Bitget Futures — Understanding the Insurance Fund

[Estimated reading time: 5 mins]

The Bitget Insurance Fund is a risk buffer mechanism established by the exchange for derivatives trading. It's designed to help traders reduce the risk of excessive losses when making derivative trades. When a trader's position is liquidated, if the liquidation price is better than the bankruptcy price, the remaining margin from the trader's position is added to the Insurance Fund. However, if the liquidation price is worse than the bankruptcy price, resulting in losses exceeding the trader's margin, the shortfall is covered by the Insurance Fund. This mechanism helps reduce the risk of auto-deleveraging (ADL).

Please note that the Insurance Fund is not a "compensation insurance" for user losses. It does not cover individual trading losses; it only intervenes in extreme shortfall situations to maintain the stability of the platform's settlement system.

How the Insurance Fund works

When a trader's account triggers liquidation, the position is settled at the bankruptcy price—the price at which the margin is fully depleted, regardless of the current market price. The Insurance Fund balance changes depending on the difference between the final executed liquidation price and the bankruptcy price.

Example: A user opens a long BTCUSDT position at a bankruptcy price of 100,000 USDT.

• If the actual liquidation price is higher than the bankruptcy price (e.g., 100,100 USDT), the remaining margin (100,100 USDT – 100,000 USDT) is added to the Insurance Fund.

• If the actual liquidation price is lower than the bankruptcy price (e.g., 99,900 USDT), the excess loss (99,900 USDT – 100,000 USDT) is covered by the Insurance Fund.

How to view the Insurance Fund

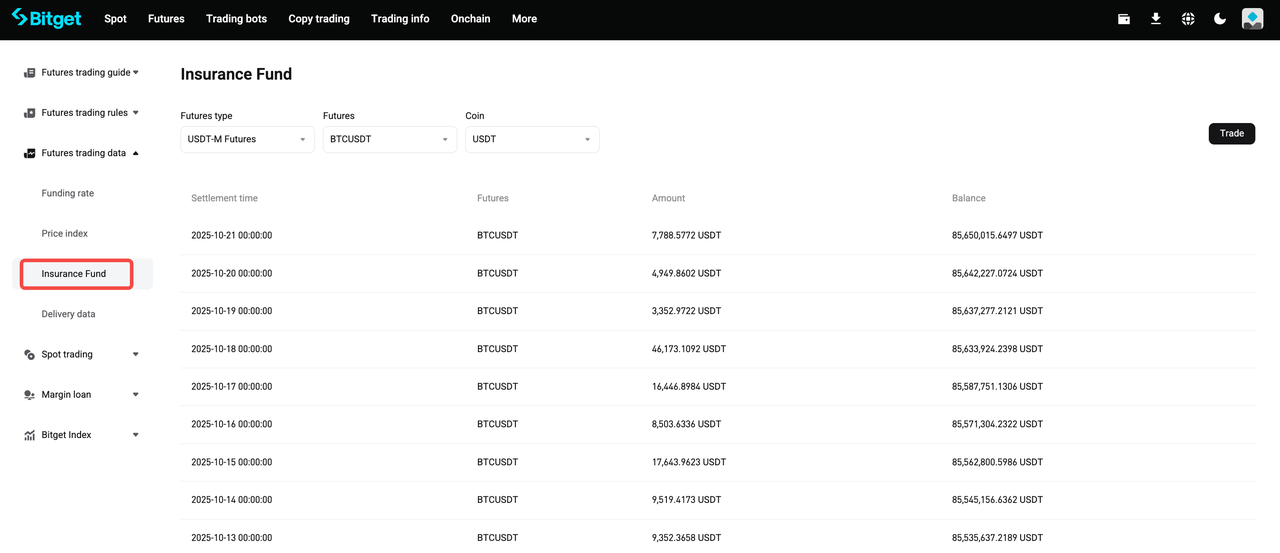

To check the Insurance Fund balance for all perpetual and delivery futures, navigate to Trading Info > Futures Trading Data, then select Insurance Fund.

You can also view the balance directly on the Insurance Fund page. Data is typically updated daily at 12:00 AM (UTC).

For USDT-M perpetual futures, all Insurance Fund balances are denominated in USDT. Some futures have separate Insurance Fund pools, while others share a pooled fund, depending on the project's specific risk level.

Insurance Fund and auto-deleveraging (ADL) mechanism

During periods of mass liquidations or extreme market volatility, if losses exceed the Insurance Fund's coverage capacity, the fund may be depleted. In such scenarios, the auto-deleveraging (ADL) mechanism will be triggered.

Isolated Insurance Fund and pooled Insurance Fund

Building on its standard isolated Insurance Fund mechanism, Bitget has introduced a pooled Insurance Fund system to better adapt to multi-pair trading environments where collateral shortfall risk is more widely distributed.

Isolated Insurance Fund (separate pool for each trading pair)

Features:

• Each trading pair or futures type has its own dedicated Insurance Fund pool.

• Bankruptcy coverage occurs only within that pair's fund and does not affect others.

• Simple, transparent, and risk-isolated.

Best for:

• High-liquidity and highly stable futures such as major trading pairs (e.g., BTC, ETH).

• Markets with high trading volume and low collateral shortfall probability.

Auto-deleveraging (ADL):

• Trigger condition: The Insurance Fund for the specific trading pair is fully depleted.

• Termination condition: The Insurance Fund for that pair returns to a positive balance.

Pooled Insurance Fund (shared pool for multiple trading pairs)

Design concept:

• Trading pairs with similar risk profiles and small-to-medium trading volumes are grouped into a shared Insurance Fund pool.

• In the event of a collateral shortfall, the shared pool covers the loss first. ADL is triggered only if the pool's balance is insufficient.

Best for:

• Pairs with small-to-medium trading volumes.

• Pairs sharing similar risk profiles and relatively high liquidity.

• Low-volume pairs that are not suitable for maintaining high-balance isolated pools.

Auto-deleveraging (ADL):

• Trigger condition: The equity of the pooled Insurance Fund decreases by 50% from its peak within a 12-hour period.

• Termination condition: The equity of the pooled Insurance Fund increases by 30% relative to its value at the trigger point.

Note: The platform reserves the right to adjust thresholds such as the 12-hour timeframe and the 50% or 30% threshold based on market conditions.

Why the pooled Insurance Fund was introduced

The pooled Insurance Fund was created to improve capital efficiency and strengthen risk management for multiple trading pairs. By grouping pairs with similar risk profiles and small-to-medium trading volumes, the shared fund allows losses to be covered without requiring high-balance isolated funds for each pair.

Key benefits:

• Higher capital efficiency: Funds are shared across pairs, reducing idle capital.

• Stronger risk hedging: The pooled fund can absorb losses across multiple pairs.

• Reduced ADL probability: Losses are distributed more evenly, lowering the chance of auto-deleveraging.

This system helps maintain platform stability while providing better risk coverage for traders, especially for pairs that do not require dedicated high-balance isolated funds.

Risk warning and disclaimer

• The Insurance Fund and pooled-fund mechanisms serve only as systemic risk buffers and do not guarantee protection from trading losses.

• Auto-deleveraging (ADL) may still be triggered, or additional user losses incurred, in the event of collateral shortfall, liquidation, or extreme market conditions.

• The platform reserves the right to adjust the size of the Insurance Fund, pool classifications, rules, and thresholds according to market conditions.

• Users engaging in margin trading should independently assess their risks and configure leverage and position sizes prudently.

FAQs

1. What is the Bitget Insurance Fund?

The Insurance Fund is a risk buffer mechanism for derivatives trading, designed to help traders reduce the impact of excessive losses in extreme shortfall scenarios. It is not compensation for individual trading losses.

2. How does the Insurance Fund work during liquidation?

When a trader's position is liquidated at the bankruptcy price:

• If the liquidation price is better than the bankruptcy price, the remaining margin is added to the Insurance Fund.

• If the liquidation price is worse than the bankruptcy price, the excess loss is covered by the Insurance Fund.

3. What is the difference between isolated and pooled Insurance Funds?

• Isolated Fund: Each trading pair has its own fund; bankruptcy coverage occurs only within that pair.

• Pooled Fund: Multiple trading pairs with similar risk profiles share a fund; losses are covered by the shared pool before triggering ADL.

4. When is auto-deleveraging (ADL) triggered?

• Isolated Fund: ADL triggers if the fund for a specific pair is fully depleted.

• Pooled Fund: ADL triggers if the pooled fund’s equity decreases by 50% from its peak within 12 hours.

5. Why was the pooled Insurance Fund introduced?

The pooled Insurance Fund improves capital efficiency, strengthens risk hedging, and reduces the probability of ADL, especially for small- to medium-volume trading pairs with similar risk profiles.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research and understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company