Beginner's guide

Bitget Futures: One-Way Mode

Beginner

2023-01-05 | 5m

One-Way Mode is a new feature for Bitget Futures products (

Bitget Coin-Ⓜ Futures,

Bitget USDT-Ⓜ Futures,

Bitget USDC-Ⓜ Futures,

Bitget Delivery Contracts), designed to satisfy the need of experienced traders as well as to extend our trading tool selection for Bitget users in general.

Defining One-Way Mode

By default, current futures trades on Bitget are opened in the Hedging Mode, meaning that Bitget users can long and short one contract at the same time. Although that allows for better risk management, we have received feedback from several users, who are veteran Forex (FX) traders, about the need for a ‘normal’ mode (one-way direction only) as in Forex m arkets. Well then, we heard it loud and clear and are now launching the One-Way Mode for Bitget Futures products, which will definitely be of great use for traders familiar with the traditional normal mode.

Already enabled, One-Way Mode is simple enough for immediate use: you can switch between the original Hedging Mode and the new One-Way Mode at any time. However, please note that:

• You cannot switch modes if you have open positions on any pair.

• The net value of your trades should remain unchanged, even though only one type of contract (long or short) can be traded. Think of it this way: In Hedging Mode, you can long 5 btcusdT and short 2 BTCUSDT at the same time, which results in a net remaining value of 3 BTCUSDT in case of a successful close. In One-Way Mode, if you choose to buy/sell long positions only, you can achieve the same outcome by buying 5 long BTCUSDT positions first, then sell 2 long BTCUSDT positions.

• You should take advantage of the

Reduce-Only order type when in One-Way Mode. It is solely available for the current position (opened under the One-Way Mode) and helps make sure that new orders reduce your position rather than increase it.

• One-Way Mode currently does not support

Bitget One-Click Copy Trade. When expert traders open a position under the One-Way Mode, his/her followers will not receive this signal (the system will not make a copy of this particular position), while copies will not be made for followers who are in the One-Way Mode if the expert trader(s) they subscribe to open a new trade under the Hedging Mode.

• The default mode of all Bitget Futures trades is the Hedging Mode. One-Way Mode has to be manually selected.

Using One-Way Mode

There are some critical points related to One-Way Mode that we hope you will pay attention to before diving in, including risk control and openable positions.

Risk control

We recommend that you have a proper risk management strategy with One-Way Mode, as the risk of liquidations is higher than with Hedging Mode. In order to help minimize this risk for users, we already set a different calculation for One-Way positions’ risk margin.

We all know that Bitget is one of the only exchanges to adopt the sophisticated mechanism of risk margin, which has proved to be extremely useful in helping traders resist liquidations. More on margin and risk margin can be found here:

What Is Margin Trading?

Risk Margin for the Hedging Mode is calculated as follows:

Risk Margin (for one pair) = Max{Maintenance Margin of Short Positions + Maintenance Margin of Long Positions} + Risk Margin of all Short Positions + Risk Margin of all Long Positions

Meanwhile, Risk Margin for the One-Way Mode is given by:

Risk Margin (for one pair) = Max{Maintenance Margin of Buying Positions + Risk Margin of Open Buying Positions + Maintenance Margin of Selling Positions + Risk Margin of Open Selling Positions}

When your margin balance falls below the Risk Margin level, our system will automatically send a notification alerting you of the situation. If no action is taken and your margin balance continues to fall below the Maintenance Margin, your position(s) will be liquidated.

Openable positions

Bitget users should always take margin requirements into account before opening any new positions. Especially when you already have some open positions, margin requirements are subject to current leverage levels, and in the case of One-Way Mode, where you can buy/sell positions in one direction only, price is another key factor.

Funds available for long position = available fund + long compensation margin - long position margin of this currency pair - margin occupied by long orders of this currency pair

Funds available for short positions = available fund + short compensation margin - short position margin of the currency pair - margin occupied by the short order of the currency pair

• When the currency pair's long position margin + the margin occupied by the long order is greater than the short position margin + the margin occupied by the short order;

Long compensation margin = the long position margin of the currency pair + the margin occupied by long orders,

Short compensation margin = long position margin of the currency pair + margin occupied by long orders + margin of long position of the currency pair.

• When the long position margin of the currency pair + the margin occupied by the long entrustment is less than the short position margin + the margin occupied by the short entrustment;

The long compensation margin = the short position margin of the currency pair + the margin occupied by the short entrustment + the short position margin of the currency pair. Compensation margin = short position margin of the currency pair + margin occupied by short order.

Then we combine the limit of the level corresponding to the current leverage of the currency pair to determine the user's maximum buying volume and maximum selling volume.

The maximum buy volume and maximum sell volume for the user are then determined by the limits of the corresponding leverage level of the coin pair.

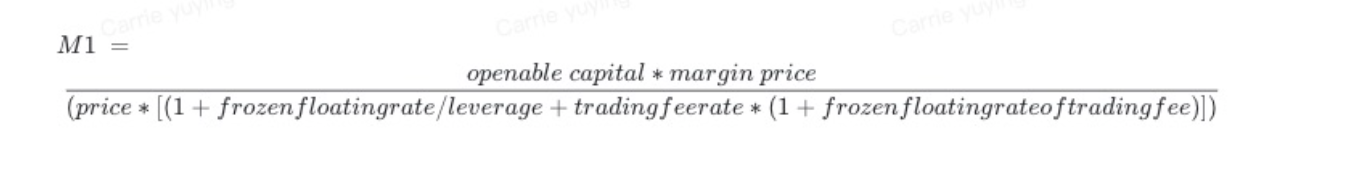

Take the maximum openings of the coin pair under the openable capital and current leverage as M1, and take the openable capital of the coin pair as the margin occupied by all orders. You can get:

Calculate the total position of the coin pair, then check the maximum openable position M2 corresponding to the tiered position table

Take the minimum value of the current position of M1 and M2, and the maximum openings = min(M1, M2 - current positions and orders). Here the current positions and orders have long ones and short ones. If the maximum openable amount of the buy is calculated, the current positions and orders are the long ones; otherwise, they are the short ones.

Share

How to sell PIBitget lists PI – Buy or sell PI quickly on Bitget!

Trade nowRecommended

We offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now