News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Dogecoin May Face Breakout or Pullback After Volume Spike, Market Cap Rises to $31.7B2World Liberty Financial (WLFI) Undertakes Token Burn as Possible Measure to Curb Post-Launch Price Decline3Yunfeng Financial, Linked to Jack Ma, Acquires 10,000 ETH and May Bolster Institutional Support for Ethereum in Hong Kong

This Special Metric May Provide Clues About the Future of Ethereum’s Price

CryptoNewsNet·2025/09/04 08:41

California’s $500 Billion Pension Fund Split Over Bitcoin Exposure

CryptoNewsNet·2025/09/04 08:41

Altcoin Developers Release Expected Report on Major Hacking Incident – Here Are the Details

CryptoNewsNet·2025/09/04 08:41

Crypto Hackers are Now Using Ethereum Smart Contracts to Mask Malware Payloads

CryptoNewsNet·2025/09/04 08:41

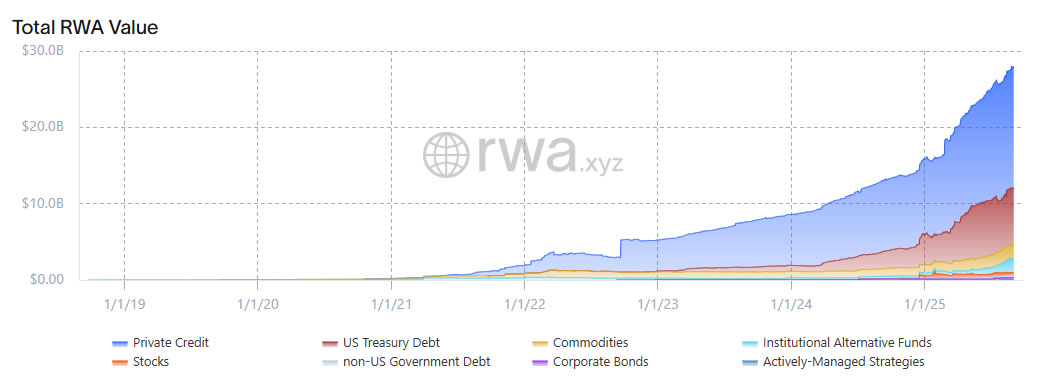

Huge week for tokenized RWAs as Fed preps DeFi, payment talks

CryptoNewsNet·2025/09/04 08:41

Ether whales have added 14% more coins since April price lows

CryptoNewsNet·2025/09/04 08:41

Crypto update: Why Bitcoin is stalling while Ethereum eyes a breakout

Coinjournal·2025/09/04 08:35

Conflux Proposes CFX Token Integration in Public Companies

Bitcoininfonews·2025/09/04 08:35

Bitcoin Enters A New Seasonal Cycle ?

Cointribune·2025/09/04 08:30

Bitcoin dominance collapses, should we bet on the outsiders?

Cointribune·2025/09/04 08:30

Flash

- 08:17The Governor of the Czech National Bank is studying "The Bitcoin Standard"Jinse Finance reported, according to market news released by The Bitcoin Historian, the Governor of the Czech National Bank has just stated that he is studying "The Bitcoin Standard".

- 08:07Analysis: If BTC price breaks through $116,000, it may revive the upward trendJinse Finance reported, according to charts released by Glassnode, that Bitcoin is currently consolidating within the $104,000 - $116,000 range, with investors showing clear signs of accumulation. Data from the futures market and ETF capital flows indicate a cooling in demand. Analysis points out that if the price can break through the $116,000 resistance level, the upward trend may resume; however, if it falls below $116,000, there is a risk of a pullback to the $93,000 - $95,000 range.

- 07:56Data: Bitcoin reserve balances have increased every month so far this yearJinse Finance reported that, according to a chart released by Sentora (previously IntoTheBlock), since the beginning of this year, bitcoin (BTC) reserve balances have shown a monthly upward trend. Despite market volatility, this continued accumulation indicates that institutions have strong confidence in it.