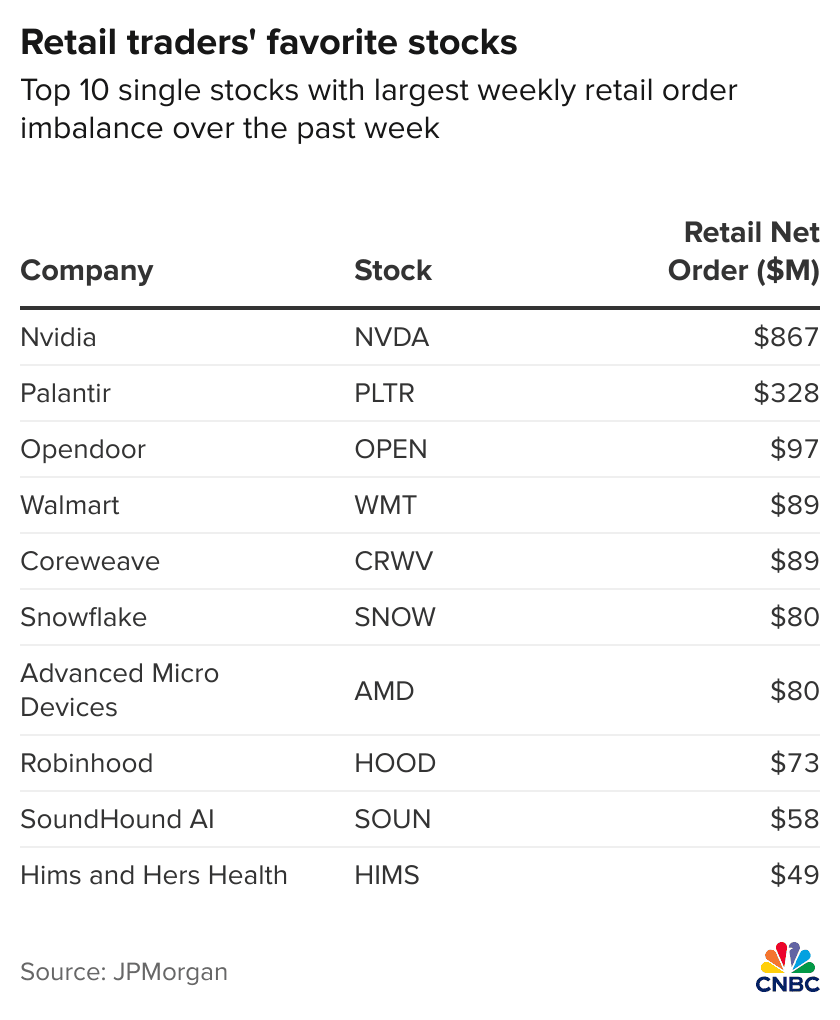

The list of stocks favored by retail investors in September is out: Nvidia and Opendoor are included.

According to data from JPMorgan, retail investors who have successfully seized the market rebound opportunity this year have significantly increased their positions in artificial intelligence favorites such as Nvidia and several other tech stocks as September approaches. Data from this Wall Street institution shows that Nvidia topped the list of the top ten stocks with the highest net retail purchases in the past week, with a net inflow of $867 million.

Despite Nvidia's stock price dropping by more than 2% last week, retail investors took advantage of the slight pullback to buy shares of this AI leader. Previously, Nvidia delivered better-than-expected earnings, with both profit and revenue exceeding expectations and issuing guidance above estimates. JPMorgan pointed out that after Nvidia's earnings release, retail buying volume during the afternoon session reached four times that of the same period the previous day.

However, Goldman Sachs stated that retail enthusiasm for Nvidia had already waned before last Wednesday's blockbuster earnings report. After reaching a nominal monthly capital inflow peak of about $140 billion in 2024, the funds flowing into the company led by Jensen Huang have now fallen back to about $50 billion.

The market's enthusiasm for other AI concept stocks also appears to be fading. JPMorgan noted that while Super Micro Computer and SoundHound AI Inc made it into the top ten retail holdings, buying momentum over the past week was relatively weak. JPMorgan strategists wrote in a client report: "Except for Nvidia, retail participation in AI concept stock trading has slowed compared to the first half of 2025."

According to JPMorgan data, the second most favored stock among retail investors is Palantir Technologies Inc., with a net purchase of over $300 million in the past week. Opendoor Technologies Inc., which has recently been at the center of the meme stock craze, also made the list of retail investors' favorite stocks in September, along with Walmart, CoreWeave, Inc., and Snowflake.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk addresses 100,000 protesters in London remotely: The UK needs "revolutionary change"

Over 100,000 far-right protesters have erupted in the UK. Elon Musk has once again transformed into a political fighter, appearing online to call for the UK to "dissolve parliament," and urging the British people to "either fight back or die."

This Week's Preview: The Fed's Rate Cut "Starting Gun" Is Imminent, AI and Metaverse Narratives Stir Up Waves Again

The cryptocurrency market remains cautiously optimistic ahead of the Federal Reserve's interest rate decision, with bitcoin prices experiencing narrow fluctuations. The market is closely watching the extent of the Fed's rate cuts and Powell's speech, while developments in the AI and metaverse industries may drive the performance of related tokens. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Why can USDC be used as Gas?

This helps to isolate transaction fees from the crypto market fluctuations that could impact the price of volatile gas tokens, and provides a fee smoothing algorithm that maintains low dollar costs even during periods of network congestion.

South Korea's leading Piggycell drives Web3 ecosystem innovation with RWA technology

"Charge-to-mine"—a Web3 application based on real-world assets has been validated in the South Korean market.