Bitcoin ETF Inflows Continue, But Market Sentiment Shifts Towards Caution Amid Bearish Signals

-

Bitcoin ETFs have seen remarkable investor interest, with over $900 million in inflows recorded on Wednesday alone, reflecting growing market participation.

-

Despite these bullish inflows, key indicators such as BTC’s open interest and funding rates are trending negatively, indicating potential market corrections ahead.

-

A recent analysis from COINOTAG notes that the BTC options market has a put-to-call ratio of 1.36, reinforcing the bearish sentiment prevalent among traders.

This article delves into the recent dynamics of Bitcoin ETFs, investor sentiment, and market indicators, offering crucial insights for crypto enthusiasts and investors alike.

Bitcoin ETFs Maintain Strong Demand Amid Market Volatility

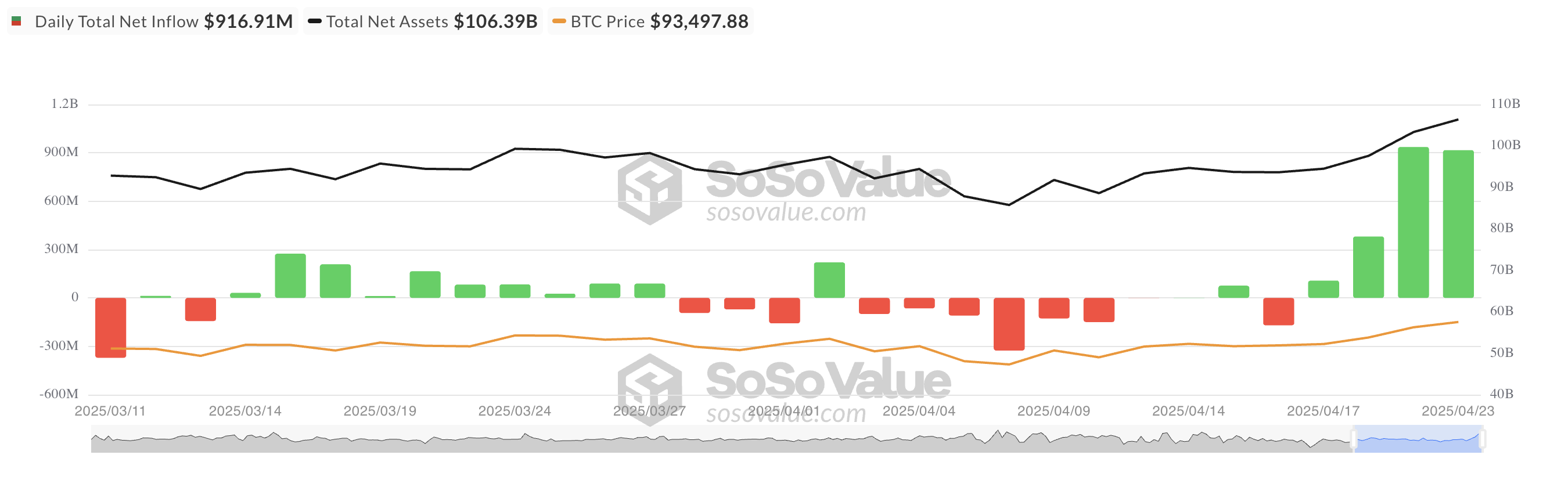

Bitcoin spot ETFs continue to be a significant draw for investors, with a remarkable $916.91 million in net inflows reported on Wednesday. This impressive figure underscores a robust institutional appetite for exposure to Bitcoin, particularly as the cryptocurrency strives to maintain its position above the critical $90,000 mark.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

On this record-setting day, BlackRock’s IBIT ETF dominated the inflow charts, garnering $643.16 million in new investments. This brings its total net inflows to a staggering $40.63 billion. Meanwhile, Ark Invest and 21Shares’ ARKB ETF maintained its competitive edge with a net inflow of $129.50 million, pushing its historical inflows to $3 billion.

Market Sentiment Shifts as Traders Reassess Positions

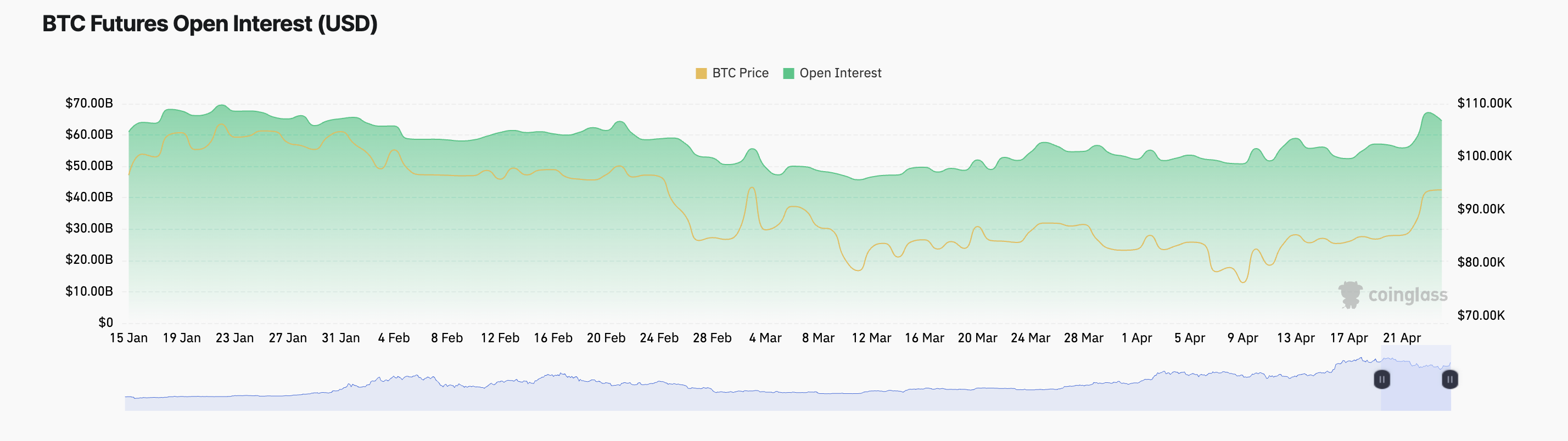

In contrast to the optimism around ETF inflows, market sentiment appears cautious. Over the past 24 hours, the total cryptocurrency market capitalization has declined by $18 billion, paralleling a 1% decrease in Bitcoin’s price. This market contraction is reflected in Bitcoin’s falling futures open interest, which has dropped to $64.54 billion, a decrease of 5% over the past day.

BTC Futures Open Interest. Source: Coinglass

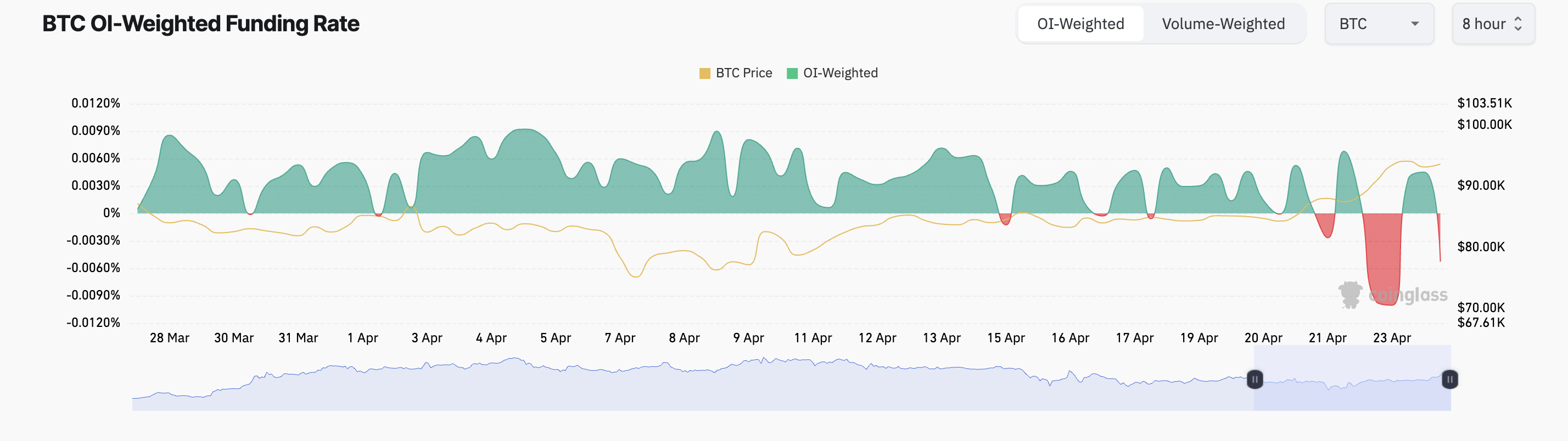

This scenario, where both price and open interest decline, is indicative of traders closing positions rather than initiating new ones, suggesting waning conviction in Bitcoin’s current momentum and the potential for a trend reversal. Furthermore, the Bitcoin funding rate has turned negative again, currently at -0.0053%, a clear sign that short traders are beginning to dominate the market.

BTC Funding Rate. Source: Coinglass

When the funding rate is negative, it signifies that those holding short positions are compensating long holders to maintain their positions. This is emblematic of dominant bearish sentiment and reflects traders’ expectations for Bitcoin’s impending price decline.

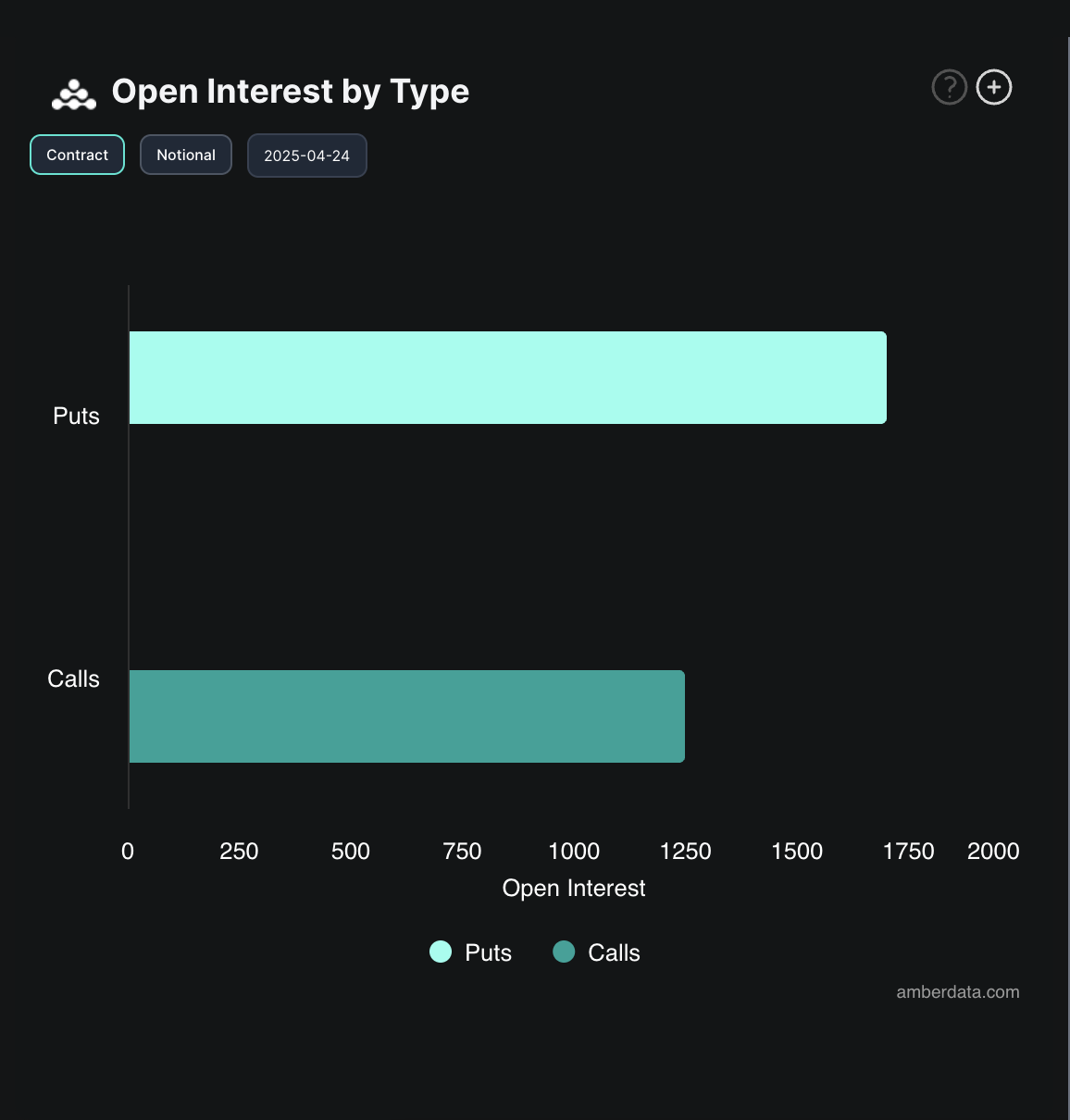

Additionally, the Bitcoin options market is signaling heightened bearish sentiment, exemplified by a put-to-call ratio of 1.36, indicating greater demand for put options compared to calls. This ratio highlights the market’s evolving expectations surrounding Bitcoin’s price direction.

BTC Options Open Interest. Source: Deribit

This growing preference for puts further substantiates the caution among traders and their increasing anticipation of a downturn in Bitcoin’s value.

Conclusion

In summary, while Bitcoin ETFs are capturing significant inflows suggesting a robust interest among institutional investors, underlying market indicators reflect a cautionary stance among traders. With key metrics such as open interest and funding rates indicating potential bearish trends, stakeholders should exercise due diligence and remain informed of market dynamics moving forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

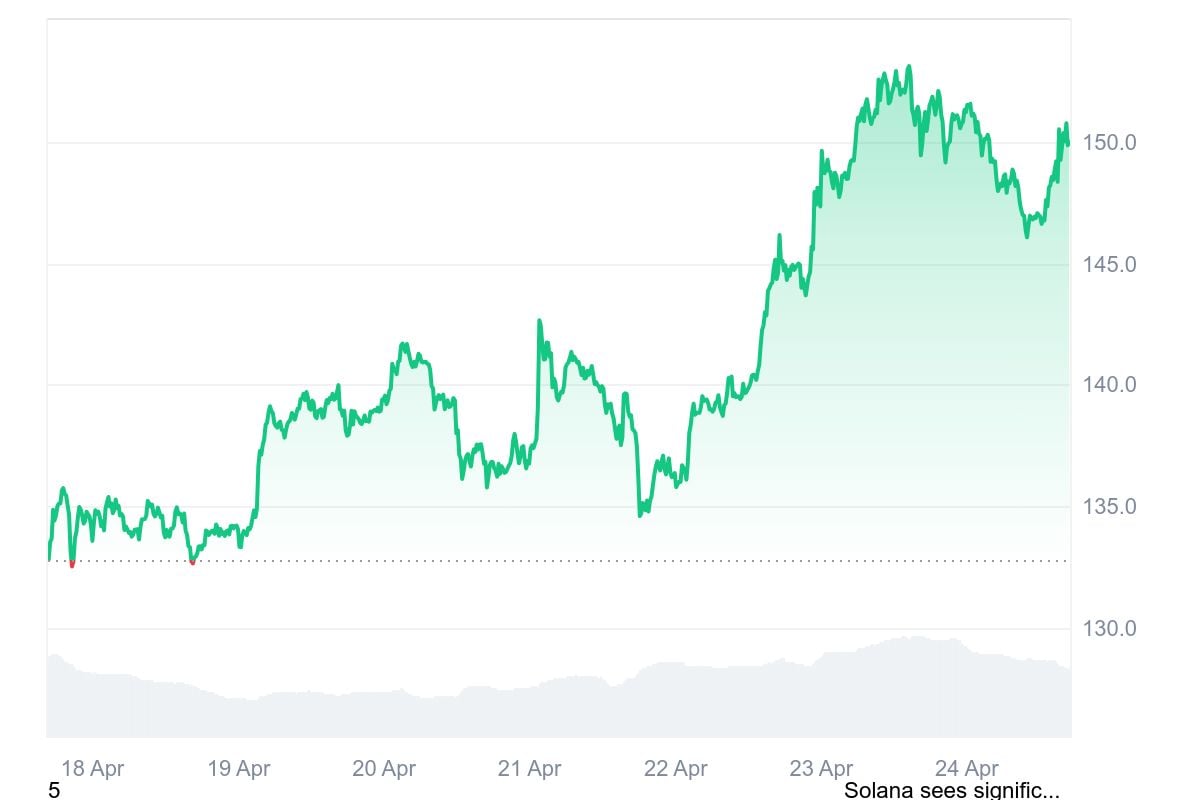

Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level

Tariffs and Bitcoin, what is the connection?

Charles Hoskinson Claims Ethereum May Collapse as Layer 2s Drain Value

Bitcoin Price Breakdown Alert – $78,000 Incoming as Head & Shoulders Pattern Confirmed