$33,000,000,000 in 6 Hours Gained by Crypto Market in Massive Reversal

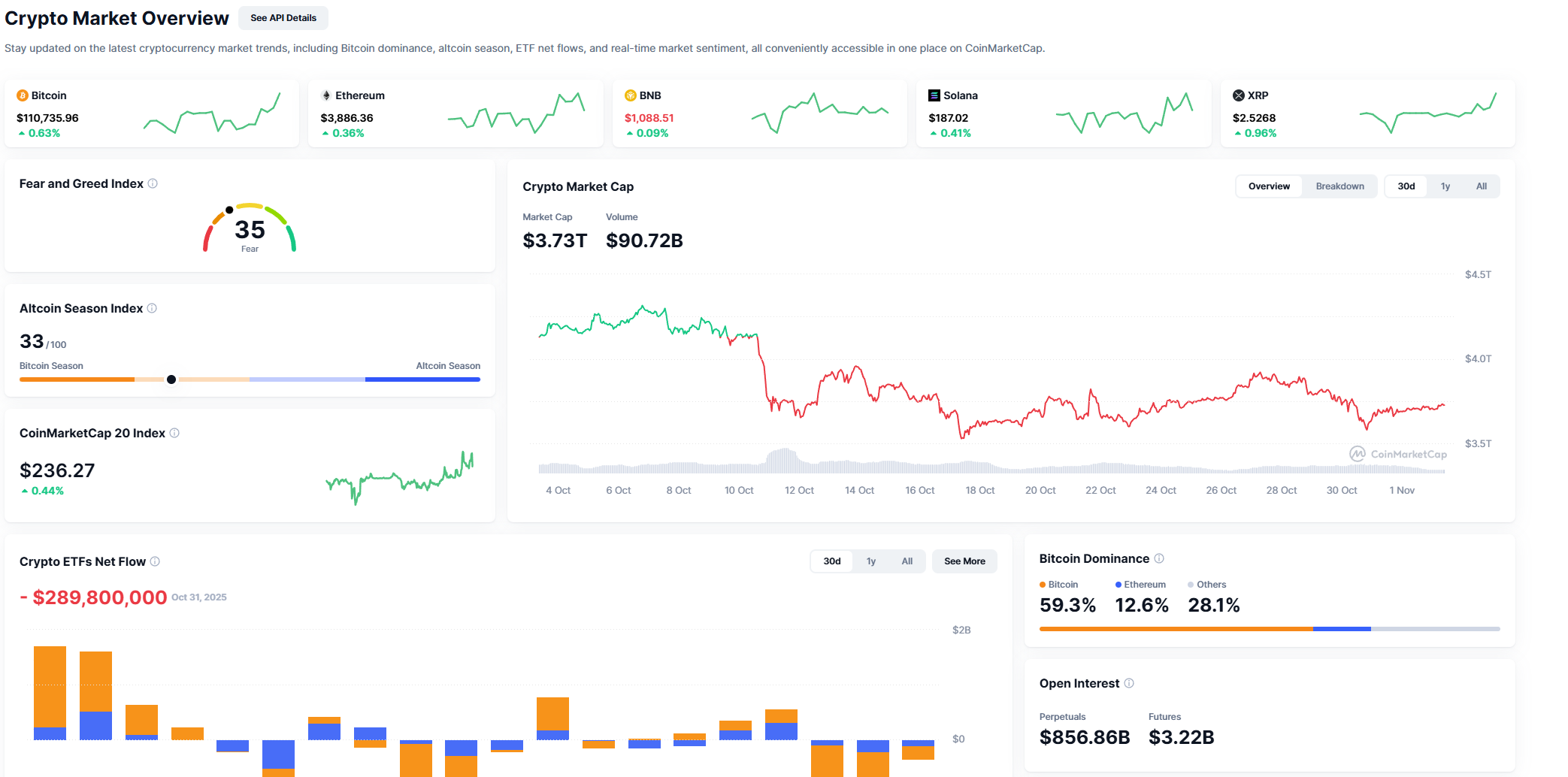

The cryptocurrency market experienced an abrupt surge of bullish momentum, adding over $33 billion in total capitalization in just six hours, indicating a short-term shift in traders’ risk-on stance. Bitcoin, Ethereum and XRP led the charge as the rally propelled almost all significant assets into the green.

Massive market growth

Bitcoin increased 0.67% to approximately $110,700, while Ethereum (ETH) increased 1.22% to regain the $3,850 mark, according to market data. Following closely behind, XRP saw a daily gain of 11%, which was sufficient to overtake BNB and reclaim the fourth-largest cryptocurrency position by market capitalization.

At $152.2 billion, XRP’s total market capitalization is now ahead of BNB’s $150.4 billion, a slight but significant lead that indicates a resurgence of investor interest. Solana (+1.04%), Cardano (+0.62%) and Dogecoin (+0.61%) are all included in the sea of green that is the overall market heat map.

Staying positive

As Bitcoin’s stable position above its 200-day moving average restored some confidence, buying pressure briefly increased even for smaller-cap assets. The technical setup for Bitcoin is still cautiously optimistic, it is still above the crucial $108,000 support zone, and the next resistance cluster is forming close to $113,800-$114,000, which is in line with the 100-day moving average.

Ahead of significant macro data releases, the timing of the rally points to aggressive short liquidations and updated institutional positioning. Although most large caps’ RSI levels are still neutral, this move might be more of a relief rally than the beginning of a full-scale bull run.

Right now, all eyes are on XRP, whose return to the fourth spot may spark new conversations about its long-term potential in payments and remittances. The general lesson, however, is obvious: traders are back in action, liquidity is returning, and the cryptocurrency market has just served as a reminder to everyone of how quickly momentum can change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "Large Investor Moves Indicate Crypto Market's 'Intense Fear' Could Precede a Rebound"

- Crypto whales and institutional traders are accumulating $19.94M in BTC and $18.71M in ETH via leveraged longs despite market declines. - Crypto Fear & Greed Index hit record low of 21, reflecting extreme panic among retail and institutional investors since October 30. - Bitcoin faces critical $108,000 support level, with technical analysis showing potential for $104k decline or $114k rebound by mid-November. - Market dynamics show institutional optimism contrasting retail fear, with whale activity seen

Victim Compensation Does Not Excuse Criminal Acts, Judges Inform SBF

- Sam Bankman-Fried’s legal team faces uphill battle as appeals judges question claims of unfair trial and lack of fraud intent. - Judges dismiss defense arguments, noting SBF admitted not relying on legal advice during FTX fund transfers. - Court rejects post-trial repayment claims, emphasizing criminal liability persists despite 90% customer fund recovery. - Case sets precedent for crypto accountability, with appeals unlikely to succeed without procedural errors.

Sequoia's Change in Leadership: Will Advancements in AI Help Restore Broken Trust?

- Sequoia Capital's Roelof Botha steps down amid reputational crises, ceding leadership to Alfred Lin and Pat Grady during strategic recalibration. - The transition follows Islamophobic controversy, COO's exit, and a $200M FTX loss, prompting cultural and financial restructuring efforts. - New leaders prioritize trust restoration via a $950M AI fund targeting disruptive startups, signaling a return to U.S.-centric operations and ethical accountability. - The shift reflects industry-wide adaptation to geopo

Solana News Update: Mutuum Finance's DeFi Strategy: Balancing Stability Against Shiba Inu's Fluctuations

- Mutuum Finance (MUTM) raises $18.27M in presale with 80% completion, targeting $0.06 launch price for 400% potential gains. - Project combines Solana's utility-driven growth with SHIB's viral appeal via dual-lending model and automated risk management protocols. - CertiK audit (90/100) and $50K bug bounty address DeFi security risks, while buy-and-distribute mechanism boosts token value retention. - Whale investments and structured tokenomics (45.5% presale allocation) signal institutional confidence ahe