights

From a technical analysis standpoint, XRP currently exhibits an **inverse head-and-shoulders pattern** on lower time frames, positioning it to potentially test resistance levels between **$2.50 and $2.67**. These pivotal levels coincide with Fibonacci extension levels drawn from historical price patterns, contributing to the likelihood of a breakout. Nonetheless, caution must be exercised, as the **relative strength index (RSI)** is nearing overbought territory, indicating that a potential price pause might be on the horizon, challenging bullish momentum.

Conclusion

In summary, while XRP is experiencing notable gains and rising open interest, the interplay between spot and futures markets paints a complex picture. Analysts’ ambitious price projections invite both excitement and skepticism, highlighting the volatile nature of cryptocurrency investing. Investors should remain vigilant, refining their strategies based on comprehensive market analysis and the evolving landscape of derivatives trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARC and VIRTUAL Show Potential for Rebound Amid Recovery in AI Crypto Sector

XRP Surges Towards Key Resistance Levels Amid Overbought Signals and Bullish Momentum Indicators

Twenty One Capital Seeks to Challenge Michael Saylor’s Strategy as a Leading Bitcoin Treasury Firm

Bitcoin ETF Inflows Continue, But Market Sentiment Shifts Towards Caution Amid Bearish Signals