Why SYC Outperforms XRP and DOGE in 2025: A Deep Dive into Presale Strategy and Utility-Driven Growth

- Smart Yield Coin (SYC) outperforms XRP and DOGE in 2025 through structured presales, institutional validation, and utility-driven innovations like AI gas fee predictions and passive income tools. - XRP relies on ETF inflows and cross-border payments but lacks smart contract capabilities, while DOGE's meme-driven model faces sustainability issues due to infinite supply and no programmable features. - SYC's deflationary tokenomics, regulatory compliance, and real-world ecosystem create a closed-loop econom

The 2025 cryptocurrency landscape is marked by a stark divergence between legacy assets and next-generation projects. While XRP and DOGE continue to anchor themselves in established narratives—cross-border payments and meme-driven virality, respectively—Smart Yield Coin (SYC) has emerged as a paradigm-shifting contender. This article examines why SYC’s strategy and utility-driven innovation position it to outperform both XRP and DOGE in the current cycle, leveraging institutional validation, regulatory clarity, and a robust ecosystem of real-world applications.

Growth Strategies: Structured Development vs. Speculative Momentum

DOGE, meanwhile, remains a pure meme-driven asset, dependent on social virality and celebrity endorsements. While its integration into Elon Musk’s X platform and ETF applications offer speculative upside, its infinite supply model and absence of programmable features make it ill-suited for long-term value retention [1]. SYC, by contrast, is underpinned by a deflationary token supply and utility-first design, creating a more sustainable value proposition.

Utility-Driven Growth: Beyond the Hype

SYC’s ecosystem is defined by tangible use cases that address pain points in the crypto space. Features like AI-driven gas fee predictions, AutoMine passive income, and Smart Yield Pay cards directly enhance user experience and adoption [1]. These tools are not merely speculative but are designed to integrate into daily financial workflows, a stark contrast to XRP’s focus on institutional cross-border transactions and DOGE’s reliance on social media trends.

XRP’s utility in 2025 is undeniably robust, with Ripple’s On-Demand Liquidity (ODL) processing $1.3 trillion in Q2 2025 alone [2]. However, its expansion into DeFi and tokenized assets remains nascent compared to SYC’s holistic approach. For example, SYC’s Hold to Earn and Smart Swap mechanisms create a closed-loop economy that incentivizes long-term participation, whereas XRP’s DeFi integrations are still in early stages [3]. DOGE, meanwhile, lacks any such infrastructure, relying instead on periodic surges in social media attention.

Institutional Validation and Regulatory Clarity

The project’s emphasis on compliance and transparency has positioned it as a “safe haven” for investors wary of the volatility associated with XRP and DOGE [1]. XRP’s ETF success—while impressive—remains contingent on macroeconomic factors like Fed rate cuts and the performance of competing altcoins [2]. DOGE, conversely, has yet to secure a regulatory foothold, with its ETF applications still pending and its tokenomics widely criticized as unsustainable [1].

The Road Ahead: Why SYC’s Model Resonates

SYC’s success lies in its ability to merge innovation with practicality. By addressing real-world challenges—such as high gas fees and passive income generation—it creates a flywheel effect that drives adoption organically. XRP and DOGE, while foundational in their own right, lack this dual focus on utility and user experience. Analysts project XRP could reach $4–$5 in 2025, but SYC’s structured ecosystem development suggest a steeper growth trajectory [3]. DOGE’s potential, meanwhile, remains capped by its token design and reliance on external factors like Musk’s X integration [1].

Conclusion

In 2025, the crypto market is bifurcating between legacy assets and utility-driven innovators. SYC’s regulatory alignment and ecosystem of real-world applications position it as a superior investment thesis compared to XRP and DOGE. While XRP benefits from institutional adoption and DOGE thrives on meme culture, SYC’s structured approach to utility and scalability offers a more compelling long-term value proposition. For investors seeking to navigate the next bull cycle, SYC represents a bridge between innovation and adoption—a model that transcends the limitations of its predecessors.

Source:

[1] XRP's Recent Rally and the Potential of SYC as an

[2] XRP and MAGACOIN FINANCE: The Twin Catalysts for 2025 Altcoin Growth

[3] From Potential : Analysts Compare SYC's

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: L2 is supposed to be secured by Ethereum, but this is no longer true

Two-thirds of L2 assets have left Ethereum's security protection.

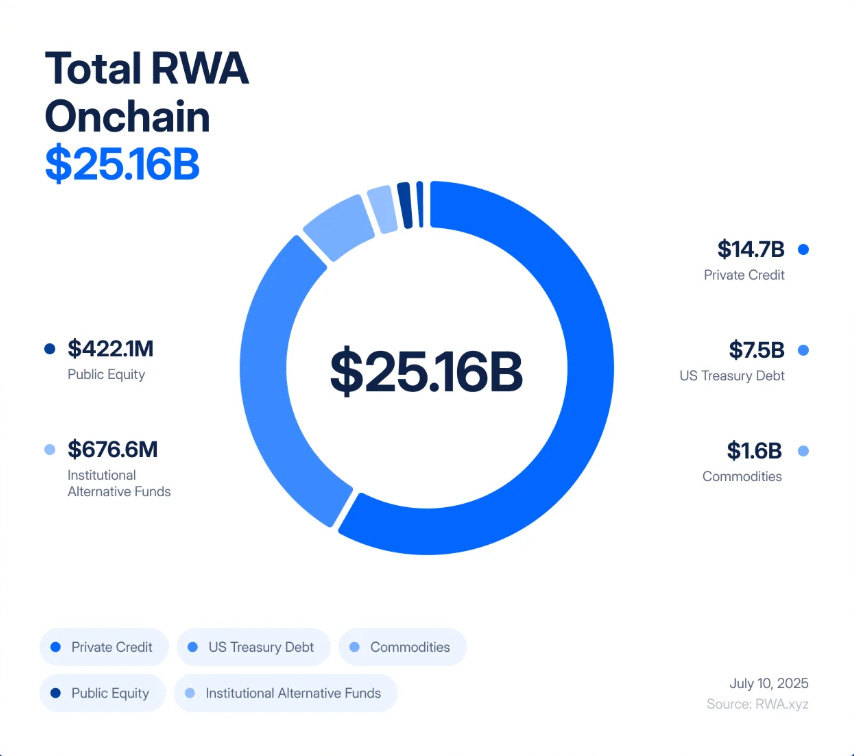

When Slow Assets Meet a Fast Market: The Liquidity Paradox of RWA

Illiquid assets wrapped in on-chain liquidity are repeating the financial mismatches of 2008.

XRP Ledger Activates Credentials Amendment for Compliance and Identity

Solana Emerges as Top Crypto Performer Amid Altcoin Rotation