Bitget Beginner's Guide — Introduction to Futures Order Types

Summary

• Order types allow users to create orders that meet their trading criteria, specifying how the order will be filled and at which price.

• Understanding the different order types and how they can be used will help improve your trading performance on Bitget.

What is an order?

An order is an instruction to buy or sell an asset. In trading, orders are generally categorized as maker or taker:

• Maker: The order is not executed immediately, but instead goes into the order book, adding liquidity to the market (e.g., a limit order). Makers usually benefit from lower transaction fees — for example, Bitget charges a 0.02% maker fee in futures trading.

• Taker: The order is matched with an existing order in the order book and executed immediately (e.g., a market order). Takers pay a higher fee — 0.06% on Bitget futures. Learn more about transaction fees here.

Bitget currently offers nine types of futures orders:

1. Market order

2. Limit order

3. Trigger order

4. Post-only order

5. Trailing stop

6. Scaled order

7. Iceberg

8. TWAP

9. Advanced limit order

Order types in details

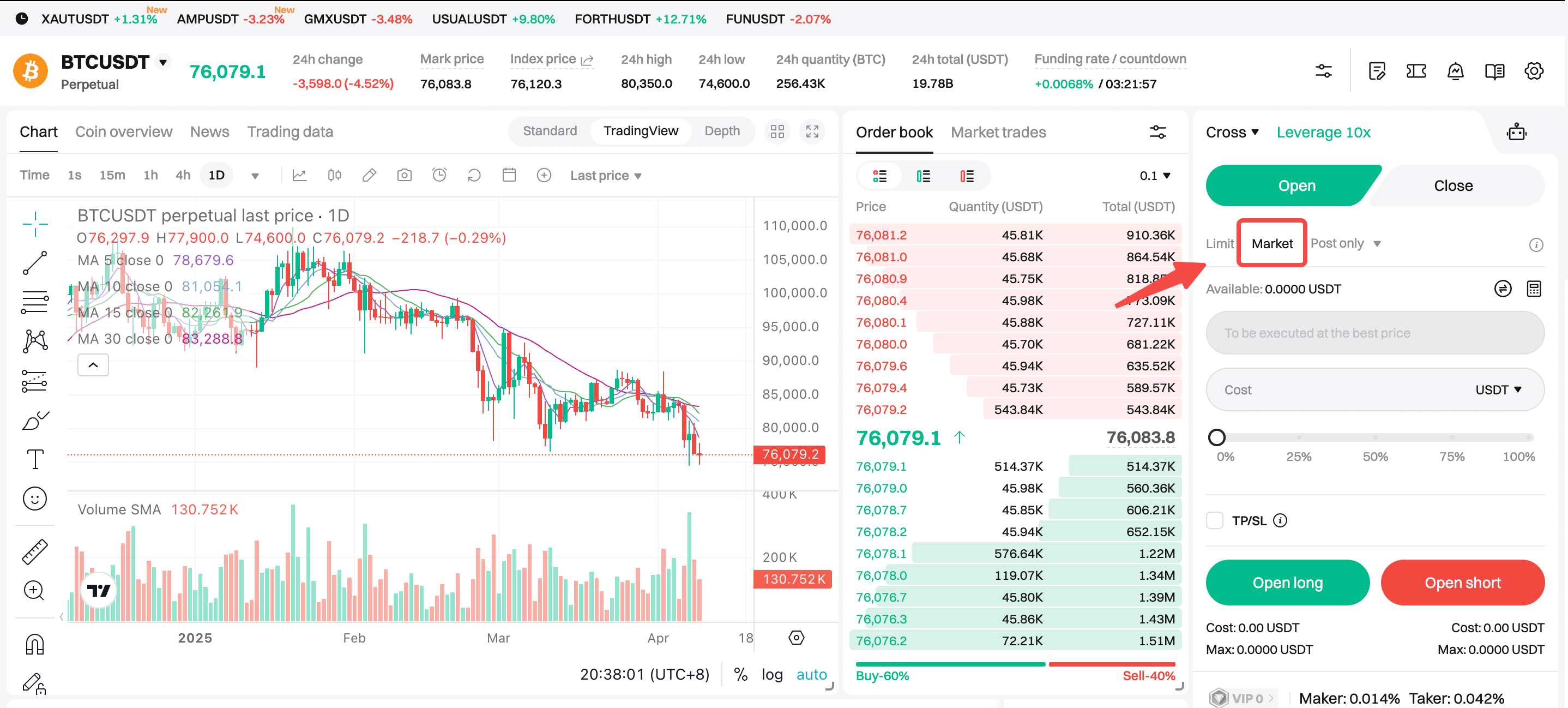

1. Market order

A market order executes immediately at the best available price. In the highly volatile cryptocurrency market, the actual execution price may differ slightly from the price displayed at the time of placing the order. The price limit rule ensures that this difference stays within a certain range: the buy price must be ≤ mark price × (1 + limit ratio), and the sell price must be ≥ mark price × (1 – limit ratio). The default limit ratio is 2%, and it may be adjusted based on market conditions. If an order is not fully filled, the system will continue to match the remaining amount at the latest market price.

Example: If BTC is trading at $66,000 and you place a market buy order, the system will execute the trade instantly at the best available price. Best for quick trades.

2. Limit order

A limit order executes at a specified price or better. You can set a lower price to buy or a higher price to sell. The order remains in the order book until the price condition is met. To ensure market stability, the order price must fall within a defined range to be placed successfully: the buy order price must be ≤ mark price × (1 + limit ratio), and the sell order price must be ≥ mark price × (1 – limit ratio). The default limit ratio is 2% and may be adjusted based on market conditions. View the futures parameters for details. Note that limit orders are not guaranteed to be filled.

Example: If BTC is trading at $66,500 and you place a buy limit order at $66,000, the trade will only execute when the market price drops to $66,000 or below. Best for price control.

3. Trigger order

A trigger order is a conditional order that allows you to set a trigger price and an execution price. When the market price hits the trigger price, the system automatically places a limit or market order at the specified execution price.

• Limit trigger order: Places a limit order once triggered.

• Market trigger order: Places a market order once triggered.

Example: When the market price reaches the trigger condition (e.g., 66,000 USDT), a market order will be placed and executed immediately, or a limit order will be placed and executed when a predetermined price is reached.

4. Post-only order

After understanding the general order types in futures trading, we can now explore some of the more advanced order types. A post-only order is an advanced type of limit order.

It ensures your order is added to the order book as a maker, meaning it will not match with any existing orders. This guarantees that the transaction fee you will pay is the lower maker fee. Main benefits:

• Always qualifies for maker fees.

• Avoids undesired losses. If your limit price is likely to result in an immediate match (e.g., better than the market price), the system will automatically cancel the order.

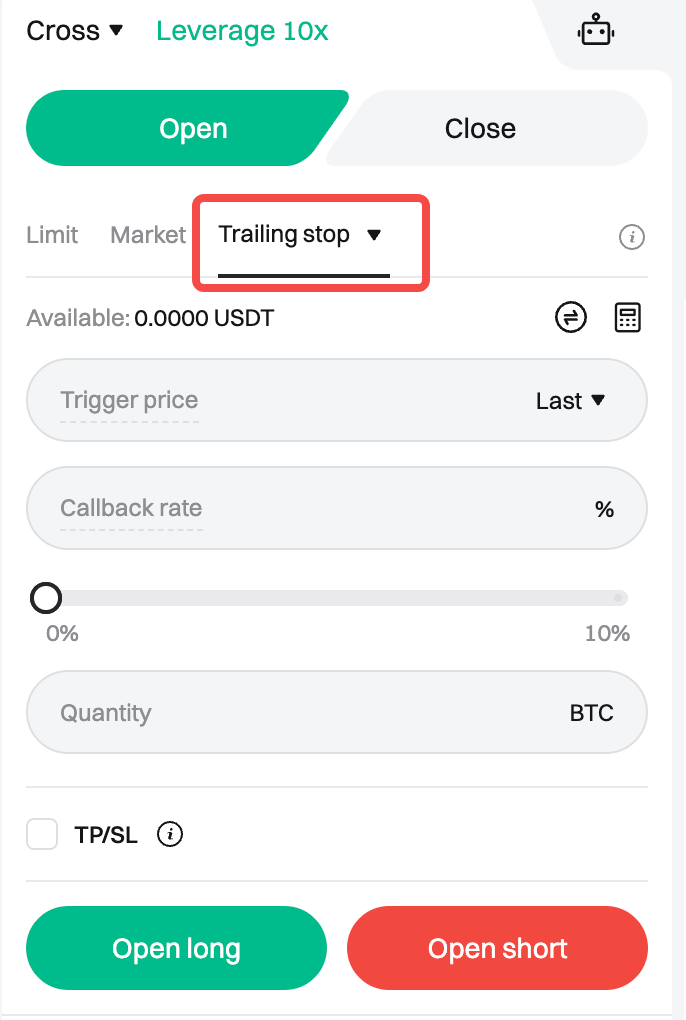

5. Trailing stop

A trailing stop order sets a dynamic trigger price range that adjusts with the market trend. It helps lock in profits or minimize losses in a trending market.

Note that a trailing stop only moves in one direction. If the market reverses by a set percentage, the order is triggered and executed at the market price.

Example

If BTC is at $60,000 and you set a 1% trailing stop:

• When BTC rises to $63,000, the stop price adjusts to $63,000–$62,370 (1% below the high).

• If BTC drops to $62,370, a sell order is triggered, securing a $2370 profit.

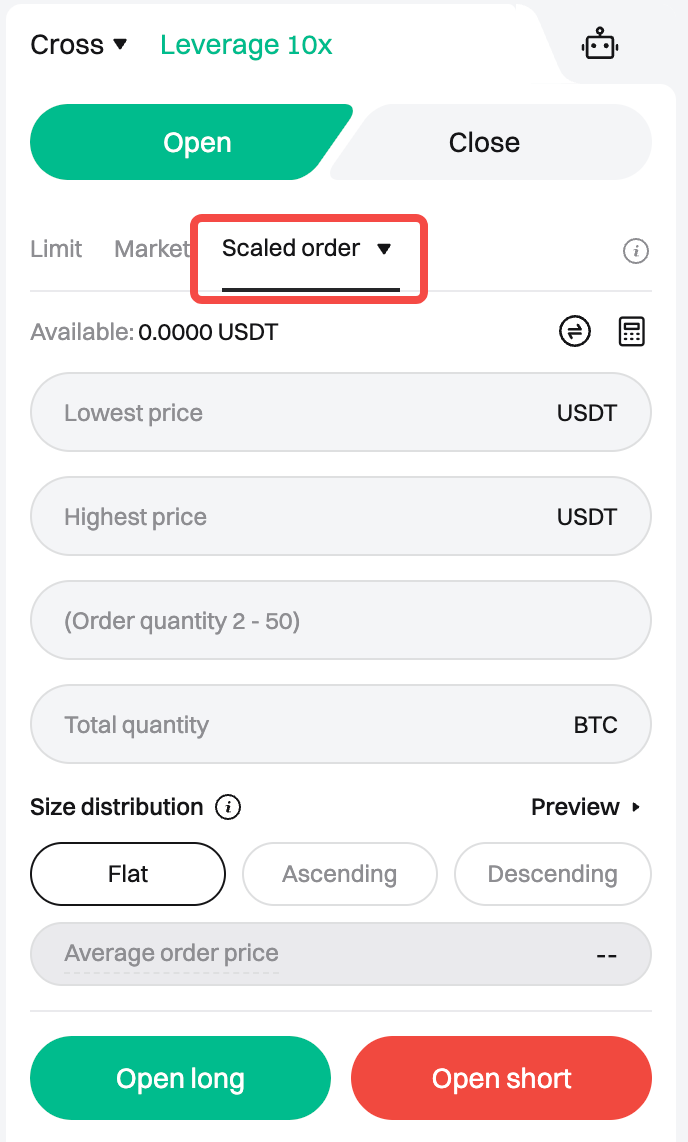

6. Scaled order

A scaled order splits a large trade into multiple smaller orders at different prices. As the market fluctuates, these smaller orders are filled gradually until the entire order is executed.

Scaled orders are often used for large trades to minimize market impact and reduce position opening costs. By placing multiple small orders, traders can conceal their trading activities and avoid alerting their counterparties.

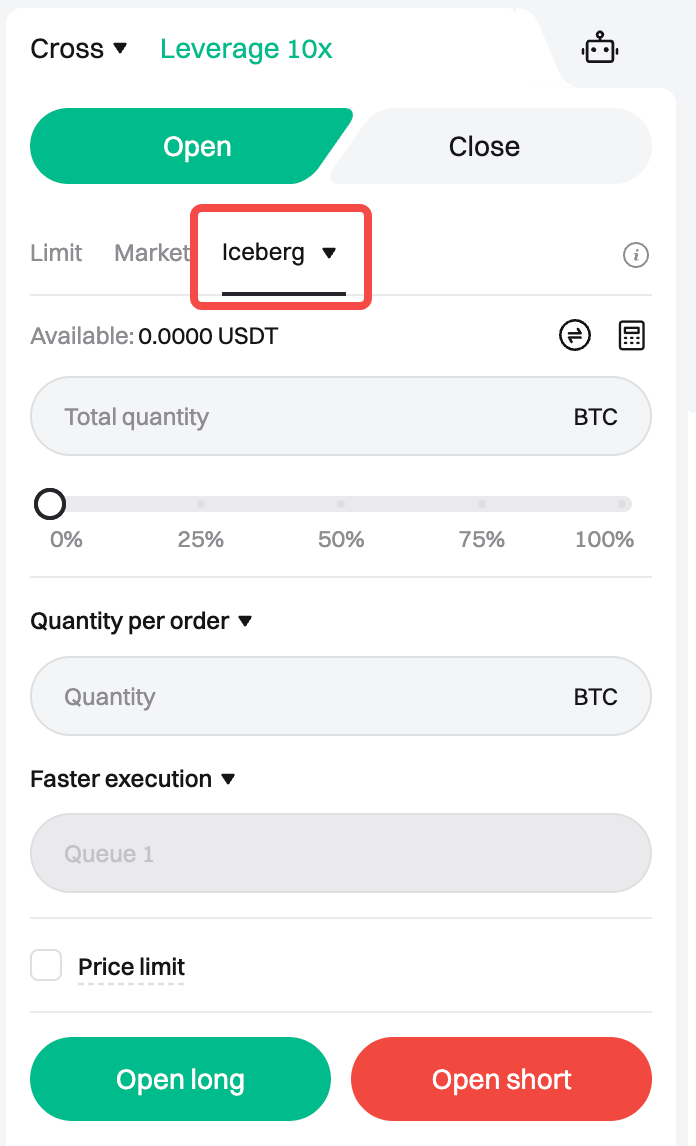

7. Iceberg order

The iceberg order is a trading strategy designed for executing large trades by breaking down big orders into smaller sub-orders. This allows for quicker market entry and minimizes slippage.

By using an iceberg order, users can reduce market impact without revealing the full size of their position. This makes it ideal for market makers and traders who prefer to keep their orders private.

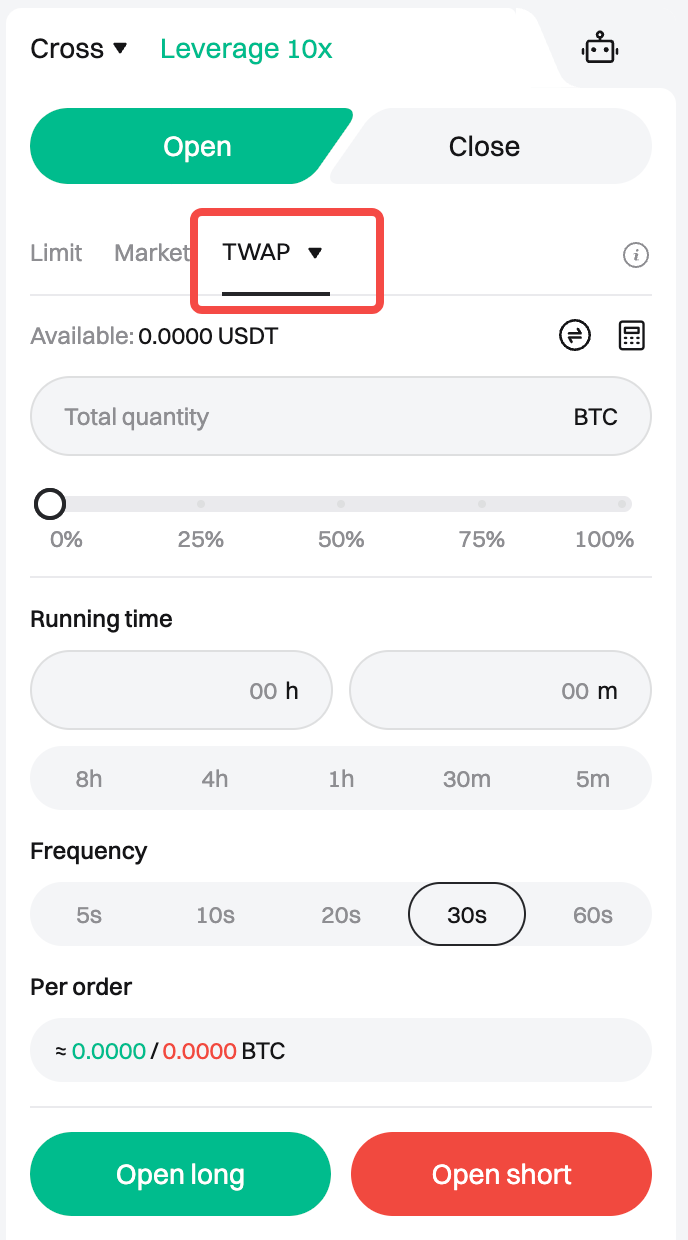

8. TWAP

A time-weighted average price (TWAP) order splits a large order into multiple smaller orders, which are placed at market price at fixed intervals over a specified time until the entire order is completed.

TWAP orders can effectively smooth out order execution costs and reduce their impact on market prices, making them ideal for large-volume orders when the market is relatively less volatile.

9. Advanced limit order

Compared to standard limit orders, the advanced limit order provides additional parameters, such as trigger and execution prices, allowing for more sophisticated trading strategies. For example:

• IOC (Immediate or Cancel)

○ If the order is not immediately executed in full, the unfilled part will be automatically canceled.

○ Use case: Only accepts the optimal execution prices, no partial fills.

• FOK (Fill or Kill)

○ The order is either immediately filled entirely or automatically canceled.

○ Use case: Requires full order execution or nothing at all.

Conclusion

Whether seizing market opportunities through market orders, setting precise pricing through limit orders, or automating trading bots through conditional orders, a comprehensive understanding of all order types helps users better navigate the market.

Related articles

• Bitget beginner's guide — What are futures?

• Bitget beginner's guide — How to make your first futures trade

Share